How Much Should My Mortgage Be

A fixed-rate conventional loan. Mortgage approvals reached its peak in.

How Much Should I Pay On My Mortgage Mutilate The Mortgage

Rather you should focus on monthly mortgage payments and whether you can easily afford them.

How much should my mortgage be. 8 rânduri The most recent ABS data suggests weekly salaries suggest that on averages and medians mortgages. That might sound exciting at first but. Your mortgage payment should not be more than 25 of your take-home pay and you should get a 15-year or less fixed-rate mortgage.

How much should my mortgage be. With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax income. Mortgage Payment Calculator With Amortization Schedule.

Lenders use your debt-to-income ratio DTI as a measure of affordability. Back-end DTI adds your existing debts to your proposed mortgage payment. You already pay 1000 per month on existing debts.

Using these figures your monthly mortgage payment should be no more than 2800. Based on your DTI and depending on your other debts you could be approved for a mortgage of 600000. The ideal mortgage size should be no more than three times your annual salary says Reyes.

However approvals surged to 403 thousand in June 2020 as businesses began reopening. Here are the guidelines we recommend. Lenders want your back-end DTI to.

A monthly payment. So if you make 60000 per year you should think twice before taking out a mortgage. Your housing payment shouldnt be more than 2170 to 2520.

Financial experts suggest that your mortgage payment should be less than 28 of your gross monthly income. How much mortgage can you afford. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees.

It includes data from February 2020 to January 2021. The main thing you and your lender should care about isnt the total mortgage amount. To calculate how much you can afford with this model determine your.

Now you can probably qualify for a much larger loan than what 25 of your take-home pay would give you. And they see a 36 DTI as an excellent one. 043 x 5000 2150.

With this option your interest rate is secure for the life of the loan keeping you. Is that amount right for you. The borrowing amount we show in our mortgage calculator is based on 4x income.

A good benchmark is to spend no more than 36 of your gross monthly income on your total debt including your mortgage payment and other debt such as car payments and credit card payments. Ideally that means your monthly debts including the mortgage. Includes taxes insurance PMI and printable amortization schedule for handy reference.

The 35 45 model. Lenders use your debt-to-income ratio DTI as a measure of affordability. Going by the 28 percent rule the borrower should be able to reasonably afford a 1400 mortgage payment.

Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the. How much should my mortgage be. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule.

Rather you should focus on monthly mortgage payments and whether you can easily afford them. Some lenders will allow you to borrow multipliers of your salary slightly lower or higher than this but we think this represents a mid-point to give you a good indication of how much you may be able to borrow. The main thing you and your lender should care about isnt the total mortgage amount.

How much extra payment should I make each month to pay off my mortgage by a specific date and how much interest will I save. However factoring in the 36 percent rule the. Monthly debt payments 400 Monthly mortgage payments 1400.

Before lockdown was lifted in May 2020 UK mortgage approvals reached as low as 93 thousand. How much will my monthly mortgage payment be. And they see a 36 DTI as an Read More How much should my mortgage be compared to my income.

If you are paying more you may want to consider lowering your mortgage payment.

Affordability Calculator How Much House Can I Afford Zillow

Affordability Calculator How Much House Can I Afford Zillow

How Much Should My Mortgage Be From Better Money Habits Home Buying Home Buying Process Home Mortgage

How Much Should My Mortgage Be From Better Money Habits Home Buying Home Buying Process Home Mortgage

How Much House Can I Afford Ramseysolutions Com

How Much House Can I Afford Ramseysolutions Com

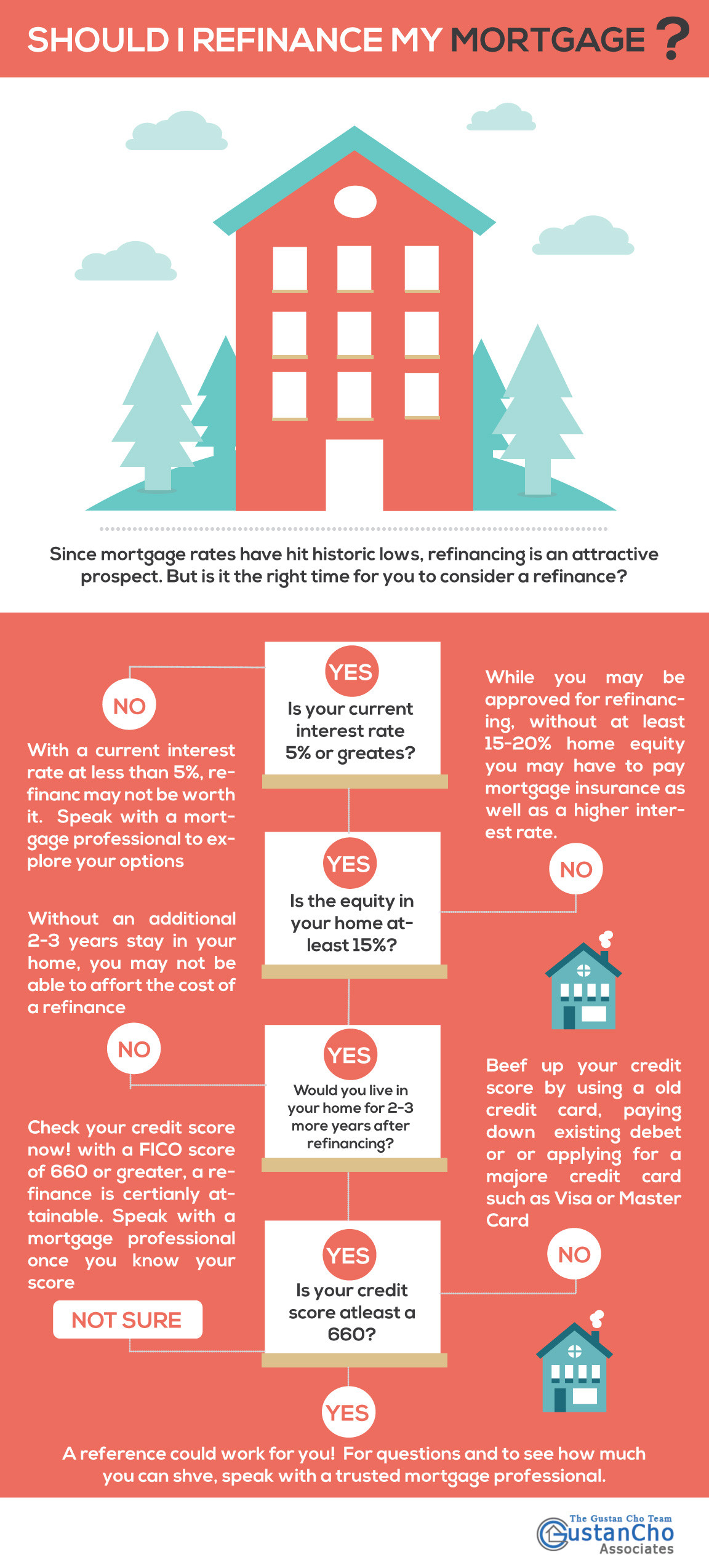

Should I Refinance My Mortgage Infographic Rates At 3 Year Low

Should I Refinance My Mortgage Infographic Rates At 3 Year Low

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How Much Should My Mortgage Be What Mortgage Payment Can I Afford

/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9.png) Down Payments How They Work How Much To Pay

Down Payments How They Work How Much To Pay

How Much A 150 000 Mortgage Will Cost You Credible

How Much A 150 000 Mortgage Will Cost You Credible

How Much Should My Mortgage Be What Mortgage Payment Can I Afford Home Buying Tips Home Ownership Home Buying

How Much Should My Mortgage Be What Mortgage Payment Can I Afford Home Buying Tips Home Ownership Home Buying

Ask An Ex Banker Mortgages Part Ii Should I Pay My Mortgage Early Bankers Anonymous

Here S How To Figure Out How Much Home You Can Afford

Here S How To Figure Out How Much Home You Can Afford

How Much House Can You Afford Money Under 30

How Much House Can You Afford Money Under 30

How Much Home Can You Afford Advanced Topics

How Much Home Can You Afford Advanced Topics

Mortgage Calculator How Much Can I Borrow Compare The Market

Mortgage Calculator How Much Can I Borrow Compare The Market

Comments

Post a Comment