Is A 401k A Traditional Ira

If neither you nor your spouse is. 1 The IRA owner is NOT an active participant in a retirement plan such as a traditional 401k ie a full-time employer 401k plan or a self-employed 401k plan such as a solo 401k plan and.

401 K Vs Ira How To Decide Human Interest

The Roth 401 k was introduced in 2006 and was designed to combine features from the traditional 401 k and the Roth IRA.

Is a 401k a traditional ira. Same goes for a Roth 401k-to-Roth IRA rollover. Unlike distributions from a regular IRA qualified Roth distributions do not affect. Even if you participate in a 401 k plan at work you can still contribute to a Roth IRA andor traditional IRA as long as you meet the IRAs eligibility requirements.

Is a 401K a traditional IRA is no. 2 A Roth conversion so called Back door Roth only works if you start with a. However if your 401k included After-Tax Contributions as well as Pre-Tax Contributions you can do a direct rollover but some portion of the rollover may be taxable.

Despite both accounts being retirement savings vehicles a 401 k is a type of employer-sponsored plan with its own set of rules. Unlike a nondeductible IRA the annual contribution to a traditional IRA is tax deductible but only if. Roth IRAs are available to people with earned income whose adjusted gross income is less than 140000 as an individual or 208000 as a married couple in 2021.

Contributions may be deductible that means your taxable income for. If you also invest in a Roth IRAthe traditional IRAs tax-free sister in which you stash after-tax money in exchange for future tax-free withdrawalsthe. The Roth 401 k is a type of retirement savings plan that allows you to make contributions after taxes have been taken out.

401K rollover to Roth and Traditional IRA If your 401k was all pretax funds whatever is rolled over into a Roth will be taxable. A 401 k is established by an employer. 1 You might not be able.

In general if you withdraw funds from either a 401 k or an IRA before the age of 59 12 a 10 early withdrawal penalty applies. A 401K is a type of employer retirement account. You can roll over from a traditional 401k into a traditional IRA tax-free.

Qualification to make a deductible contribution to a traditional IRA depends on income and whether you or a spouse are covered by a qualified plan like a 401 k. The answer to your question. 2 the IRA owners adjusted.

An IRA is an individual retirement account. While both plans provide income in retirement each plan is administered under different rules. A 401 k-to-Roth IRA.

Beyond the type of IRA you want to open youll need choose a financial institution to invest with. Then you receive tax-free withdrawals when you retire. You cant roll a Roth 401k into a traditional IRA.

While a 401 k and an IRA will both help you save for your retirement there are a few important differences. Like a Roth IRA a traditional IRA is a retirement account that you open on your own independently of your employer. Its an option for people who dont have a 401 k plan through their job or those who want to save even more for retirement outside of their employers plan.

A traditional IRA is an account that the. If you choose to roll it over into a traditional IRA there is no immediate tax impact 100 of your 401 k balance transfers tax-free into your traditional IRA account. Some basic investigation into the types of investment options available at various institutions should shed some light on which IRAs.

A traditional IRA is valued at the pre-tax level for estate tax purposes. Is a 401k Plan considered a Traditional IRA for purposes of inclusion on Line 6 of Form 8606 1 Yes Any money in any Traditional SEP or SIMPLE IRA must be included on line 6 on the 8606 form. A traditional IRA is ideal for those who favor an immediate tax break.

However there are some important differences in the rules. There is a difference between 401K and traditional IRA accounts. Eligibility to contribute to a Roth.

Most employer sponsored retirement plans tend to be pre-tax dollars and are similar in that respect to a traditional IRA so if additional retirement savings are made beyond an employer-sponsored plan a Roth IRA can diversify tax risk.

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

What S The Difference Between A 401 K And An Ira One Day Advice

What S The Difference Between A 401 K And An Ira One Day Advice

High Earners To Roth 401 K Or Not Greenleaf Trust

High Earners To Roth 401 K Or Not Greenleaf Trust

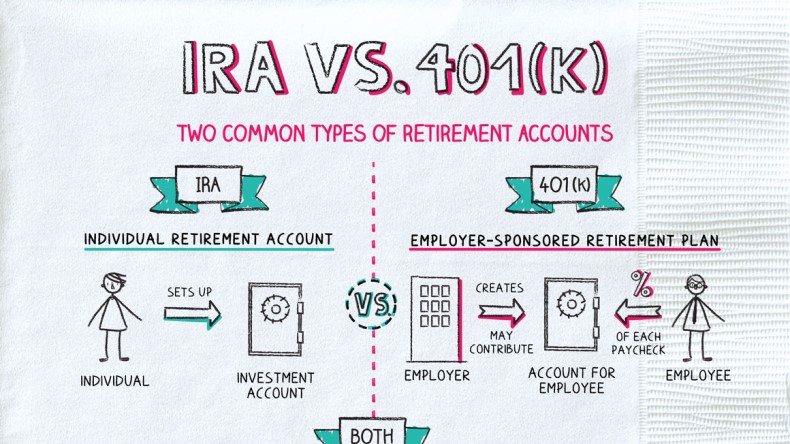

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

401 K Vs Traditional Ira Vs Roth Ira Vs Myra Human Interest

401 K Vs Traditional Ira Vs Roth Ira Vs Myra Human Interest

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

How To Choose Between A Traditional And Roth 401 K

How To Choose Between A Traditional And Roth 401 K

Roth Ira Or Traditional Ira Or 401 K Fidelity

Roth Ira Or Traditional Ira Or 401 K Fidelity

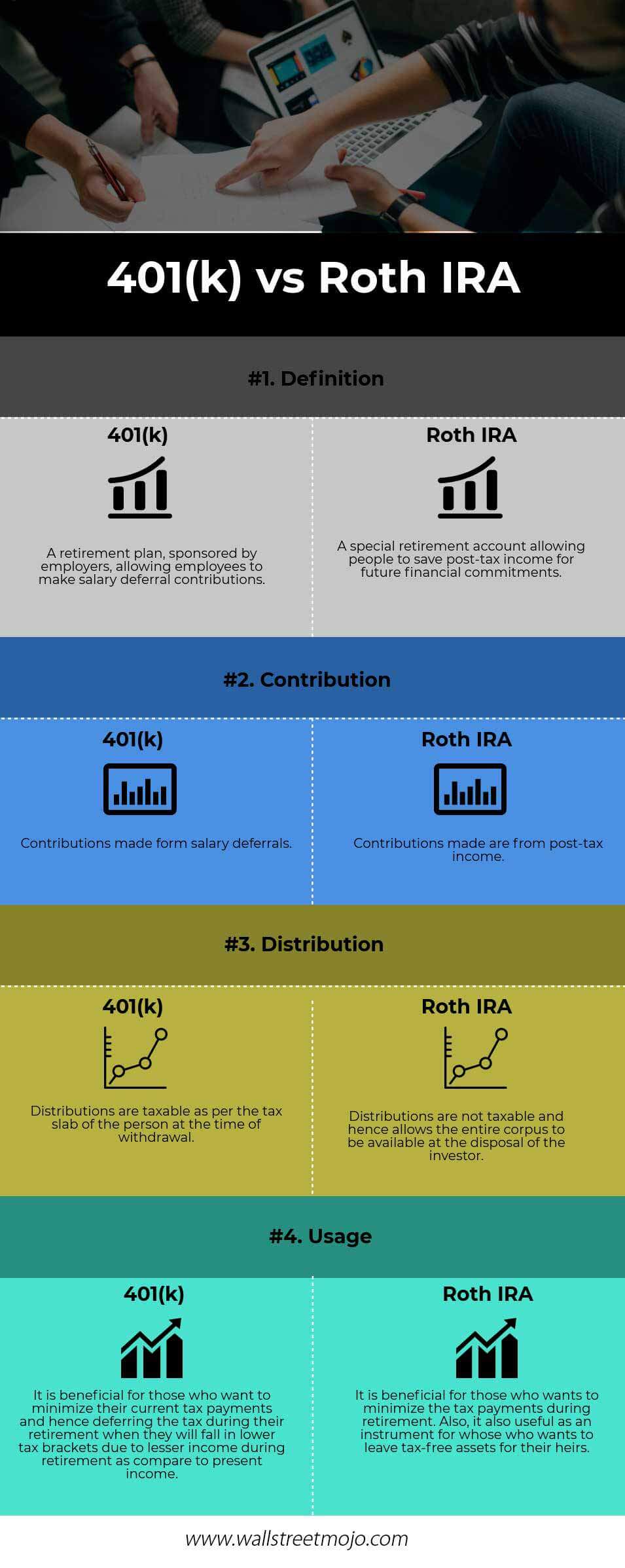

401k Vs Roth Ira Top 4 Best Differences With Infographics

401k Vs Roth Ira Top 4 Best Differences With Infographics

What S The Difference Between A 401 K And An Ira One Day Advice

What S The Difference Between A 401 K And An Ira One Day Advice

What Is A 401 K Traditional Vs Roth Rules Of Each Plan Money Tip Central

401 K Or Ira How To Choose Where To Put Your Money Ellevest

401 K Or Ira How To Choose Where To Put Your Money Ellevest

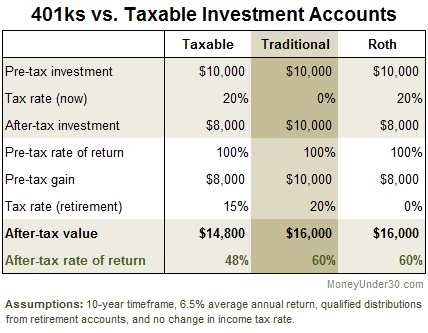

What S The Difference Between A 401k And Ira And Which Should You Invest In Money Under 30

What S The Difference Between A 401k And Ira And Which Should You Invest In Money Under 30

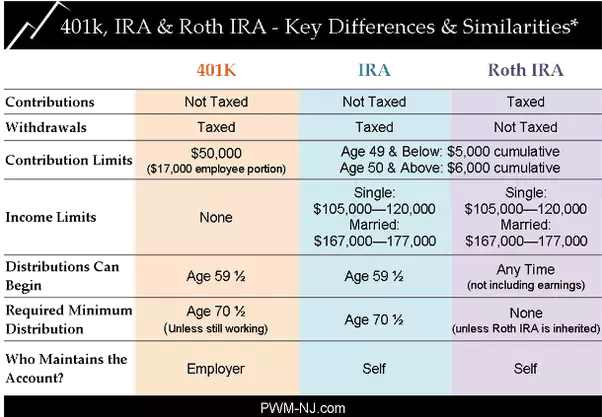

What Is The Difference Between A 401k And Ira Quora

What Is The Difference Between A 401k And Ira Quora

Comments

Post a Comment