Mortgage Deferment Vs Forbearance

The term mortgage deferment is sometimes used interchangeably with mortgage forbearance. Mortgage deferment or payment deferral is a repayment option that may be offered to borrowers who have missed mortgage payments or are exiting forbearance.

Mortgage deferment is slightly different from mortgage forbearance.

Mortgage deferment vs forbearance. Both tactics allow a borrower to. Deferment offers greater flexibility because you receive immediate mortgage relief and arent required to repay your missed payments until the end of your loan. Do you know the difference between a mortgage forbearance and mortgage deferment.

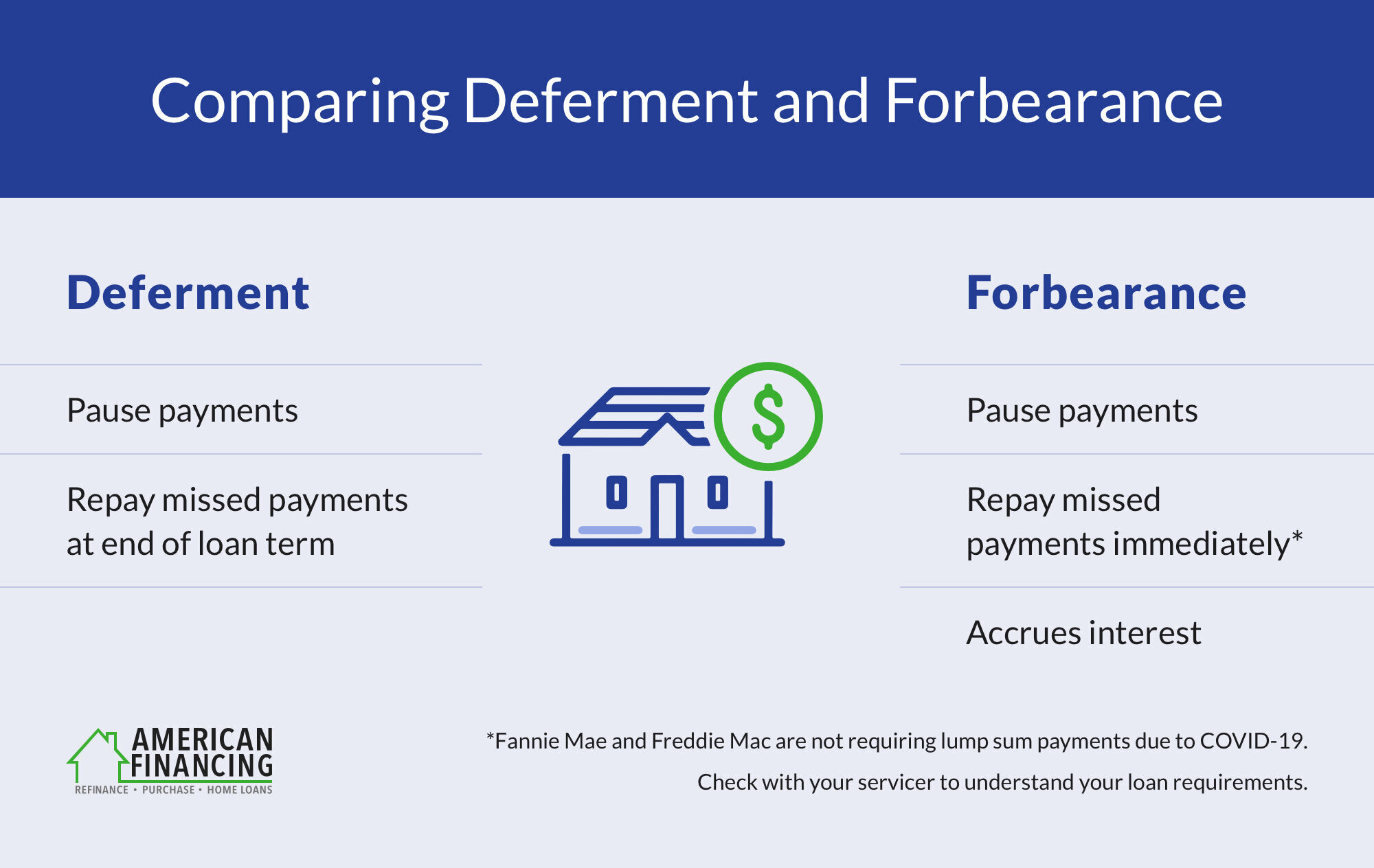

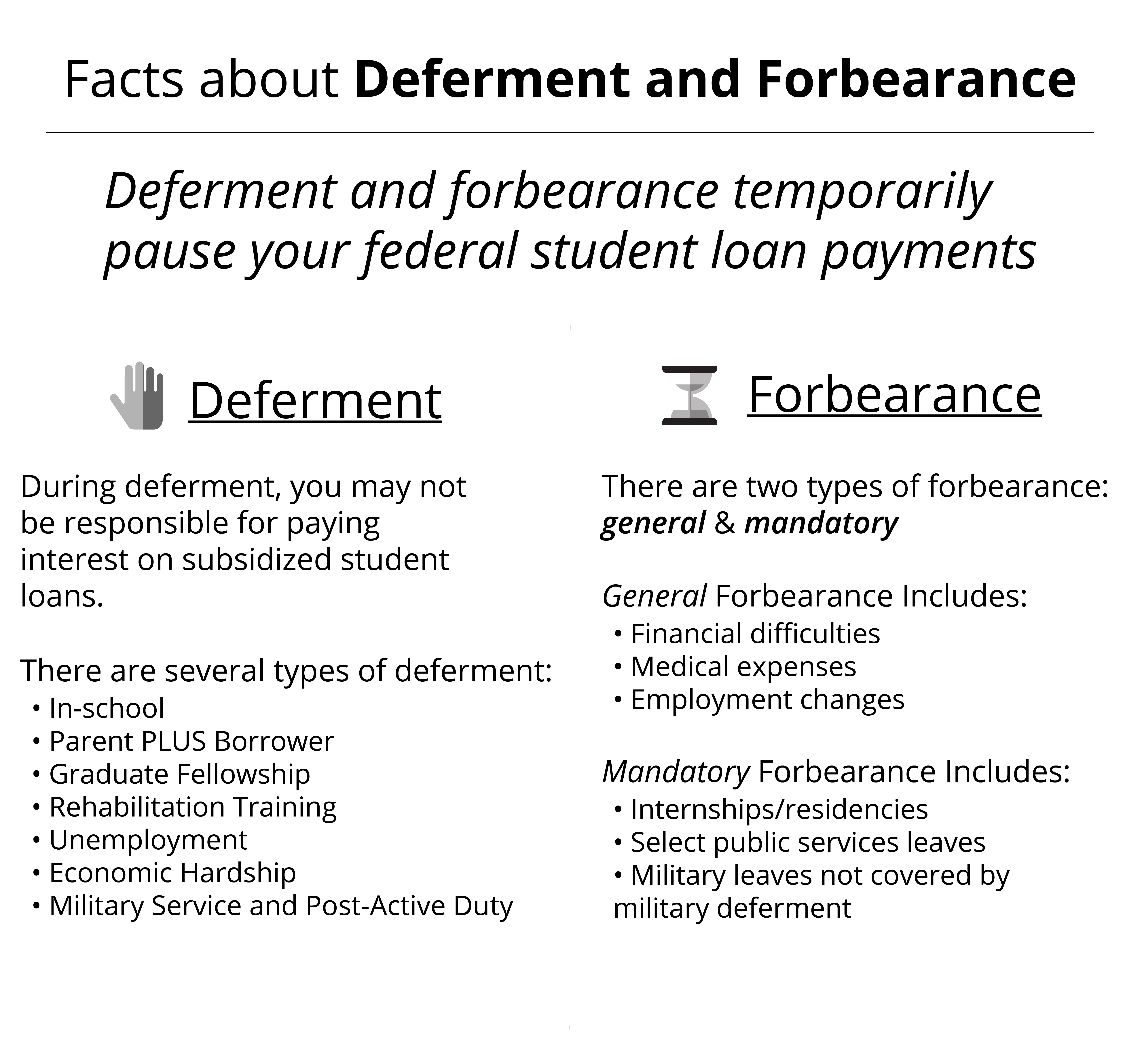

Unlike deferment a forbearance involves the possibility of interest and fees being tacked on. The difference however is that in the case of forbearance interest is accrued and in the case of deferment interest is not. The main difference between mortgage forbearance and deferment is that forbearance typically requires you pay the paused amount all at once at the end of the forbearance period.

Deferment allows you to either pay the paused amount at the end of your loan term or gradually throughout the loan term with increased monthly payments. Is deferment better than forbearance. The differences between mortgage forbearance and deferment There are two main differences between forbearance and deferment.

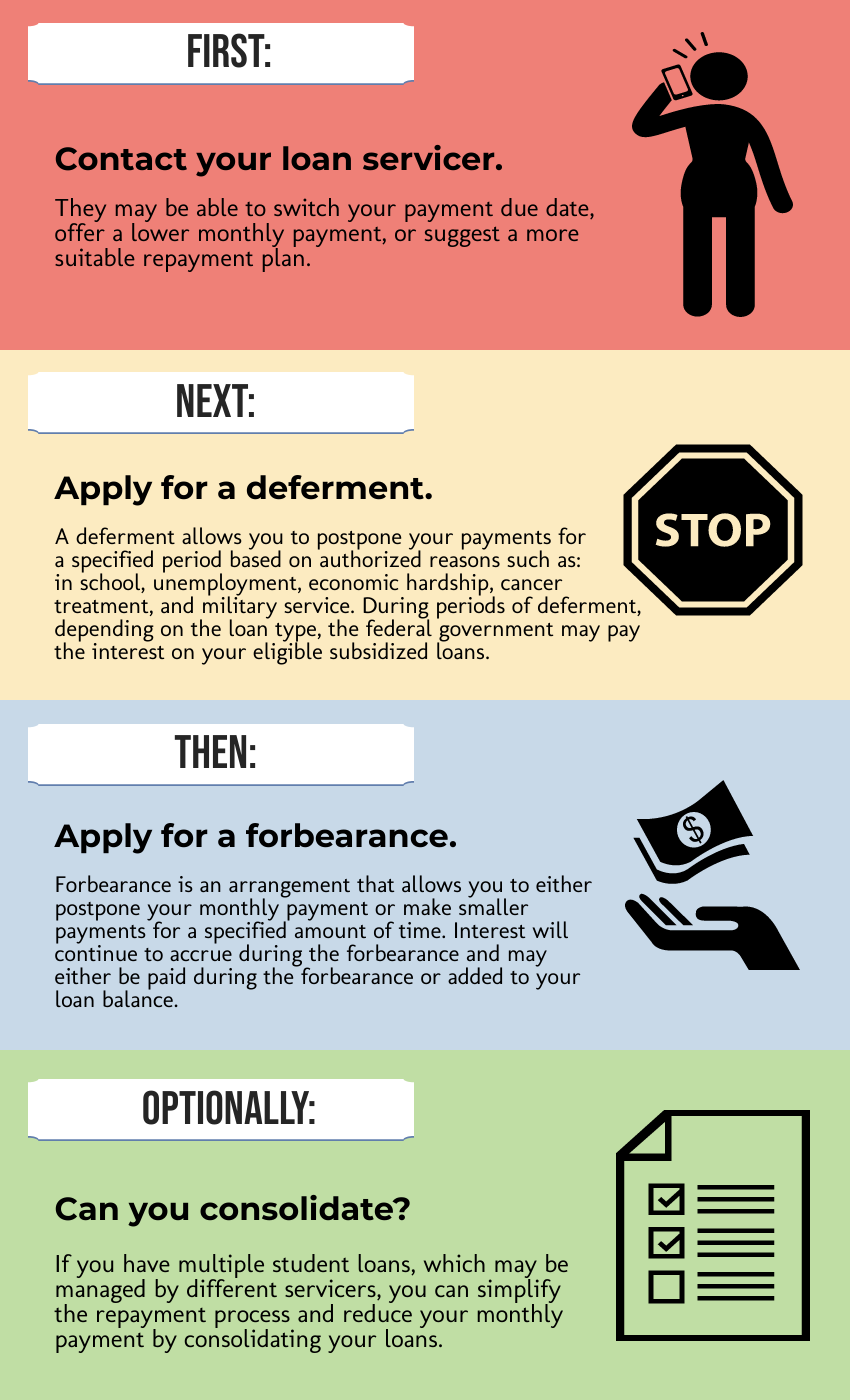

Forbearance is a program under which the customer temporarily pauses paying on a mortgage or temporarily pays at a reduced rate. Does it hurt your credit. If your mortgage loan lender allows you to defer your mortgage payments for a period of time the deferred payments are typically added on to the end of the mortgage loan not to the end of.

Interest accrual and howwhen you repay. Overall forbearance is saying Hey something has happened I cannot pay A book Carlson has dubbed her Bible of the financial world Surviving Debt by the National Consumer Law Center makes no distinction between forbearance and deferment. At the end of a forbearance period the amount of payments missed are due in a lump sum Singhas explains.

They do not even use the word deferment in terms of a mortgage everything is called a forbearance in this book she says. If your financial hardship has ended and youre able to resume making your regular mortgage payments but arent able to pay back the amount you owe in missed payments deferral may be a good option for you. The customer will be responsible to repay any missed payments after the forbearance period either in lump sum or in adjusted payment amounts over a period of time.

Forbearance on the other hand will be more costly once your payments resume. Why Do I Care What The Difference Is. Forbearance simply means pausing your mortgage payment while deferment is an option once a forbearance term is completed to take care of any missed mortgage payments.

Deferment Now when we actually talk about forbearance or deferment its usually in the context of a student loan. Mortgage deferment is similar to forbearance in that the payment can be temporarily stopped but a deferment payment may allow for the amount outstanding to be repaid over time or have it added at the end of their loan period. Mortgage deferment and mortgage forbearance allow borrowers to temporarily stop making their monthly payments but they differ in what happens afterwards.

However its important to realize that although the terms may be used interchangeably they dont mean the. Have you requested a forbearance or deferment on your mortgage payments fro. Forbearance means your lender has allowed you to pause loan payments.

At the end of the forbearance period you will need to discuss with your servicing. Both forbearances and deferment essentially press pause on a payment that is required. Two strategies that many borrowers are anxious to invoke right now are mortgage deferment and mortgage forbearance.

If youre experiencing trouble making your mortgage payment a mortgage forbearance along with a deferment may provide much-needed relief from a financial hardship. If youre experiencing financial hardship thats impacting your ability to pay your mortgage seeking guidance from an experienced real estate lawyer can be beneficial. Mortgage Forbearance and payment deferment is the beginning and end of the mortgage payment relief options available to you if you were impacted by the COVID.

If you choose the latter option the catch up payments are in addition to your regular monthly payment. However lenders may choose to work with borrowers to structure a payment plan. According to Experian you can either do that as a lump sum or in monthly installments over 12 months.

However it isnt the same.

Loan Forbearance Deferment Or Modification Nashville Real Estate

Loan Forbearance Deferment Or Modification Nashville Real Estate

Deferment And Forbearance Rountree Realty

Deferment And Forbearance Rountree Realty

Understanding The Difference Between Forbearance And Deferment Magnifymoney

Understanding The Difference Between Forbearance And Deferment Magnifymoney

Mortgage Forbearance Vs Deferment Know Your Options Clermont Florida Homes For Sale Clermont Florida Real Estate

Mortgage Forbearance Vs Deferment Know Your Options Clermont Florida Homes For Sale Clermont Florida Real Estate

Postponing Student Loan Payments Deferment And Forbearance

Postponing Student Loan Payments Deferment And Forbearance

How To Apply For Forbearance Or Deferment Tuition Io Dealing With Overwhelming Loans Student Loan Payment Student Loan Help Student Loans

How To Apply For Forbearance Or Deferment Tuition Io Dealing With Overwhelming Loans Student Loan Payment Student Loan Help Student Loans

Mortgage Forbearance Vs Deferment What You Must Know

Mortgage Forbearance Vs Deferment What You Must Know

Deferment Vs Forbearance What Are Your Relief Options Experian Global News Blog

Deferment Vs Forbearance What Are Your Relief Options Experian Global News Blog

How Forbearance Impacts Mortgage Brokers And Homeowners Aime Group

How Forbearance Impacts Mortgage Brokers And Homeowners Aime Group

Mortgage Forbearance Vs Deferment What You Must Know

Mortgage Forbearance Vs Deferment What You Must Know

Mortgage Forbearance Facts Community Lending Of America

Mortgage Forbearance Facts Community Lending Of America

Student Loan Deferment Vs Forbearance Credible

Student Loan Deferment Vs Forbearance Credible

Comments

Post a Comment