How Long Should I Save Tax Returns

Those who filed online through a tax preparation service can often access past returns. The reason for the three-year answer is that the IRS has up to.

2020 Dutch Income Tax Return News News About Us Expat Centre Leiden

2020 Dutch Income Tax Return News News About Us Expat Centre Leiden

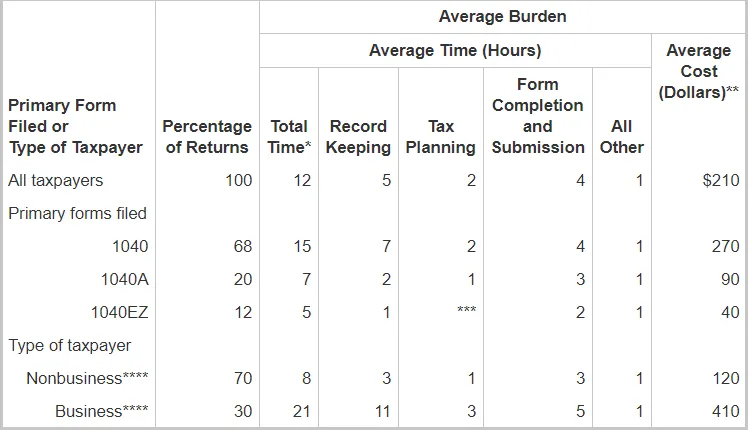

Keep employment tax records for at least four years after the date that the tax becomes due or is paid whichever is later.

How long should i save tax returns. Tax returns sent after the. Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax whichever is later if you file a claim for credit or refund after you file your return. If you send your 2020 to 2021 tax return online by 31 January 2022 keep your records until at least the end of January 2023.

Since old tax returns can help in preparing future tax returns not to mention making computations on an amended return theres a strong. You probably learned that you should keep a tax return for at least three years after filing it. How Long to Keep Documents Chart.

That means most taxpayers should keep their tax records for three years after the date they filed. The IRS recommends that tax records be kept at least three to four years after the filing date. After that the statute of limitations for an IRS audit expires.

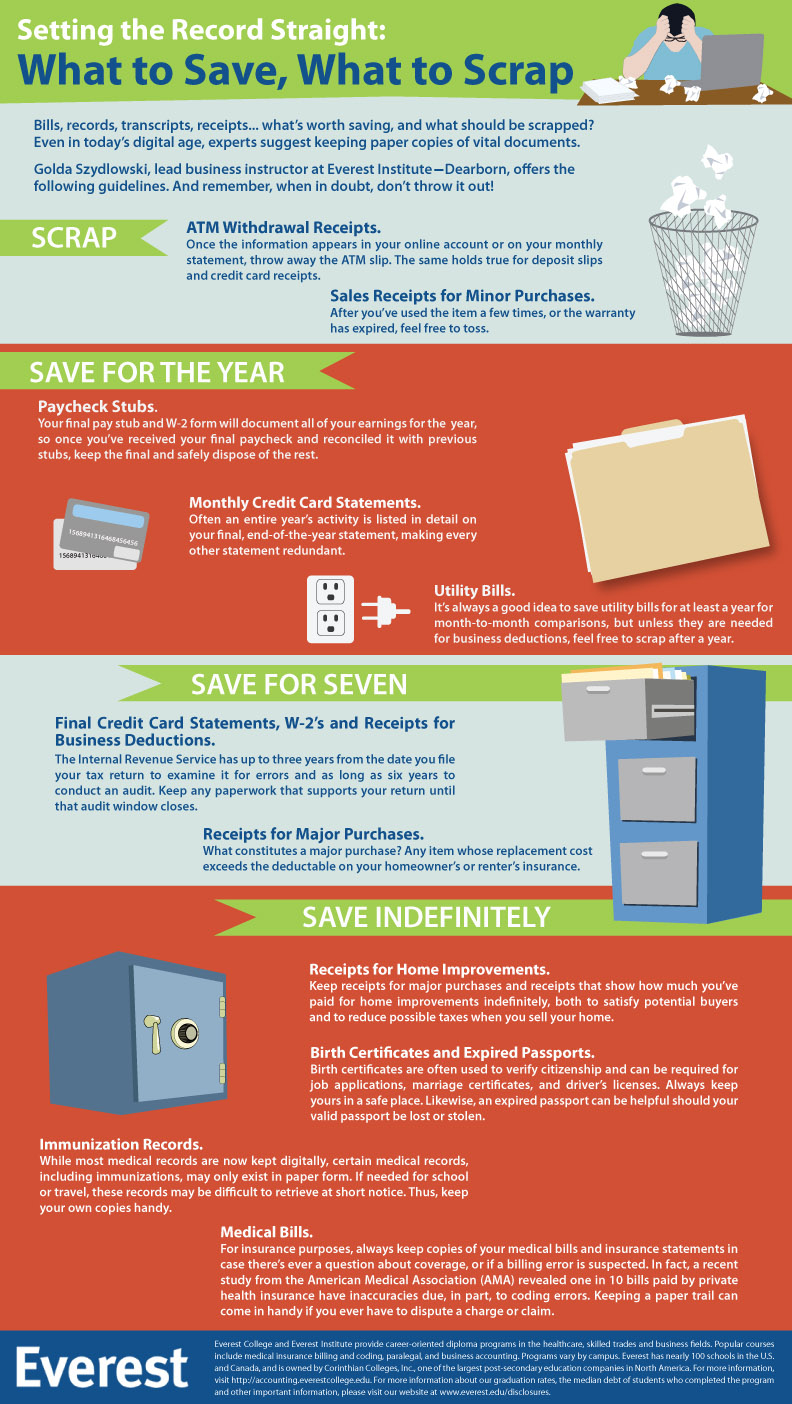

Generally you want to save your tax returns for at least three years. Sales receipts electronic or paper. You should keep every tax return and supporting forms.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax whichever is later if you file a claim for credit or refund after you file your return. According to Schenck a top CPA and consulting firm the answer to this is everything when it comes to sales and use tax documentation. In most cases you should plan on keeping tax returns along with any supporting documents for a period of at least three years following the date you filed or the due date of your tax return whichever is later.

But the standard answer is wrong. They help in preparing future tax returns and making computations if you file an amended return. If youve under-reported income by 25 percent however the IRS can go six years back or seven if you claim a loss for bad debt or worthless securities.

Tax documents such as a Form 1099-INT should be kept with that years tax return. If you fail to report all of your gross income on your tax returns the government has six years to collect the tax or start legal proceedings. This goes for anything like.

Keep for seven years. To put it more plainly you will need to keep your tax records between. But while you may think youre done with that tax return once its been filed with the IRS youd be wise to save your tax information and supporting records for at least three years after the fact.

Heres what they advise for several common records. To be on the safe side McBride. How Long To Keep Tax Returns.

If you took a deduction for bad debt or worthless securities youll generally want to hold on to them for seven. Some experts advise keeping your records for even longer up to seven years depending on your tax situation for the year. What Tax Records Should I Keep.

When it comes to titles you should retain that document in a safe place until you sell the vehicle off. That means the current year plus three years back but everyone should check with their own accountant to see if theres any reason to keep tax paperwork beyond three years she explains. The IRS recommends taxpayers keep their returns and any supporting documentation for three years after the date of filing.

You should keep most documents for three years according to. How long should you keep mortgage. Previously seven years was the recommendation but Morgenstern maintains that three years is enough.

Three years The statute of limitations for an IRS audit expires after three years. This is how long you should keep tax returns Theres a simple rule that applies the majority of the time. Keep records for 3 years if situation 4 5 and 6 below do not apply to you.

Taxes 2019 How Long Should I Keep My Tax Returns

Taxes 2019 How Long Should I Keep My Tax Returns

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

How Long You Should Keep Your Tax Returns Cheapism Com

How Long You Should Keep Your Tax Returns Cheapism Com

How Long Should You Keep Irs Tax Records Bankrate

How Long Should You Keep Irs Tax Records Bankrate

Calameo Crucial Question How Long Should I Keep Accounting Records

Calameo Crucial Question How Long Should I Keep Accounting Records

How Long Do I Need To Keep Old Tax Returns

How Long Do I Need To Keep Old Tax Returns

An Expat S Guide To Safely Filing The 2019 Dutch Income Tax Returns Sponsored Nl Times

An Expat S Guide To Safely Filing The 2019 Dutch Income Tax Returns Sponsored Nl Times

How Long Should You Keep Tax Records Kiplinger

How Long Should You Keep Tax Records Kiplinger

How Long To Keep Tax Records And Other Statements Brandongaille Com

How Long To Keep Tax Records And Other Statements Brandongaille Com

How Long Should You Keep Tax Returns Longer Than You Think

How Long Should You Keep Tax Returns Longer Than You Think

Your Essential Guide For How Long To Keep Financial Statements Moneysmartguides Com

Your Essential Guide For How Long To Keep Financial Statements Moneysmartguides Com

How Long Should You Keep Tax Records Nerdwallet

How Long Should You Keep Tax Records Nerdwallet

Why You Should Keep Tax Records For More Than Three Years

Why You Should Keep Tax Records For More Than Three Years

How Long Should You Keep Your Tax Records Thestreet

How Long Should You Keep Your Tax Records Thestreet

Comments

Post a Comment