How Do Tax Preparers Get Paid

Depends on tax volumes and services and prices of returns filed. Sometimes is 2 to 3 percent of what income is generated.

The Scary Truth About Your Independent Tax Preparer Huffpost

The Scary Truth About Your Independent Tax Preparer Huffpost

Take a 60-hour qualifying education course from a CTEC approved provider within the past 18 months.

How do tax preparers get paid. To do so you must. Purchase a 5000 tax preparer bond from an insurancesurety agent. Anyone who prepares and files 11 or more individual tax returns a year must file electronically.

New York requires that paid tax return preparers register with the state and pay a 100 fee if they are preparing over 10 commercial tax returns in a single calendar year. Just in case you need a simple salary calculator that works out to be approximately 2078 an hour. There are more than 9600 volunteer program sites across the.

Answered April 4 2017 - Office ManagerTax Preparer Former Employee - Lexington TN. Pay a 33 registration fee. The IRS Volunteer Income Tax Assistance Program also provides free tax preparation for low-income taxpayers as well as for the elderly disabled Native Americans rural citizens and those for whom English is a second language.

An entry-level Tax Preparer with less than 1 year experience can expect to earn an average total compensation includes tips bonus and overtime pay. A Tax Preparer will usually earn wages on a scale from 24000 to 36000 based on levels of tenure. But if you prefer to use the paper option Form W-12 IRS Paid Preparer Tax Identification Number PTIN Application PDF it will take 4-6 weeks to process.

It only takes about 15 minutes to apply for or renew your PTIN online. As of Apr 16 2021 the average annual pay for a Seasonal Tax Preparer in the United States is 43225 a year. 51 rows In general tax preparers earn much less than accountants and auditors do.

You can use it with Intuit ProSeries Tax Intuit ProConnect Tax or Intuit Lacerte Tax. Some tax preparers charge a flat fee with additional flat charges for each additional form over the standard return. Give your clients a simple way to pay for your tax preparation without worrying about upfront out-of-pocket costs.

There are many variables that. For more information on completing Form W-12 view instructions PDF. The basic IRS requirement for all paid tax preparers is to pass the suitability check and get issued a PTIN.

How Are Tax Preparers Paid. Most preparers charge a flat fee per return but some may charge an hourly rate. Tax bank products deduct your fee from clients refunds and distribute it directly to your bank account.

Heres how Pay-by-Refund works. Tax Preparers can make the most money in Massachusetts which has average pay levels of approximating 60440. Send completed Form W-12 and payment of 3595 to.

However once you start talking about the work of an enrolled agent there will be additional requirements such as a state license or an electronic filing identification numbers EFIN. They must sign in the paid preparers area of the return and give the taxpayer a copy of the return. Start your research by searching your states name and requirements for tax preparers to find checklists of what you need to accomplish before getting started.

Theres no standard fee for tax-return preparation. Salary information comes from 643 data points collected directly from employees users and past and present job. Average HR Block Tax Preparer hourly pay in the United States is approximately 1346 which is 12 below the national average.

Obtain a Preparer Tax Identification Number PTIN from the IRS and. Tax preparers are paid in a couple of different ways depending on the client type of taxes and the tax preparer. How do I become a certified IRS tax preparer.

They usually get an hourly rate plus commission or bonus based on the total amount done over a set amount. Tax Preparers will most likely earn a compensation of Thirty Seven Thousand One Hundred dollars every year. This is the equivalent of 831week or 3602month.

Refund transfers also known as bank products make it easier to get paid during tax season giving you more time to focus on other paid work. Generally anyone who gets paid to prepare or help prepare a federal tax return must have a Preparer Tax Identification Number PTIN.

Remote Tax Preparer Jobs Guide To Work From Home Tax Preparer Jobs Unremot Com

Remote Tax Preparer Jobs Guide To Work From Home Tax Preparer Jobs Unremot Com

3 Things Your Tax Preparer Won T Tell You And Why It Matters

3 Things Your Tax Preparer Won T Tell You And Why It Matters

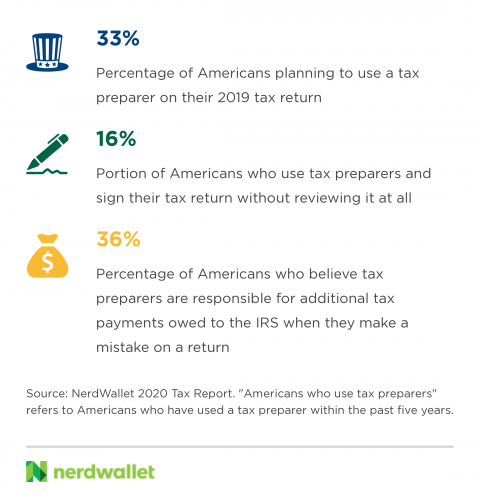

Your Taxes Your Responsibility What Hiring A Tax Pro Doesn T Buy You Nasdaq

Your Taxes Your Responsibility What Hiring A Tax Pro Doesn T Buy You Nasdaq

Do Tax Preparers Make Good Money One More Cup Of Coffee

Do Tax Preparers Make Good Money One More Cup Of Coffee

Become A Tax Preparer Before Next Season

7 Tips To Find The Best Tax Preparer Near You Nerdwallet

7 Tips To Find The Best Tax Preparer Near You Nerdwallet

7 States That Regulate Paid Tax Preparers Don T Mess With Taxes

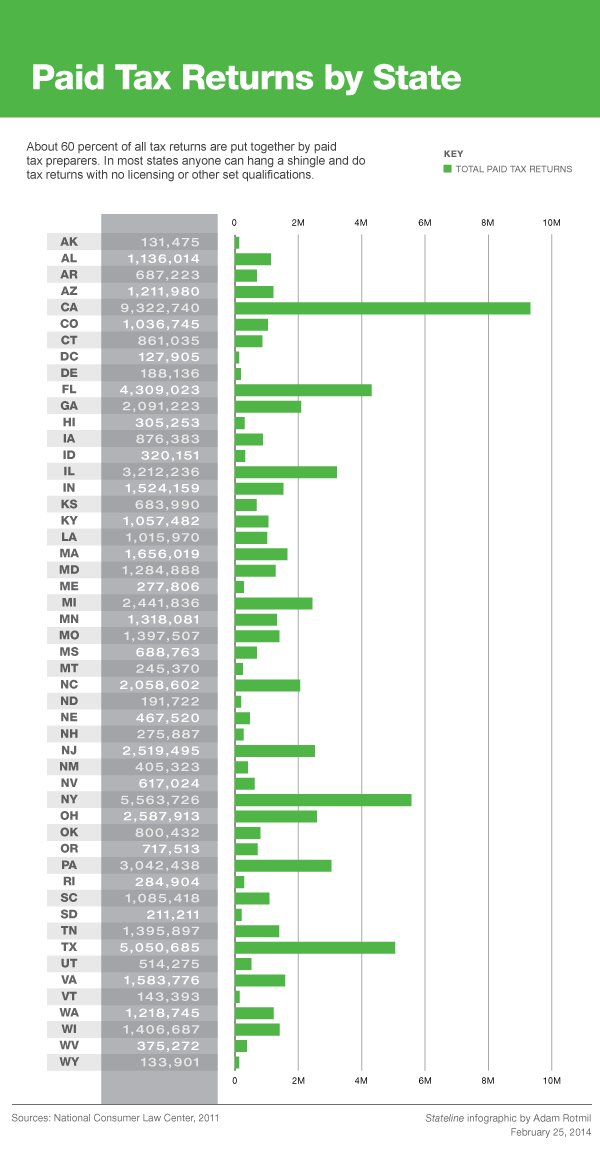

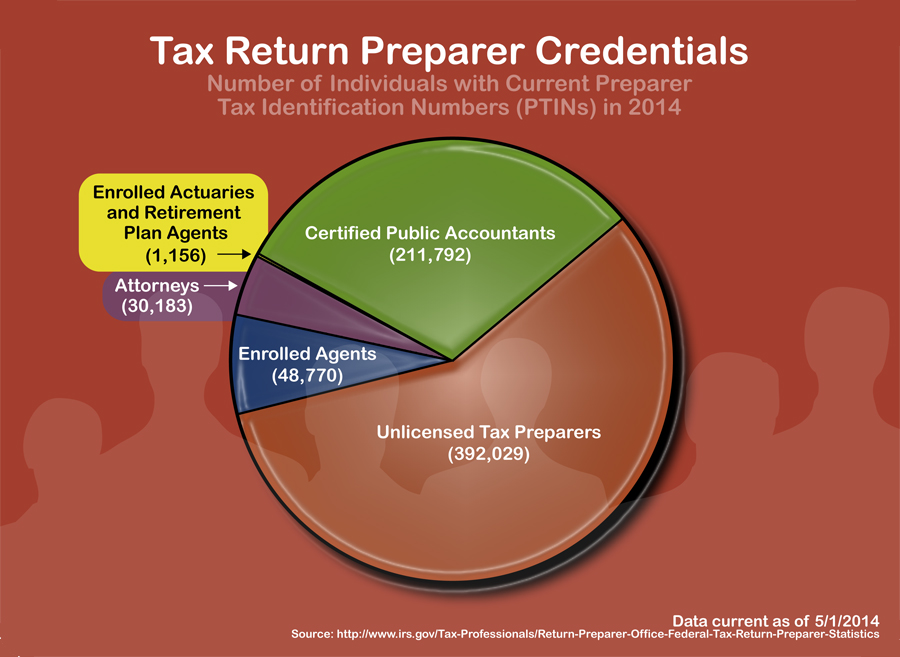

The Majority Of Paid Tax Return Preparers Are Unlicensed

The Majority Of Paid Tax Return Preparers Are Unlicensed

Should You Hire A Tax Preparer Money Under 30

Should You Hire A Tax Preparer Money Under 30

Why Do Low Income Families Use Tax Preparers Tax Policy Center

Why Do Low Income Families Use Tax Preparers Tax Policy Center

How To Become A Seasonal Tax Preparer To Earn Additional Income

How To Become A Seasonal Tax Preparer To Earn Additional Income

Do You Need To Pay Someone To Do Your Taxes Nasdaq

Do You Need To Pay Someone To Do Your Taxes Nasdaq

How To Find The Perfect Tax Preparer This Tax Season

How To Find The Perfect Tax Preparer This Tax Season

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif) How Much Is Too Much To Pay For Tax Returns

How Much Is Too Much To Pay For Tax Returns

Comments

Post a Comment