Starting Credit Score

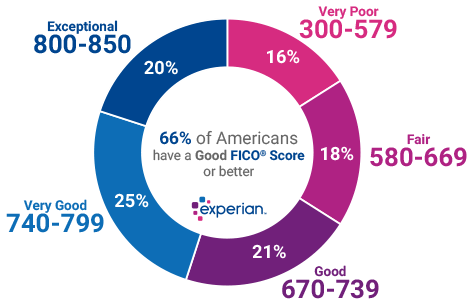

Once you get one or more credit accounts on your credit report and start using them youll receive a FICO Score. A perfect credit score of 850 is hard to get but an excellent credit score is more achievable.

What Is My Starting Credit Score Discover

What Is My Starting Credit Score Discover

Once you have established credit your first credit score could range anywhere from lower than 500 to well in the 700s depending on your initial financial performance.

Starting credit score. Once you begin to establish a credit history you might assume that your credit score will start at 300 the lowest possible FICO Score. But this still doesnt answer what credit score do you start with. Open a UK bank account If you havent already got one having a UK bank account benefits your credit report in three ways.

Five factors go into the equation that calculates your initial and subsequent ratings. The only connection between your first credit score and the scoring metrics would be the age of your credit profile. While you likely wont start at the worst possible you will start below average.

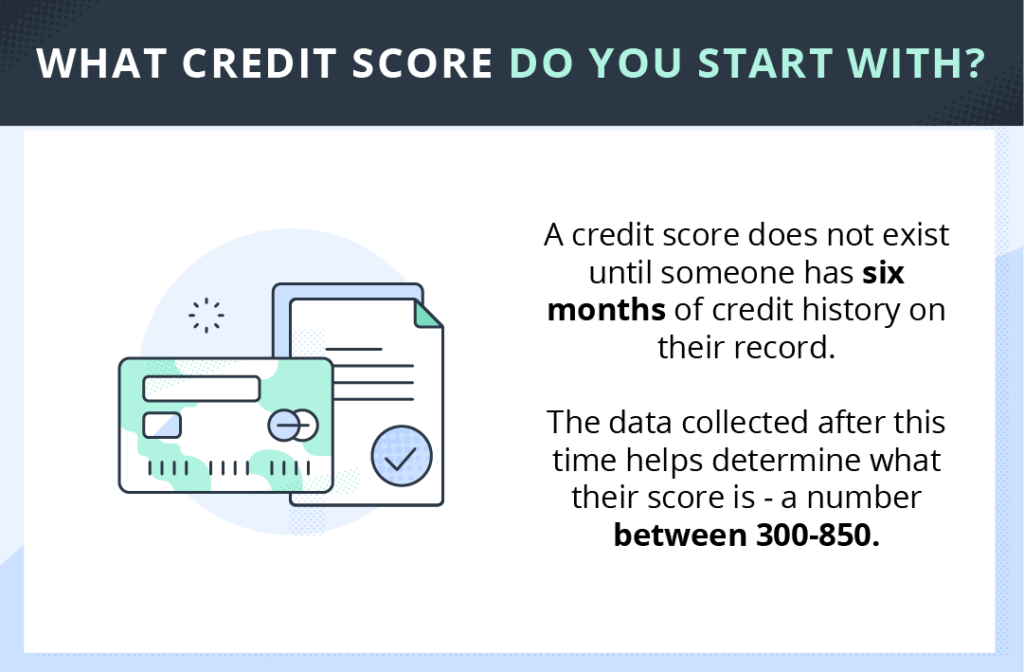

For FICO it falls between the range of 800 to 850 and for VantageScore its between 781 to 850. You dont immediately have a credit score. Usually you will get a credit score after your first 6 months of having credit.

However the starting credit score isnt zero. To have a FICO score you need at least one account thats been open six months or longer and at least one creditor. The initial starting point for your credit score depends on your early actions when you start your credit journey.

Most in the US. Before youve established credit history you have no credit score. Since credit scores range from 300 850 300 could be considered the starting score.

A credit score is a number or category that reflects how good or bad a credit risk a particular lender thinks you are. A starting credit score is calculated on the basis of credit history and repayment behaviour. If you have only had mishaps to start the only evidence credit bureaus.

If you are just starting out you dont have a credit history. Whether the lender is willing to lend you money. Estimating First Credit Score The exercise of estimating your first credit score can commence after you have established a consumer credit report with at least one tradeline with a minimum of six months on record.

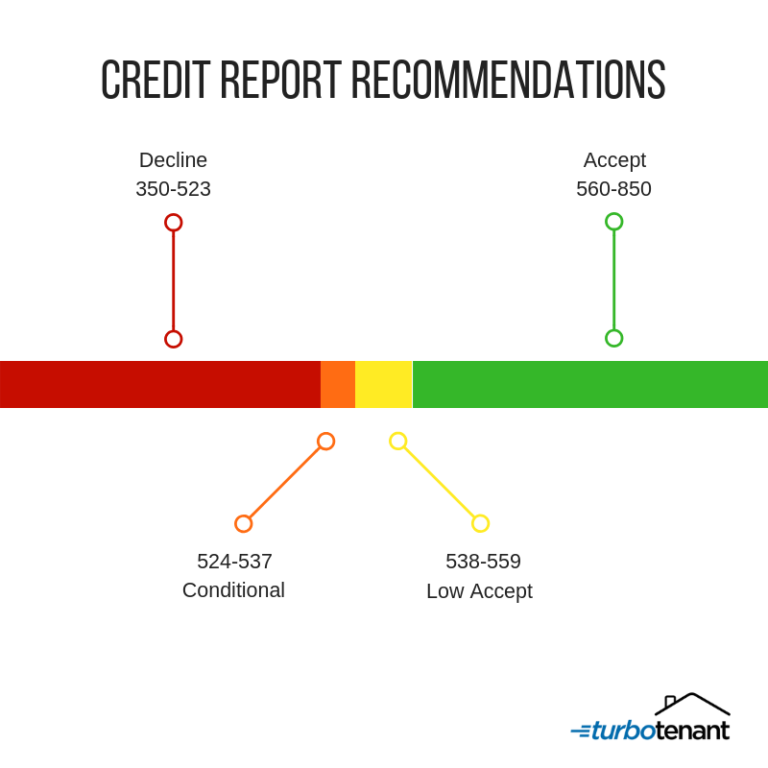

Starting with the basics a credit score is a number that ranges from 300-850 based on your credit history number of open accounts levels of debt and repayment history that determines someones creditworthiness the higher the score the more trustworthy you are perceived by lenders or in the rental business a landlord. This applies to credit cards loans utilities such as cell phone services and any other account that requires a monthly payment. There will be 6 months worth of data to analyze and credit bureaus can assign you a score based on that data.

Rather your first score could range anywhere from under 500 to well into the 700s depending on your initial performance according to credit expert John Ulzheimer who has worked at both FICO and Equifax. Building a good credit score takes time and a history of on-time payments. But its highly unlikely your first credit score will be that low unless you start off with very poor credit habits.

The only correlation between your first score and the scoring metrics would be the age of your credit file he said. Your credit score can determine. Making timely payments is the most important thing you can do to build credit as payment history makes up 35 of your credit score.

Start at 300 and sometimes lower depending on the scoring system so you cant have a credit score of zero. Nor will your first credit score be the highest level under the two most commonly used credit scoring models. Heres how you can build a great credit score even if youre starting right from scratch.

After 6 months however you will finally have a score. First credit score can be generated after 6 months of the first credit that you have availed. So if you have not taken any credit till now then your credit score will not be generated r the score will be zero.

Before your information appears in a credit bureau file. It typically takes at least six months of payment history for the credit bureaus to calculate a score according to Mortgage News Daily. If you get a credit card and start using it and pay the balance off every month which shouldnt be much then after 3 months your starting credit score of no record found will now be too new to rate.

The credit score you start with will depend on how you deal with your first credit. Normally the higher the number the better the risk you are. Some credit scores such as Bankcard and Auto scores can range from 250-900.

This first credit score will range between 300 and 850 depending on how well you manage your credit. For example if you miss your very first payment on your very first credit card your credit score will start a bit lower.

The Starting Credit Score A Guide For Beginners Internet Vibes

The Starting Credit Score A Guide For Beginners Internet Vibes

9 Ways Your Credit Score Affects Your Everyday Life Student Loan Hero

9 Ways Your Credit Score Affects Your Everyday Life Student Loan Hero

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

What Credit Score Does Everyone Start Out With

What Credit Score Does Everyone Start Out With

What Credit Score Does Everyone Start Out With

What Credit Score Does Everyone Start Out With

![]() How To Raise Your Bad Credit Score Above 700 Mybanktracker

How To Raise Your Bad Credit Score Above 700 Mybanktracker

What Credit Score Do You Start With Credit Sesame

What Credit Score Do You Start With Credit Sesame

What Is A 300 Credit Score Credit Sesame

What Is A 300 Credit Score Credit Sesame

What Credit Score Does Everyone Start Out With

What Credit Score Does Everyone Start Out With

What Credit Score Do You Start With Credit Sesame

What Credit Score Do You Start With Credit Sesame

What Credit Score Do You Start With Credit Sesame

What Credit Score Do You Start With Credit Sesame

18 Ways To Start Building Credit At 18 Or Any Age

18 Ways To Start Building Credit At 18 Or Any Age

What Is The Starting Credit Score Savingadvice Com Blog

What Is The Starting Credit Score Savingadvice Com Blog

What Credit Score Do You Start With Creditrepair Com

What Credit Score Do You Start With Creditrepair Com

Comments

Post a Comment