Capital One 360 Savings Minimum Balance

You dont need to maintain a minimum balance to keep a fee-free 360 Performance Savings account open. You can easily open two 360 accounts savings and checking to take advantage of quick internal transfers.

Capital One 360 Performance Savings Is It Worth It

Capital One 360 Performance Savings Is It Worth It

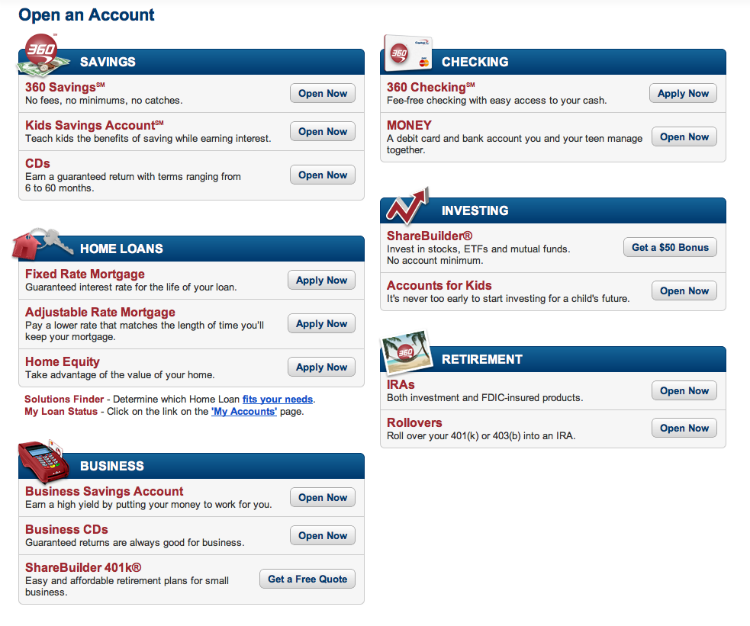

Capital One 360 Savings Capital Ones savings account offering is called 360 Performance Savings.

Capital one 360 savings minimum balance. I have a card with Capital One and they sent me a promotion that if I open up a savings their 360 savings account with 10k theyll add 200 immediately plus it will yield 160 each year. Capital Ones 360 Performance Savings account has no minimum balance requirements and you can open an account with as little as 0. Capital One 360 doesnt nickel-and-dime you which is another plus.

As a bonus you earn a small amount of interest on your balance. Capital One IRA Savings Account. Theres no need to qualify for fee waivers which is notable for a large bank with physical branches.

As with other Capital One accounts there are no minimum opening deposits and no minimum balance. The Capital One 360 Performance Savings Account interest rate is 040 with no minimum balance. Theres no minimum balance to open a 360 Savings account or a 360 Checking account for that matter.

Capital One 360 Performance Savings isnt available on Finder right now. The Capital One 360 Savings account offers an interest rate of 150 APY which is significantly higher than the national average of 007. Ive had my standard bank savings account forever which is attached to my checking.

Capital One 360s checking and savings accounts are free to open and maintain and they require no minimum balance. The checking and saving accounts of Capital One 360 are free to be opened and managed with no minimum balance required. Capital Ones 360 Performance Savings is a high-yield savings account that earns 040 APY.

Its easy to sign up and start earning interest thanks to no fees no minimum balances and a competitive 04 APY. This means that if Capital One Bank defaults the federal government guarantees the balance in your savings account up to 250000. Different types of savings goals take different types of savings accounts.

Read our review or Apply for a CIT Savings Builder account. Much of its business is carried out online and through its mobile app. But there are a.

There are other stipulations too but its a nice alternative to the Capital One 360 savings. Its Capital Ones new name for their high-yield no-fee online savings account. However although its rates are higher than what youll find at many local banks interest rate junkies might prefer to look elsewhere since other online banks offer more competitive APYs.

CDs are a no-market-risk all-returns approach to saving with fixed rates and a bit more security than your average sock drawer thanks FDIC insurance. Capital One offers a variable rate online savings account designed for your IRA individual retirement account or Roth IRA. Account-holders can earn an impressive 050 annual percentage yield APY by simply keeping their money in this high-yield savings account.

All of Capital One 360s deposit accounts are FDIC insured. The Capital One 360 Performance Savings Account interest rate is 040 APY significantly higher than the national average of 006. The Capital One 360 Performance Savings account is all about simplicity.

360 IRA Online Savings Rate. What is Capital One 360 Performance Savings. All Capital One 360 deposit products are FDIC insured up to 250000 per depositor.

Is there any downside to this. Should I transfer my savings over. Thats much better than the national average of 007 annual percentage yield.

The 360 Checking account is Capital Ones version of a free online checking account. Your deposits are FDIC-insuredup to the allowable limits. Most of its business is conducted online and through its cellphone app.

It offers a 040 APY but you have to either deposit 25000 and keep that amount in there or deposit at least 100 per month into an account. Is Capital One 360 Safe. But support isnt 247 as it is with some online banks.

You get an interest rate of 040 APY with no minimums. The rate of our 360 Performance Savings account is high yield based on lnforma Research services national percentile data for savings accounts on balances of 1. Your funds are FDIC insured up to 250000 theres a mobile.

Theres no minimum deposit required to open one and no. Compare 360 CD accounts. The rate of our 360 Performance Savings account is 5X the national average based on FDICs published National Rate for balances.

Online Savings Account 360 Performance Savings Capital One

Online Savings Account 360 Performance Savings Capital One

Online Checking Account No Fee 360 Checking Capital One

Online Checking Account No Fee 360 Checking Capital One

Capital One Consumer Bank Savings Account Review My Money Blog

Capital One Consumer Bank Savings Account Review My Money Blog

How To Open A Sub Account At Capital One 360 Cash Money Life

How To Open A Sub Account At Capital One 360 Cash Money Life

Capital One Bank Review Smartasset Com

Capital One Bank Review Smartasset Com

Hsbc Direct Savings Review Low Fees 1 Opening Deposit

Capital One Bank Review Smartasset Com

Capital One Bank Review Smartasset Com

Capital One 360 Guide For Online Banking Credit Cards

Capital One 360 Guide For Online Banking Credit Cards

Capital One 360 Savings Review Special 25 Cash Bonus

Capital One 360 Savings Review Special 25 Cash Bonus

Capital One 360 Review Online Checking Savings Accounts

Capital One 360 Review Online Checking Savings Accounts

Capital One 360 Review 2021 Fee Free Bank Accounts

Capital One 360 Review 2021 Fee Free Bank Accounts

Capital One 360 Savings Review Ing Direct Re Branded As Capital One 360

Capital One 360 Savings Review Ing Direct Re Branded As Capital One 360

:max_bytes(150000):strip_icc()/Capital-one-4e60cf54cb204302adceb1ee35757be4.jpg)

Comments

Post a Comment