How To Set Up A Trust Fund

It is advisable to be very clear and specific to the goals of setting up your fund. To do this you will need to have all of the information about the Trust to hand including.

/money_with_ribbon-5bfc328f46e0fb0083c1bfee.jpg) How To Set Up A Trust Fund If You Re Not Rich

How To Set Up A Trust Fund If You Re Not Rich

Break Down the Specifics - List all of your assets.

How to set up a trust fund. Choose the right type of trust. You meet with an attorney and decide on the beneficiaries and set stipulations. Trustee name plus any directions about replacing a trustee if he or she can no longer serve.

Register the Trust With. Collect all the necessary data. There are revocable trusts and irrevocable trusts.

Living trusts and testamentary trusts. Consider why you want to create a new legal arrangement to restrict a specific group of property or. And the name address date of birth and National Insurance number or passport number of any individuals named in the Trust.

Name of the trust. You can place cash stock real estate or other valuable assets in your trust. How to Set Up a Trust Fund.

A trustee is the. How to set up a trust The legal wording of a trust needs to be precise so you should ask a solicitor to set it up. Description of the trust namely why the trustor is creating it.

The steps below will help you set up your fund. Once the fund is set up all you have to do is deposit your assets into the fund. Find a Reputable Attorney.

Maybe you say that the beneficiaries. To create a trust fund youll need the following information. Find a solicitor to draw up a trust The Law Societies keep searchable databases to help you find a qualified solicitor near you.

5 Steps to Help You Set Up a Trust. Before we talk about how to set up a trust fund lets review a few key terms. You are considered the grantor - the one with the assets that you want to transfer through a.

Steps to Setting up a Trust Fund Collect Key Details. A grantor is the person who establishes and puts assets into a trust fund. Though trust law differs from state to state it has standardized to some degree over the.

Software developer Luke Childs has demonstrated how Bitcoins code can be used to establish a trustless trust fund The system can even be future-proofed for situations such as grantors dying or losing their keys. How to set up a trust fund Once you determine that youve got enough assets that warrant the establishment of a trust its a good idea to put your trust in place. They can be real estate stock cash or anything else you want.

Before you set up a trust fund think about the purpose it will serve. The person setting up a trust fund is known as the grantor while the person people or organization receiving the assets are known as the beneficiaries. The National Insurance passport or driving licence number of each of the trustees.

There are also trusts for particular use cases. List of property owned by the trust fund. Steps to Set Up a Trust Fund Step 1.

You can deposit the assets all at once or over time. You now know the basics about trusts but may not completely understand the process of establishing one. To set up a trust youll want to engage the help of both a financial planner or advisor and an estate lawyer.

Unlike its traditional counterparts such a trust. Setting up a trust fund.

What Is A Trust Fund How It Works Types How To Set One Up

What Is A Trust Fund How It Works Types How To Set One Up

How To Set Up A Trust Fund If You Re Not Rich

How To Set Up A Trust Fund If You Re Not Rich

What Is A Trust Fund And How Does It Work Types Meaning Definition

What Is A Trust Fund And How Does It Work Types Meaning Definition

How To Set Up A Trust Fund Wealthfit

How To Set Up A Trust Fund Wealthfit

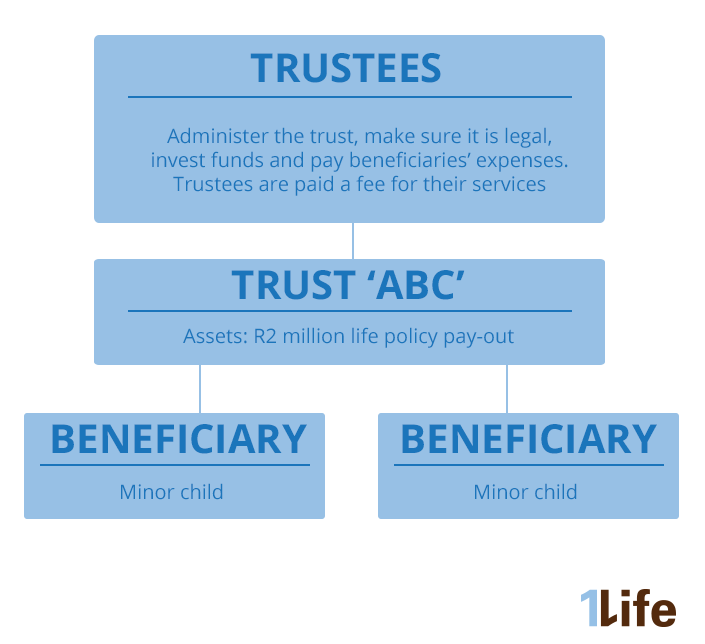

An Easy Guide To Setting Up A Trust For Minor Life Cover Beneficiaries 1life

An Easy Guide To Setting Up A Trust For Minor Life Cover Beneficiaries 1life

/How-to-Set-Up-a-Trust-Fund-56a0938d3df78cafdaa2da3d.jpg) Steps To Setting Up A Trust Fund

Steps To Setting Up A Trust Fund

Should You Set Up A Trust Fund

Should You Set Up A Trust Fund

How To Set Up A Trust Fund Wealthfit

How To Set Up A Trust Fund Wealthfit

How To Set Up A Trust Fund Wealthfit

How To Set Up A Trust Fund Wealthfit

How To Set Up A Trust Fund Pillar

How To Set Up A Trust Fund Pillar

How To Set Up A Living Trust Fund Estate Planning Checklist Setting Up A Trust Trust Fund

How To Set Up A Living Trust Fund Estate Planning Checklist Setting Up A Trust Trust Fund

Setting Up A Trust Fund Family Trust Fund Setting Up A Trust Trust Fund

Setting Up A Trust Fund Family Trust Fund Setting Up A Trust Trust Fund

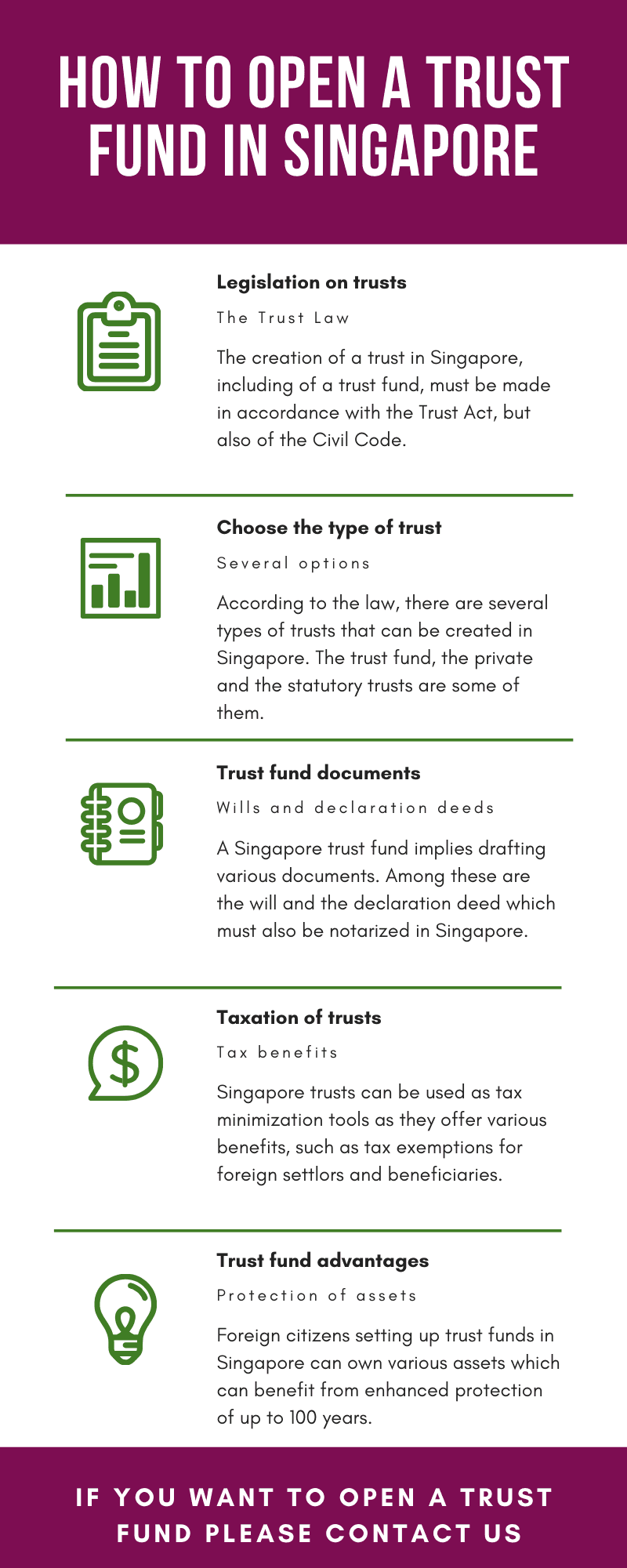

Open A Trust Fund In Singapore

Open A Trust Fund In Singapore

3 Ways To Create A Trust Fund Wikihow

3 Ways To Create A Trust Fund Wikihow

Comments

Post a Comment