Day Trading Vs Long Term

After your backtest is reliably profitable every week for 10-12 weeks at least start with 10 risked per trade and. Typically a day trader would invest in instruments like currency trading and derivatives markets with the help of technical analysis.

Day Trading Vs Investing What S The Difference The Money Venture

Day Trading Vs Investing What S The Difference The Money Venture

Only when the minority becomes the majority will true change take place.

Day trading vs long term. This is the speculative arena of cryptocurrency investing. Day Trading vs Long Term Investing One way to look at the difference between day trading and investing for a longer term is that a trader will either sink or swim by trading through a market storm. Some successful long-term investors lose their money when attempting to day trade and some day traders cant pick a good long-term investment.

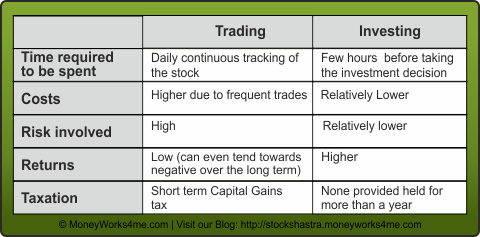

Unlike the long term buy and hold strategy the day trading strategy can go long or. With small daily stock price variations you could make huge percentage gains by Day Trading That would be a good return for a whole year for a long-term investor and you could do it in 10 days by day trading. Investing takes a long-term approach to the markets and often applies to such purposes as retirement accounts.

The Cost of Trading Commissions. Pros and Cons of Day Trading Versus Long-Term Investing Minimum Capital Requirements. I have a number of personal Laws that I have created over the years that I use to remind myself to be happy to be diligent to have fun and etc.

1000 would become 37000. When you day trade youre trying to take advantage of cryptocurrency price fluctuations that typically happen within a day. Day Trading Cryptocurrencies.

Some successful long-term investors lose their money when attempting to day trade and some day traders cant pick a good long-term investment. The truth is that day traders and long-term investors both make money and lose money. Far easier and meant to provide supplemental income.

Their day job is generating profit from short-term trades. But if you dont realize that a reward like that takes an insane amount of hard work you are just going to wind up losing a lot of money along the way. Stick to swing trading or long term investing.

An investor will ride through the storm and see what happens on the other side usually. Obviously at first it wont be your primary source but that should be the goal. Learn risk management trade management first.

Nearly 9 for the SP 500. A day trader is looking to profit from short bursts of trending or non-trending price activity either to the downside or upside. Assume that your broker charges a commission of 7 per trade.

So why isnt everyone doing this. To day-trade stocks in the US youll need to maintain a brokerage account balance of at. FX Leaders introduced long term trading signals as an exclusive addition to our premium members offering them greater insights into market.

In the meanwhile get 30-35K ready for a trading account pdt is a bummer this is the bare minimum to day trade and not face pdt lockouts with some mistakes. If you want to learn paper trade for 3-6 months and develop and backtest a strategy. And buying the stock on January 1 and.

Trading involves short-term strategies to maximize returns daily monthly or. Keep that up for a whole year and youd return 3700 with compounding. Newcomers to investing would be well served to understand the fundamental differences between the.

There is more than one way to approach the stock market and many different schools of thought exist on how to best make money buying and selling securities. Day Trading is for people looking to make it their primary source of income. If you bought GameStop just one day earlier youd actually have a 7 gain vs.

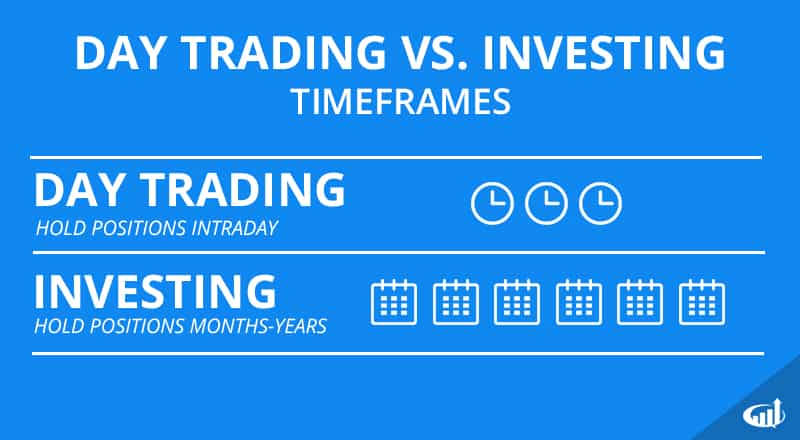

Day traders can be investors too. Differences between Intraday Trading vs Long-term Investing 1. Long-term stocks are held for several years and any fluctuations in the short-term do not affect your investment decision.

In terms of trading the difference is mainly in personal temperament and time. The truth is that day traders and long-term investors both make money and lose money. Often times these are smaller gains but they can quickly add up if you have a lot of coins.

One of my personal favorites reads as follows. In terms of trading the difference is mainly in personal temperament and time. A day trader do not intend to hold it for long term and hence aims at gaining profit with the short term fluctuations of the security that happens during the day.

What is day trading. Here holding period may vary from two years to even several decades. There are a million ads proclaiming wealth through day trading.

Still trading costs while day trading will be significantly higher than with long-term investing. Though you can also do swing trades which will happen over a series of a few days or even a couple of weeks. Assuming there is profit it can then be reinvested properly for the long term.

Losses can be large Since day traders trade with higher risk levels than long-term investors the potential losses can be higher as well.

Trading Vs Investing 6 Things You Need To Know M1 Finance

Trading Vs Investing 6 Things You Need To Know M1 Finance

Day Trading Vs Long Term Investing Invest Mindset

Should You Day Trade Or Hold For The Longer Term Contracts For Difference Com

Should You Day Trade Or Hold For The Longer Term Contracts For Difference Com

Day Trading Vs Long Term Investing Invest Mindset

Day Trading Vs Long Term Investing Invest Mindset

Bone Up Beating The Bulls In A Day

Bone Up Beating The Bulls In A Day

Pros And Cons Of Day Trading Versus Long

Pros And Cons Of Day Trading Versus Long

Day Trading Vs Long Term Investing Youtube

Day Trading Vs Long Term Investing Youtube

Day Trading Or Long Term Investing Which Is Better Invest And Up

Day Trading Or Long Term Investing Which Is Better Invest And Up

How To Trade Trader Styles Technical Vs Fundamental Short Term Vs Long Term And Discretionary Vs Automated Trading Systems 17 May 2015 Traders Blogs

How To Trade Trader Styles Technical Vs Fundamental Short Term Vs Long Term And Discretionary Vs Automated Trading Systems 17 May 2015 Traders Blogs

/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png) Day Trading Tips For Beginners

Day Trading Tips For Beginners

Day Trading Brokers Everything You Need To Know

Day Trading Brokers Everything You Need To Know

Trading Or Investing What S Right For You Investment Shastra

Trading Or Investing What S Right For You Investment Shastra

Day Trading Vs Long Term Investing Phil Town Youtube

Day Trading Vs Long Term Investing Phil Town Youtube

Differences Between Day Trading And Investing

Differences Between Day Trading And Investing

Comments

Post a Comment