Credit Score Categories

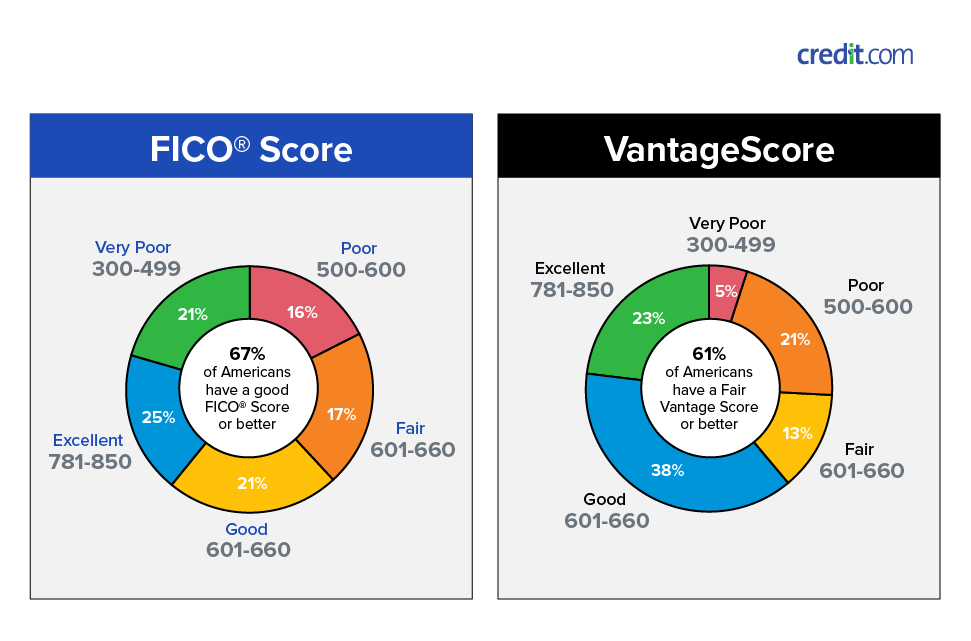

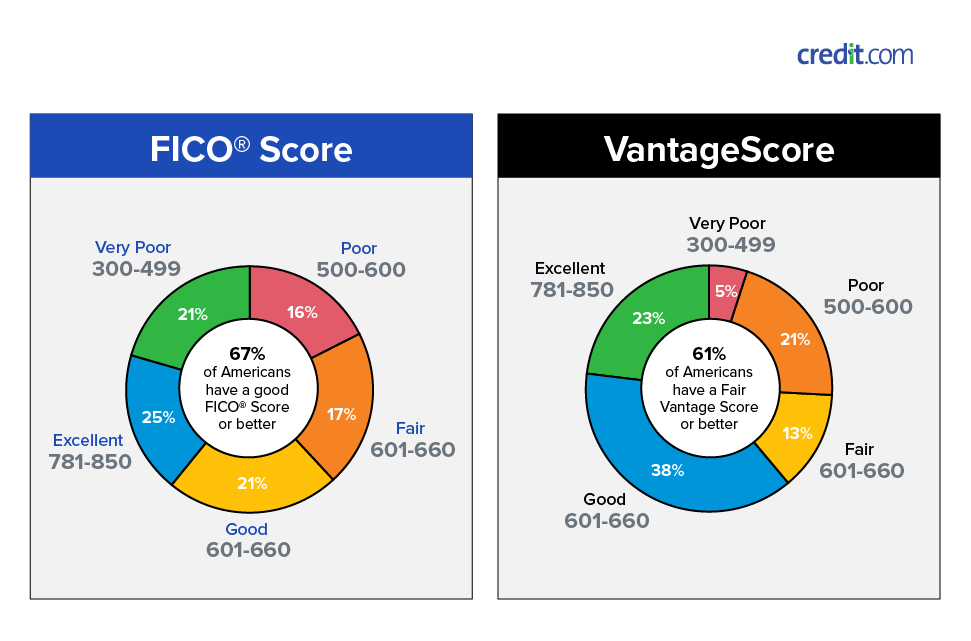

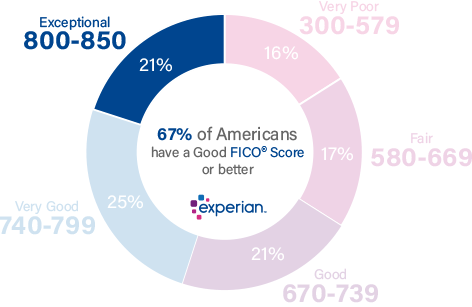

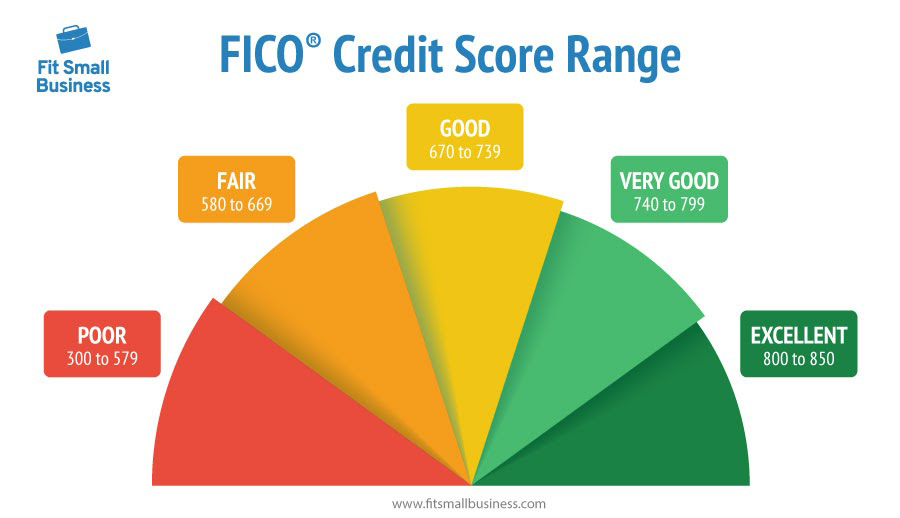

Credit scores calculated using the FICO or VantageScore 30 scoring models range from 300 to 850. Wikimedia Commons has media related to Credit rating.

The Five Categories Of Credit Mortgagemark Com

The Five Categories Of Credit Mortgagemark Com

Excellent Credit Score Range.

Credit score categories. Get everything you need to master your credit today. Intellirent provides you with a TransUnions ResidentScore powered by a sophisticated analysis of more than 500000 actual resident records. Here are some different credit scores and their credit score ranges.

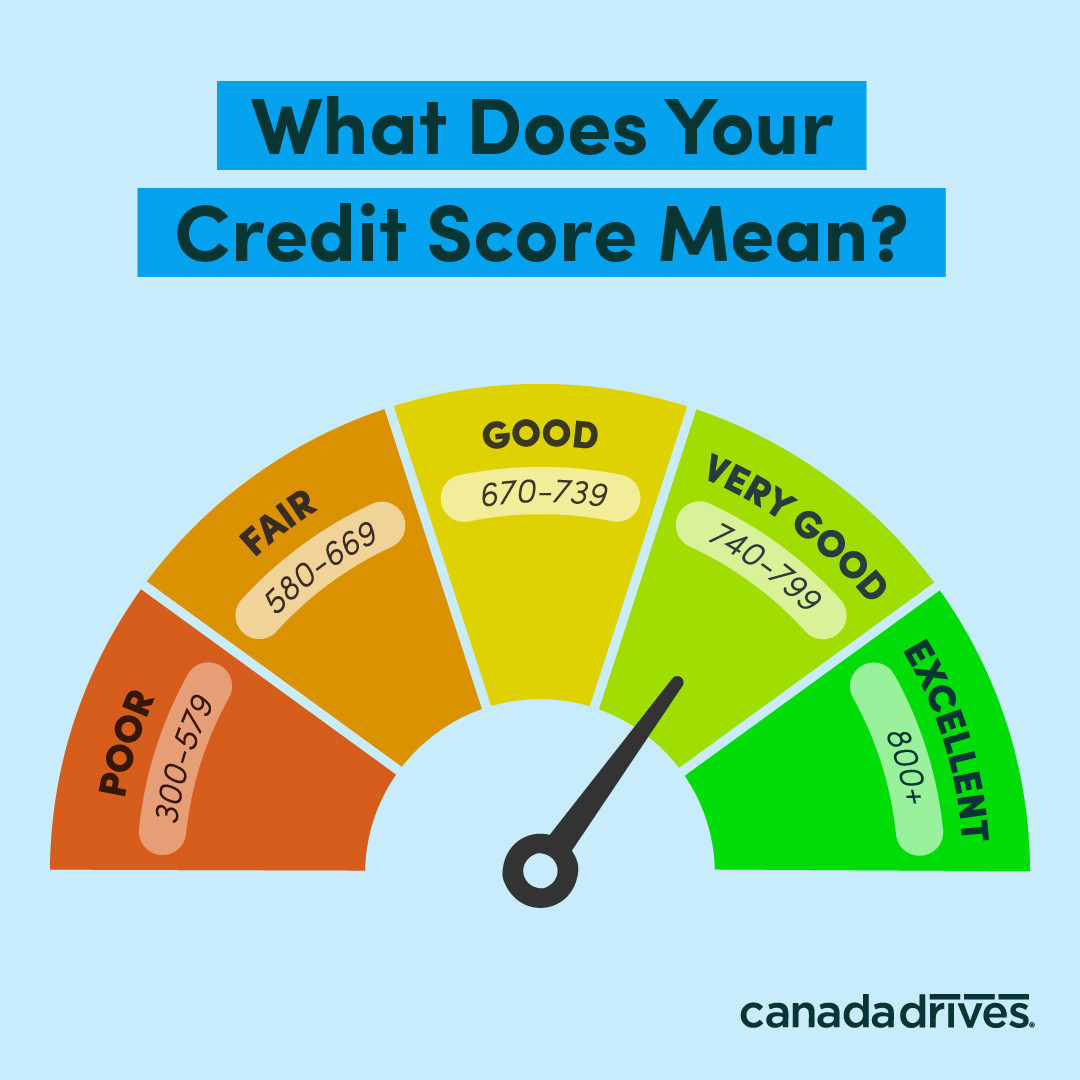

Where you fall on that scale can determine a lot about your financial life. The newer VantageScore 30 scale is the same as the FICO Score 8 scale going from 300 to 850. Its always a good idea to pay your bills on time and keep your credit utilization ratio low.

Those scores are broken down into five categories though the breakdowns differ slightly. Bankcard and auto scores can range from 250 to 900. Decline Conditional Low Accept or Accept.

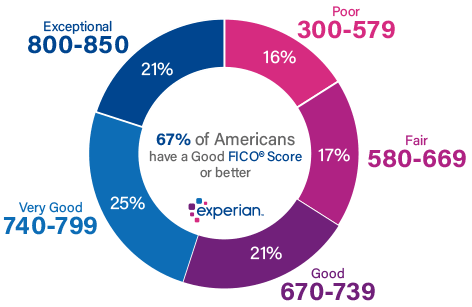

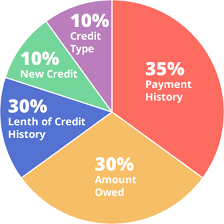

Credit scores are calculated using information in your credit reports including your payment history the amount of debt you have and the length of your credit. A credit score is a three-digit number typically between 300 and 850 designed to represent your credit risk or the likelihood you will pay your bills on time. For FICO a good credit score is 670 or higher.

They may have some dings on their credit history but there are no major delinquencies. Amounts owed is the amount of money you owe. Credit scores range from 300 to 850.

From Wikipedia the free encyclopedia. 800 credit score 801 credit score 802 credit score 803 credit score 804 credit score 805 credit score 806 credit score 807 credit score 808 credit score 809 credit score 810 credit score 811 credit score 812 credit score 813 credit score 814 credit score 815 credit score 816 credit score 817 credit score 818 credit score 819 credit score 820 credit score 821 credit score 822 credit score 823 credit score 824 credit score 825 credit score 826 credit score 827 credit score 828 credit score. The data is used to analyze the credit report and produce a score between 350-850.

FICO VantageScore and other credit scores. If you have a credit score your profile falls into one of the following categories. Borrowers with credit scores ranging from 580 to 669 are thought to be in the fair category.

For most mortgages originated in the United States three credit scores are obtained on a consumer. Payment history is whether you pay your credit accounts on time or not. With all FICO and VantageScore models a higher score signifies that youre a lower risk borrower.

As with the FICO scales a higher number indicates lower credit risk. VantageScore ranges can vary as well but that is based upon the version a lender uses more on that below. Each of the major credit bureaus Experian Equifax and TransUnion has its own credit score which is determined from the information held within your credit report.

Credit Score Categories. For the older VantageScore 10 and 20 models the credit score scale ran from 501 to 990. Jump to navigation Jump to search.

A Quick Breakdown of the 5 Categories of Your FICO Score 1. A credit score can range from 300 to 850 depending on the scoring model such as a mortgage score. Risky activity like late payments and high credit utilization will.

A Beacon 50 score Beacon is a trademark of FICO which is calculated from the consumers Equifax credit history a FICO Model II score which is calculated from the consumers Experian credit history and a Classic04 score which is calculated from the consumers Trans Union history. Amounts Owed This category details the portion of your available credit you are using. Lower scores indicate that someone is riskier to the.

The score models can be divided into three major types. Get started for free. A score above 800 is considered exceptional.

Credit Score Charts for FICO and VantageScore. If you have bankruptcies judgments liens or other negative marks on your credit history it shows up in this category and can negatively affect your credit score for up to 10 years. The main article for this category is Credit.

Super-prime prime near-prime subprime and deep subprime. However experts generally agree that chasing a credit score of 850 is. With paying your credit.

4 What credit score ranges mean for you.

Credit Score Range What Is The Credit Score Range In Canada

Credit Score Range What Is The Credit Score Range In Canada

What Is A Good Credit Score Experian

What Is A Good Credit Score Experian

![]() What Is A Good Credit Score Range Mybanktracker

What Is A Good Credit Score Range Mybanktracker

Credit Score Cutoffs Credit Sesame

Credit Score Cutoffs Credit Sesame

5 Categories Of Credit Scoring The Credit Monkey

5 Categories Of Credit Scoring The Credit Monkey

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

What Is A Good Credit Score And How Can I Get One

What Is A Good Credit Score And How Can I Get One

9 Ways Your Credit Score Affects Your Everyday Life Student Loan Hero

9 Ways Your Credit Score Affects Your Everyday Life Student Loan Hero

What Is A Good Credit Score Credit Com

What Is A Good Credit Score Credit Com

850 Credit Score Is It Good Or Bad

850 Credit Score Is It Good Or Bad

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

Comments

Post a Comment