529 Plan Penalty

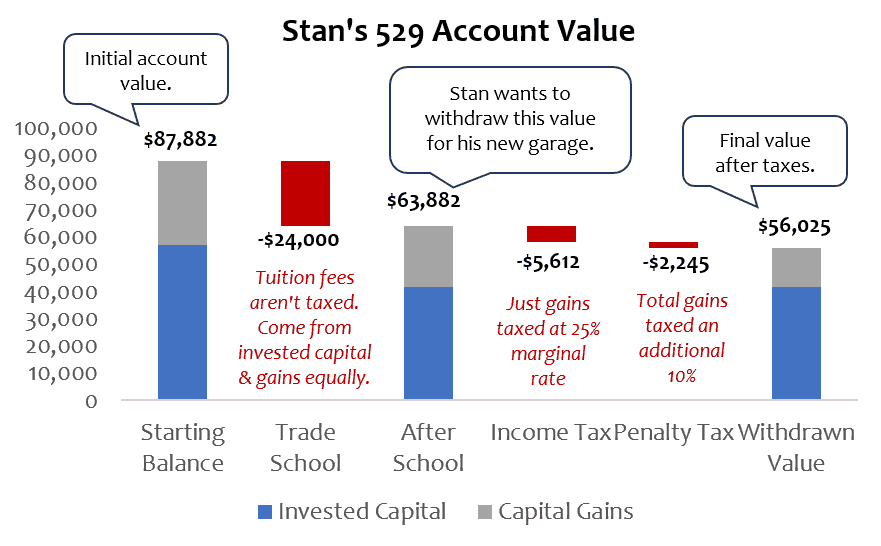

Unlike normal investment accounts the growth of your college accounts is treated and taxed as income and not capital gains. 529 plan withdrawal penalty 529 plan distributions are allocated between the earnings portion and the basis which is the contribution portion The contribution portion will never be subject to tax or penalized since it was made with after-tax dollars In.

Line 7 is then a simple subtraction to remove the excepted portions and the final adjusted number is multiplied by 10 to calculate the penalty owed on line 8.

529 plan penalty. If the money is used for. It might be difficult to imagine but the federal government actually doesnt want you to pay a 10 penalty on 529 withdrawals. If you violate this rule you get hit with federal income taxes and a 10 penalty on the accumulated earnings.

Lets say you contributed 14000 toward your 529 plan and it grew to 20000 in six years. First you have to. The limit for withdrawals is 10000 per year when used for private school tuition and earnings and withdrawals are tax-free.

If you take a distribution from your childs 529 plan and use some or all of it to cover nonqualified expenses you will owe not just taxes but in most cases an additional 10 penalty on the. Then on line 6 you note the taxable amount that is excepted from the 10 penalty. There will be a 10 penalty on the account earnings of the amount withdrawn and the earnings of the amount withdrawn will be taxed at the owners rate of income.

Penalty for Withdrawing From a 529 Plan Penalties. How to Open a 529 Plan. This means 70 came from your contributions and 30 came from investment returns earnings.

One of the more expensive disadvantages of 529 plans centers on the 10 penalty that applies when money in the account is used for something other than. Otherwise youll be hit with a 10 penalty and youll also be required to pay ordinary income tax on earnings. A 529 college savings plan allows families to save money for their childs college education in a tax-free investment account.

The accounts designated beneficiary dies and the distribution is paid to their estate or to another beneficiary. A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. Make sure you only use your 529 for primary and secondary school tuition.

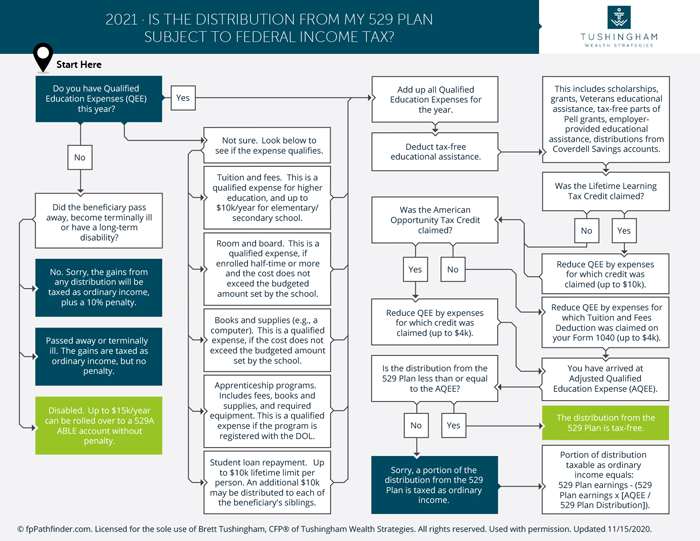

The money that grows over time is subject to penalties though. The IRS allows for one tax-free rollover per 529 beneficiary in a 12-month period. If you take a qualified distribution from your 529 plan not only do you not have to pay income.

If you take a non-qualified distribution from your 529 plan the penalties are two-fold. The beneficiary becomes permanently. There are three exceptions to the 10 penalty.

If you then make a 10000 nonqualified withdrawal 30 or 3000 will face federal income tax at your bracket plus a 10 penalty. A 10 penalty sounds like a lot but the reality is that most of the time it is a very manageable amount. Specifically a withdrawal from a 529 plan that is not used for qualified education expenses is not subject to the 10 penalty in these situations.

In each of the following cases the 10 withdrawal penalty is waived but you must still pay income taxes on the earnings portion of the withdrawal. 529 plans legally known as qualified tuition plans are sponsored by states state agencies or educational institutions and are authorized by Section 529 of the Internal Revenue Code. Has to say about the penalty associated with withdrawing funds from your sons 529 plan.

Usually withdrawals from a 529 plan that are not used for eligible educational expenses are subject to a 10 penalty but there are some instances in which the penalty is waived. Federal law imposes a 10 penalty on earnings for nonqualified distributions beginning in 2002. The most important thing to know about penalties and your 529 plan is that your principal can always be withdrawn without penalty.

Only the earnings within the 529 plan will be subject to penalties not what the saver has contributed to the plan. If you withdraw money from the 529 account and you dont use it for qualified educational expenses youll have to pay the 10 withdrawal penalty on the earnings and growth in the account. That penalty is in place to prevent abuse of 529 plans as a.

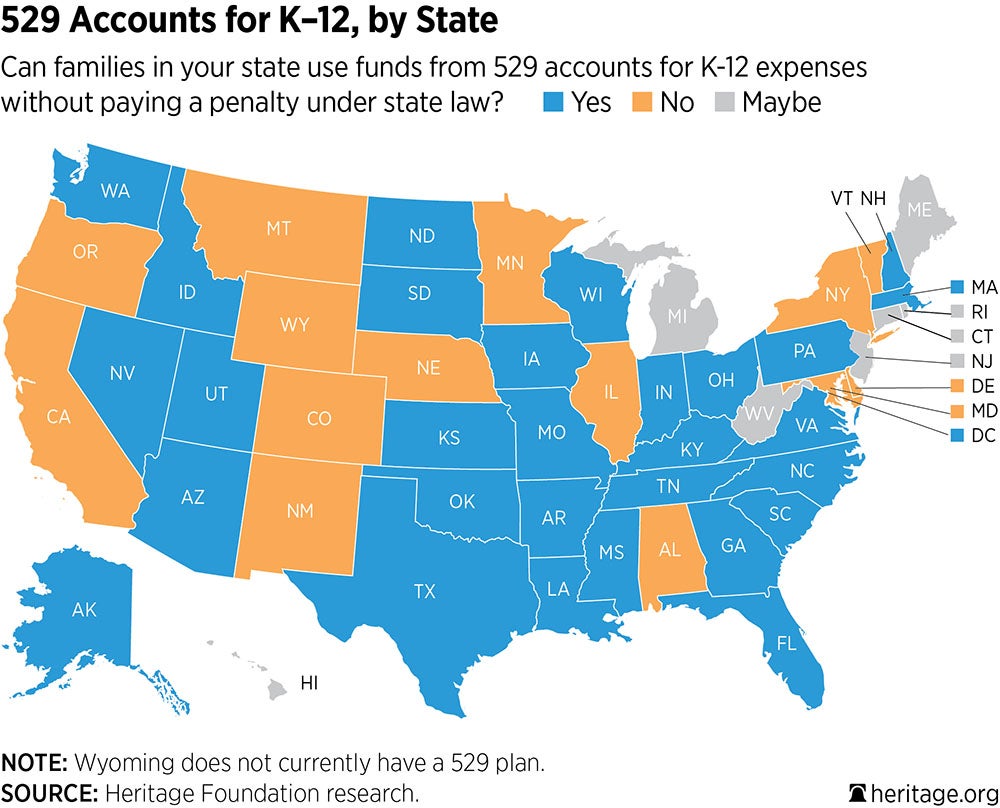

529 Accounts In The States The Heritage Foundation

529 Accounts In The States The Heritage Foundation

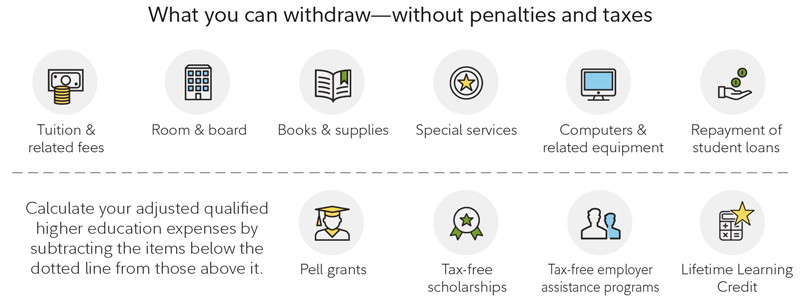

Qualified 529 Expenses Withdrawals From Savings Plan Fidelity

Qualified 529 Expenses Withdrawals From Savings Plan Fidelity

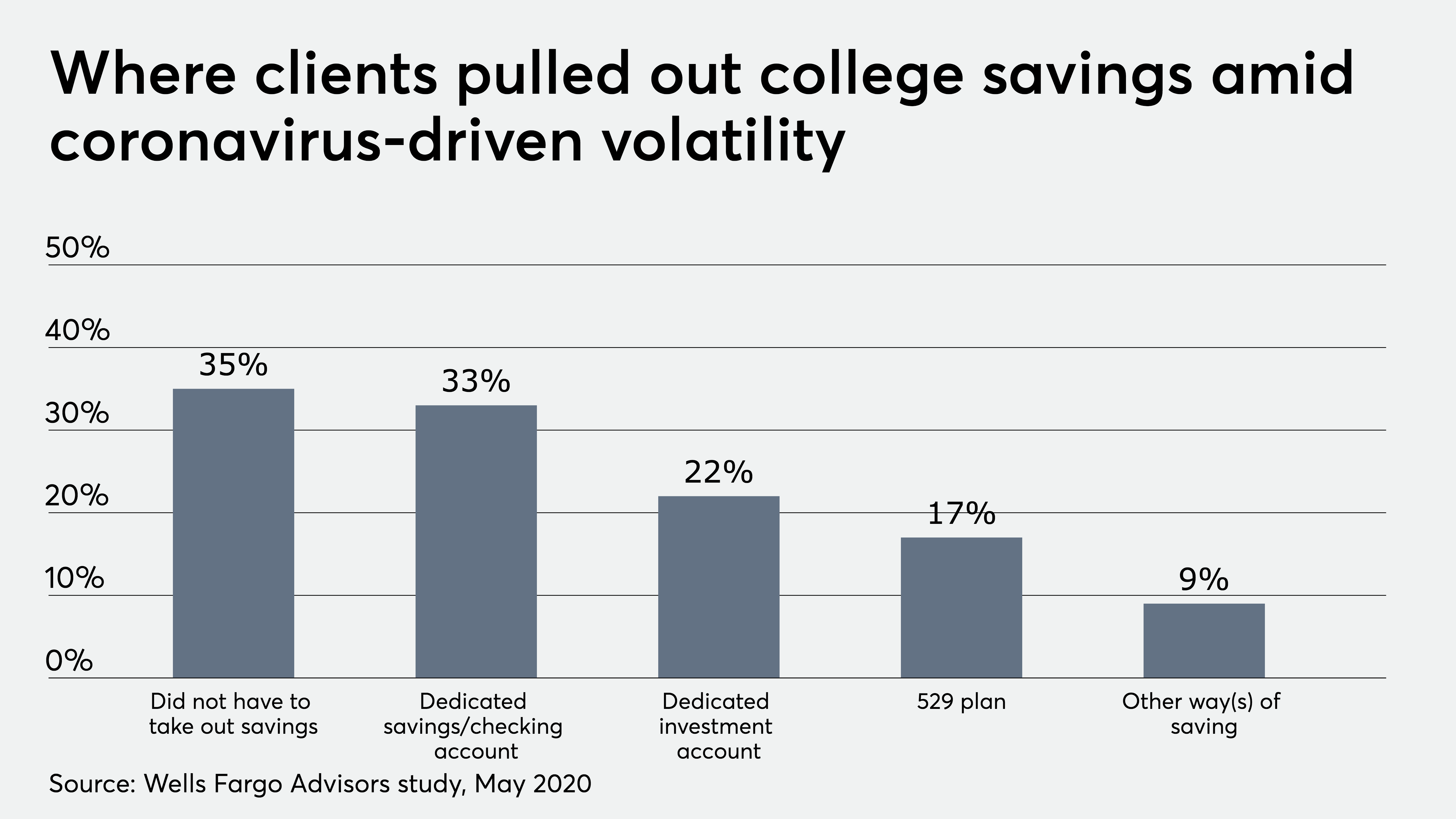

How 529 Plans Performed During Coronavirus Pandemic Market Volatility Financial Planning

How 529 Plans Performed During Coronavirus Pandemic Market Volatility Financial Planning

What Can I Do With Unspent Money In A 529 Plan Law Offices Of Robert J Varak

What Can I Do With Unspent Money In A 529 Plan Law Offices Of Robert J Varak

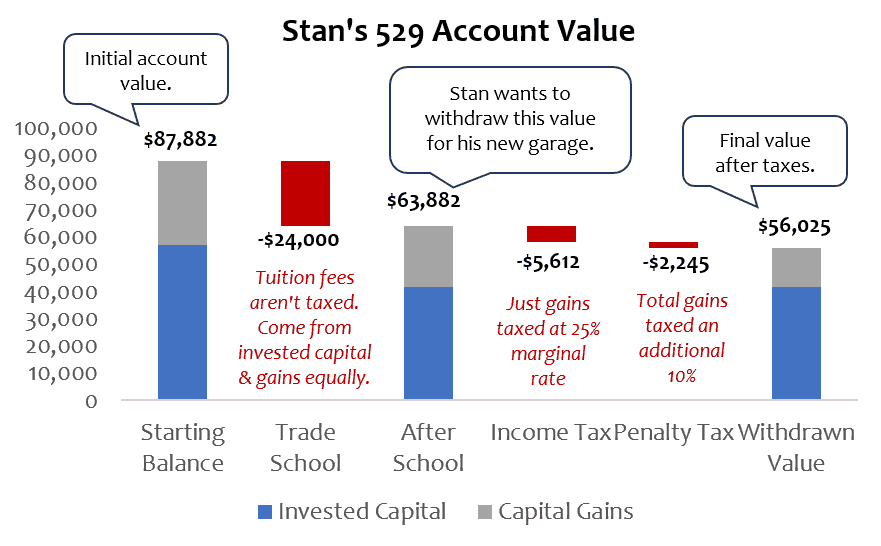

Saving For Education Expenses 529 Plan Vs Taxable Investment Account Piece Of Wealth Planning

Saving For Education Expenses 529 Plan Vs Taxable Investment Account Piece Of Wealth Planning

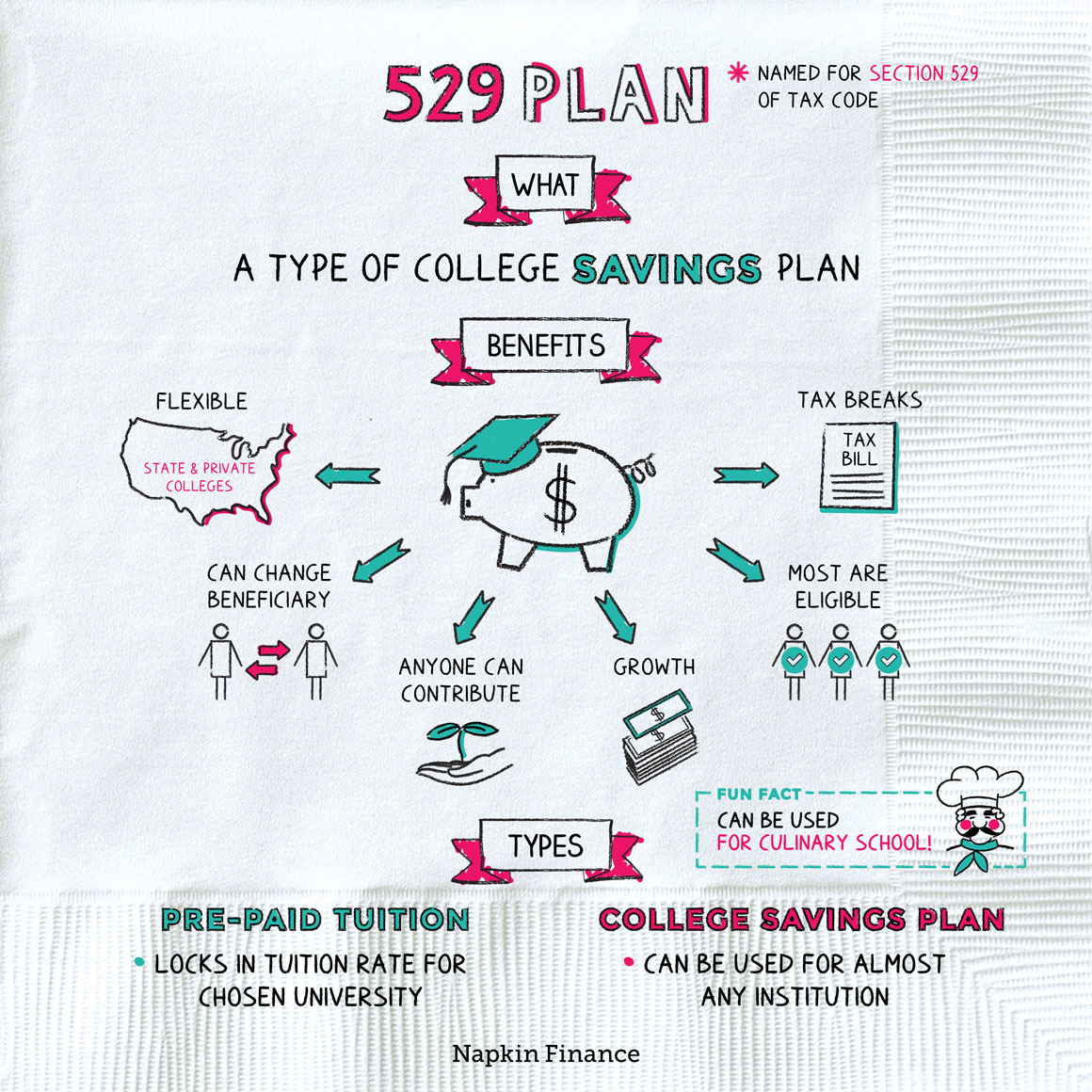

What Is A 529 Plan Napkin Finance

What Is A 529 Plan Napkin Finance

What Happens To Your 529 Plan If Your Child Doesn T Go To College Smart Money Mamas

What Happens To Your 529 Plan If Your Child Doesn T Go To College Smart Money Mamas

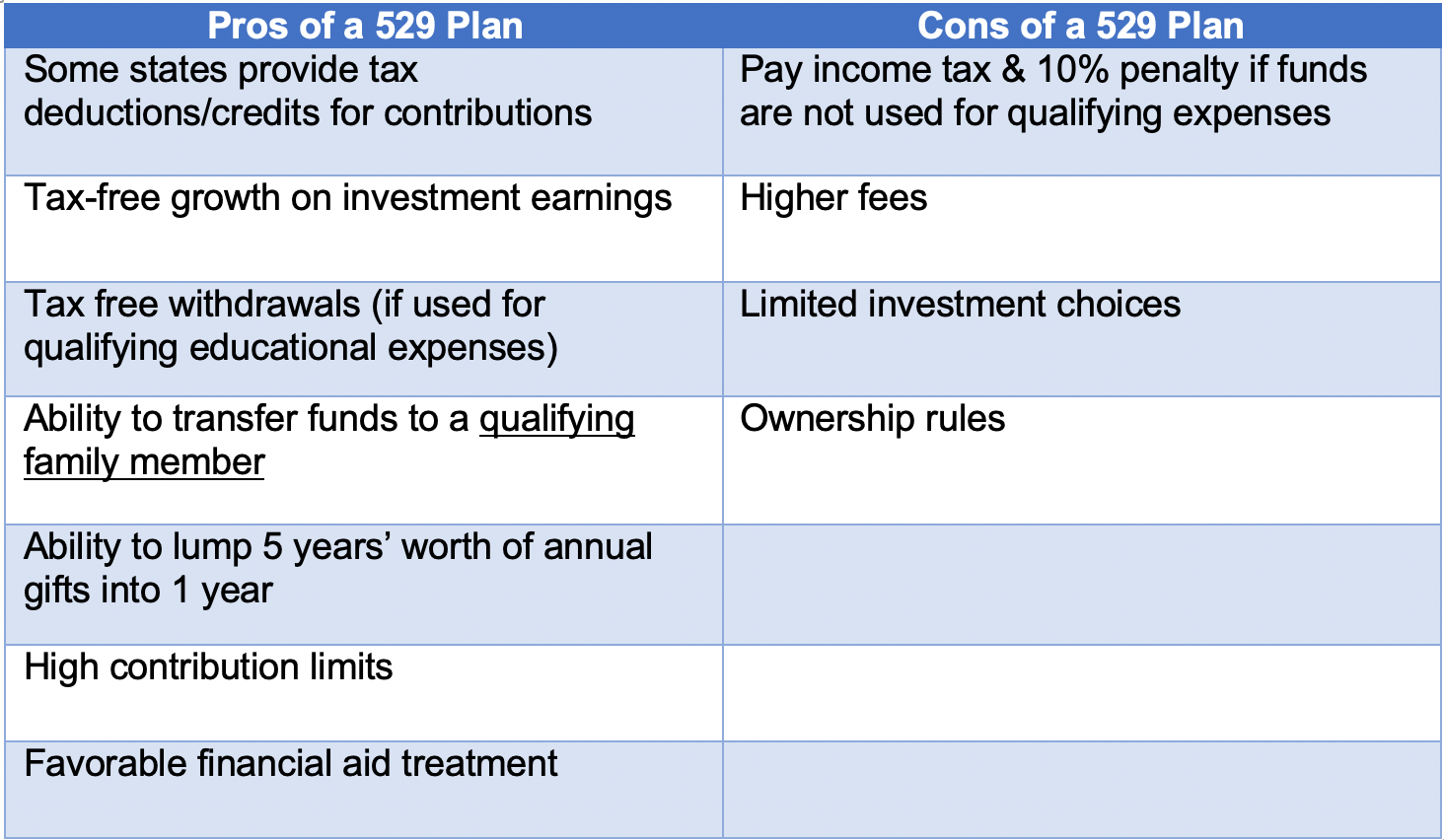

529 Plan Definition Types Advantages Disadvantages

529 Plan Definition Types Advantages Disadvantages

Is The Distribution From My 529 Plan Taxable

Is The Distribution From My 529 Plan Taxable

Astute Savers Don T Just Use 529 Plans For College Savings

Look Before You Leap Into A 529 Plan Journal Of Accountancy

Look Before You Leap Into A 529 Plan Journal Of Accountancy

What Is The Penalty For Early Withdrawal From 529 Plans The Motley Fool

What Is The Penalty For Early Withdrawal From 529 Plans The Motley Fool

Does A 529 Plan Help Pay For College American Pacific Tax Limited

Comments

Post a Comment