Pay Quarterly Estimated Taxes Online

To pay online you have to use an ACH transfer from your checking account or a debitcredit card. You will need your Minnesota tax ID number password and banking information.

How To Calculate And Pay Quarterly Estimated Taxes

How To Calculate And Pay Quarterly Estimated Taxes

The taxpayer pays the first quarterly.

Pay quarterly estimated taxes online. Penalty is 25 percent of the tax due minimum 25 per quarter for failure to make estimated payments or 10 percent minimum 10 per quarter. The estimated taxable income is 8500 and the estimated income tax liability is 300. Paying your taxes online is completely secure and its the quickest way to pay your taxes.

Personal Income Tax return amended return quarterly estimated or assessmentdeficiency Electronic payment using Revenue Online. The City Income Tax Administration follows the City Tax Act guidelines for estimated tax requirements. Mail Franchise Tax Board PO Box 942867 Sacramento CA 94267-0008.

The IRS makes it easy to pay taxes online. If your estimated tax liability is greater than 150 you are required to make estimated tax. Since all your data are on this file we can manually pay the taxes outside QuickBooks.

Pay your estimated tax electronically by logging into e-Services. When I was a newbie freelancer years ago I was pretty confused by the concept of paying income taxes four times a year instead of just once a year like employees do. An individual is making joint estimated tax payments on a calendar-year basis.

Mail a check or money order. You should pay taxes on the earnings from each quarter after the quarter has ended. If income will be greater or less than initially estimated the estimated tax payment should be adjusted.

Enrollment required Electronic Funds Withdrawal during e-filing Same-day wire bank fees may apply Check or money order. Interest is 1 percent above the adjusted prime rate. Yes you can pay quarterly estimated taxes online.

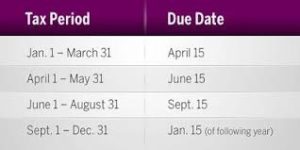

First Quarter January 1 to March 31. 1 st Quarter April 15 2021 2 nd Quarter June 15 2021. An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make.

Visit IRSgovpayments to view all the options. Youre correct that the option to pay quarterly taxes isnt available in QuickBooks Online. Estimated tax payment deadlines are.

However the quarters arent equal the second quarter is two months and the fourth quarter is four months. Electronic Federal Tax Payment System best option for businesses or large payments. If you are self-employed or do not have Maryland income taxes withheld by an employer you can make quarterly estimated tax payments as part of a pay-as-you-go plan.

If you want to use QuickBooks Self-Employed then you can directly pay the taxes inside QuickBooks. You can handle most of your tax transactions on the IRS website. You can also pay your estimated tax online.

You can pay your estimated taxes using Form 1040-ES and mailing a check to the IRS or at the IRS website. To avoid penalties for failure to make estimated tax payments your total tax paid through credits and withholding must be 70 percent of your current year tax or 70 percent of your prior year tax. If you are not required to pay electronically and choose to pay by check please complete.

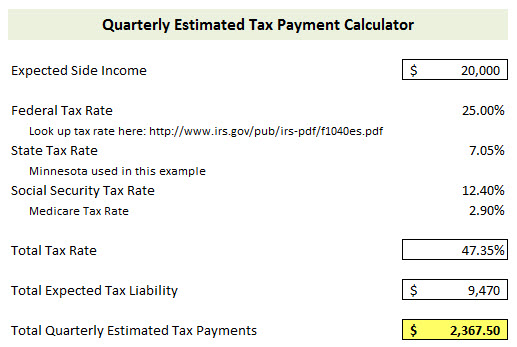

How Do You Calculate Your Estimated Taxes. State taxes for California where I live can be paid. 2021 Quarterly Estimate due dates.

You can make estimated payments online using iFile which also allows you to review your history of previous payments made through iFile and also schedule the payments. How to pay Online To make your payment online. For more details on quarterly estimated taxes and how and why freelancers pay them please see my Freelancers Guide to Quarterly.

Any payment received after the due date will apply to the following quarter. When to Pay Estimated Taxes. You can use page 8 of Form 1040-ES instructions to calculate your estimated taxes.

Estimated payments will apply to the quarter in which they are received. Use Estimated Tax for Individuals Form 540-ES vouchers to pay your estimated tax by mail. How to pay quarterly payments.

If you file your income tax return by January 31 of the following year and pay your entire balance you do not have to make the January 15 payment. Once youve calculated your quarterly payments You can submit them online through the Electronic Federal Tax Payment System. Log in and select Make an Estimated Payment See the instructions for Form 760 760PY or 763 for more on computing your estimated tax liability.

In 2021 estimated taxes are due on April 15 June 15 September 15. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Make your check or money order payable to the Franchise Tax.

How To Pay Your Quarterly Taxes Online. Choose to pay directly from your bank account or by credit card service provider fees may apply. If you expect to owe over a certain amount you must make estimated tax payments throughout the year.

You can also pay using paper forms supplied by the IRS. Other Ways You Can Pay. For additional information refer to Publication 505 Tax Withholding and Estimated Tax.

Visit our payment options. However if you have a large amount of income coming from multiple non-income tax withheld sources Crypto trading rental income business income etc. I have articles here that have detailed information about taxes.

You can also submit estimated payments using Form. For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and January 15 of the following year. The final quarterly payment is due January 18 2022.

It has everything you need to pay your taxes including installment options digital payments estimated tax payment forms and more. Select the payment type 2021 Estimate. When you file your annual tax return you will pay the balance of taxes that were not covered by your quarterly payments.

2 They may file the income tax return and pay the tax in full on or before March 1 of the year following the tax year.

How To File Quarterly Taxes In An Instant

How To File Quarterly Taxes In An Instant

How To Pay Federal Estimated Taxes Online To The Irs In 2021

How To Pay Federal Estimated Taxes Online To The Irs In 2021

How To Pay Quarterly Estimated Taxes Online

How To Pay Quarterly Estimated Taxes Online

How To Pay Quarterly Taxes Online Irs Il Dor The Dancing Accountant

How To Pay Quarterly Taxes Online Irs Il Dor The Dancing Accountant

Some Irs Online Services Including Ways To Pay Estimated Taxes Are Working Despite Shutdown Don T Mess With Taxes

How To Pay Quarterly Taxes Online Or By Mail Shared Economy Tax

How To Pay Quarterly Taxes Online Or By Mail Shared Economy Tax

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents Estimated Tax Payments Tax Payment Quarterly Taxes

Quarterly Taxes 5 Quick Steps To Pay Estimated Tax Payments Online Careful Cents Estimated Tax Payments Tax Payment Quarterly Taxes

How To Calculate And Pay Quarterly Estimated Taxes Young Adult Money

How To Calculate And Pay Quarterly Estimated Taxes Young Adult Money

How To Pay Quarterly Estimated Taxes Online

How To Pay Quarterly Estimated Taxes Online

Aci Payments Inc Pay State Estimated Quarterly Taxes

Aci Payments Inc Pay State Estimated Quarterly Taxes

The Joys Of Quarterly Estimated Taxes

The Procrastinator S Guide To Filing Quarterly Taxes Cashville Skyline

The Procrastinator S Guide To Filing Quarterly Taxes Cashville Skyline

Freelancer S Guide To Quarterly Estimated Taxes The Wherever Writer

Freelancer S Guide To Quarterly Estimated Taxes The Wherever Writer

How To Pay Quarterly Estimated Taxes Online

How To Pay Quarterly Estimated Taxes Online

Comments

Post a Comment