Converting Term Life To Whole Life

First check the language of your policy to see if conversion is an option it is on most. Well maybe you arent rich but perhaps youre simply better off than when you.

Term Life Vs Whole Life Insurance Instant Cost Calculator

Term Life Vs Whole Life Insurance Instant Cost Calculator

Check out these four reasons you should consider making the switch.

Converting term life to whole life. Unfortunately converting your permanent life insurance to term life insurance isnt the easiest thing to do. Alternatives to life insurance conversion Purchase a new term life insurance policy. If you bought your life insurance on your own or through a proprietary agent converting term life to whole life insurance still isnt very hard.

Reasons to Convert Term to Whole Life Insurance Build savings. The entire process can be completed in just a few days. Down the road you can use your accumulated cash value for many purposes such as adding to your retirement income paying off debts or covering emergency expenses.

Read the conversion terms carefully. Most policies allow term life to be converted to whole life or universal life insurance and one of the benefits of conversion according to Haney is that there should be no medical element so they cannot deny you if your health has changed The process for conversion is fairly simple. Use the ladder strategy to stack term life insurance policies.

Converting your term insurance to whole life is a limited time opportunity However there are a lot of factors to consider such as your current budget financial obligations and other policies or financial vehicles. Another option to explore if youre seeking partial. Now you can afford it.

If you current term policy is convertible you will be able to keep the health rating you got when you first got your insurance policy. No new medical exams will be required and you may even receive conversion credits that reduces the initial premium of your new whole life policy. Knowing how to convert term life insurance to whole life insurance is a good idea.

While many companies provide the option to up your coverage from term life to whole life they tend to discourage lowering your coverage. Youll probably outlive your term life policy Term life polices are great in that theyre affordable. Converting a term life policy to a permanent policy is much simpler than applying for a new policy.

You now may be able to have whole life coverage. It can be an excellent idea to get professional advice when making financial decisions. Another advantage of converting term to whole life is that you will begin building cash value at a guaranteed interest rate.

Term life insurance conversion credit. Top 7 Reasons why converting term to whole life makes sense 1. You can easily convert your term life insurance to whole life insurance by making completing a little paperwork.

Part of the price for permanent life insurance goes toward a cash value account which builds slowly. When you purchased your term life insurance policy you recognized the need to protect your loved ones after youre gone. Converting a temporary policy into a permanent one will save you from losing all the money you paid in premiums.

Since most term life insurance policies are convertible youll usually have the option to convert some or all of your term policy to a permanent. Benefits of Converting Term Life to Permanent Life Permanent life insurance such as whole life offers premiums that remain the same and provides your loved ones with protection throughout your lifetime provided premiums are paid as required. Just call customer service and complete any paperwork or other requirements they ask for.

But gradually converting some or all your term to whole life will give you the peace of mind that comes with knowing that your family will always be protected if something happens to you and you will no longer have to be concerned about the expiry date of your term life insurance policy. The main reason to convert your term policy to Whole Life is to have permanent insurance that never expires. One of the easiest ways to extend your insurance coverage to match your evolving needs is by converting your term life policy to a whole life policy.

Convert Your Life Insurance for a Lifetime of Value. Some companies may require you to be under 65 years old in order to convert your policy. Given the steep cost of whole life insurance its possible that taking out a.

You might have wanted some permanent insurance but balked at the price for universal or whole. Now you have an opportunity to make an even greater impact on the financial security of your family by converting your term policy to whole life insurance. The short answer is yes.

Contact your insurance agent or company. Before you do anything its important to talk to an.

Converting Term Life To Whole Life Get The Facts Trusted Choice

Converting Term Life To Whole Life Get The Facts Trusted Choice

Can I Convert My Term Life Policy To Whole Life The Insurance Pro Blog

Can I Convert My Term Life Policy To Whole Life The Insurance Pro Blog

Convertible Term Life Insurance

Convertible Term Life Insurance

How To Convert Your Term Insurance To Whole Life Insurance Youtube

How To Convert Your Term Insurance To Whole Life Insurance Youtube

Can I Convert Term Life To Whole Life Pacific Wealth Solutions

Can I Convert Term Life To Whole Life Pacific Wealth Solutions

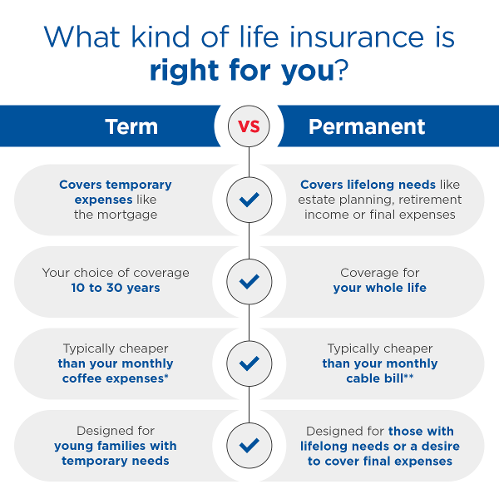

Term Vs Permanent Life Insurance Aaa Life Insurance Company

Term Vs Permanent Life Insurance Aaa Life Insurance Company

Converting A Term Life Insurance Policy To Whole Life Insurance Bankrate Com

Converting A Term Life Insurance Policy To Whole Life Insurance Bankrate Com

Term Conversion Convert To Term To Permanent Whole Life Insurance Northwestern Mutual

Term Conversion Convert To Term To Permanent Whole Life Insurance Northwestern Mutual

Can A Term Life Policy Be Converted To Whole Life American Income Life Insurance Co

Can A Term Life Policy Be Converted To Whole Life American Income Life Insurance Co

Convert Term Life Into Permanent Life Insurance To Keep Your Rate Class

Convert Term Life Into Permanent Life Insurance To Keep Your Rate Class

Converting Term To Whole Life 6 Reasons To Convert To Whole Life

Converting Term To Whole Life 6 Reasons To Convert To Whole Life

How And Why To Convert Term Life To Permanent Life Insurance Forbes Advisor

How And Why To Convert Term Life To Permanent Life Insurance Forbes Advisor

Can I Convert My Term Life Insurance Into A Whole Life Insurance Policy

Can I Convert My Term Life Insurance Into A Whole Life Insurance Policy

Comments

Post a Comment