What Does Tax Liability Zero Mean

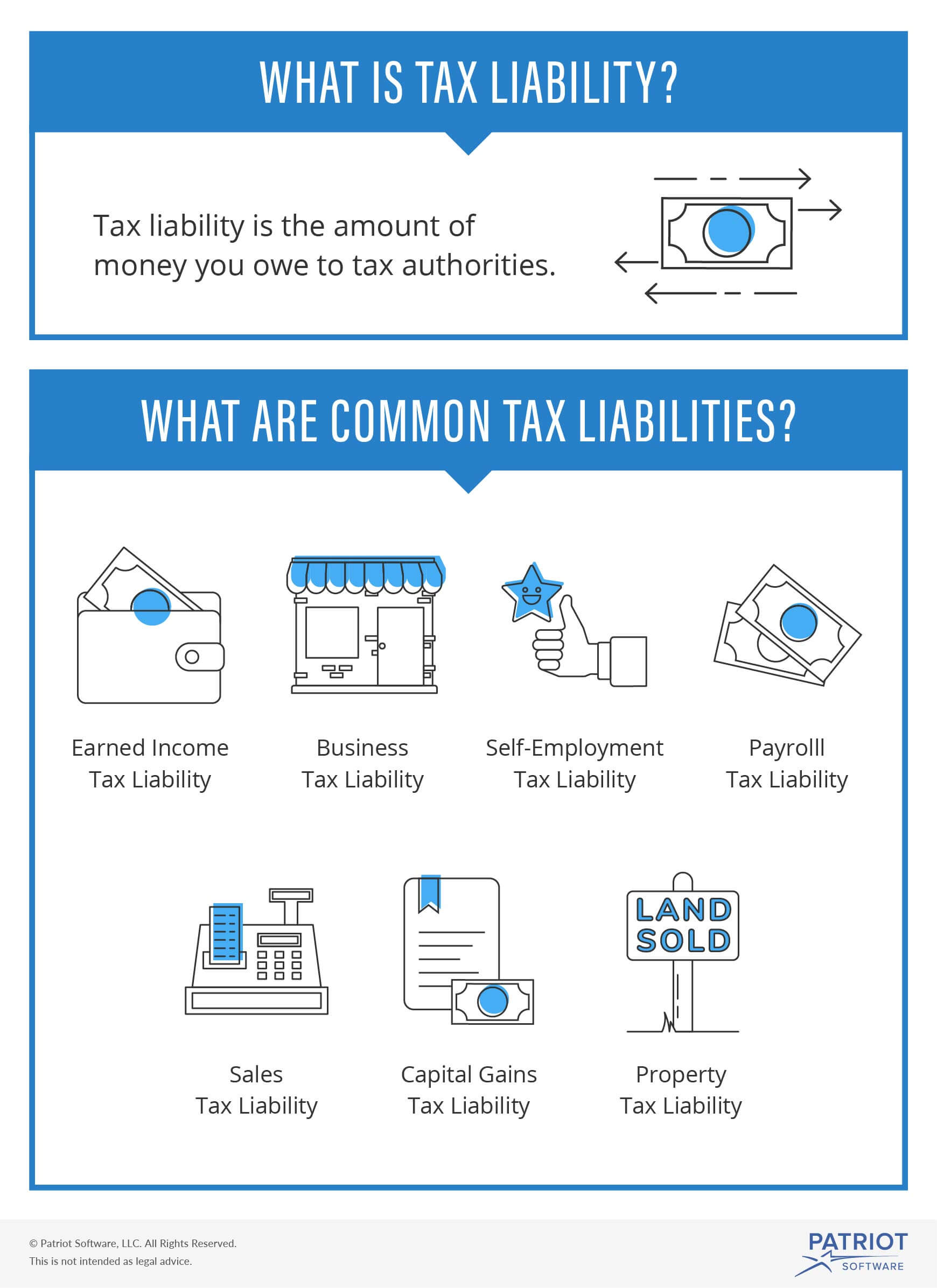

Tax liability is the total amount of tax owed in a given period by individuals and organizations to federal state and local governments. Individual Income Tax Return or Form 1040-SR US Tax Return for Seniors was zero.

What Is Tax Liability Definition Examples More

What Is Tax Liability Definition Examples More

A tax liability is what you owe to the IRS or other taxing authority when you finish preparing your tax return.

What does tax liability zero mean. Your current years tax liability appears on. If could mean you had deductions equal to. Tax liability is the amount of money you owe to tax authorities such as your local state and federal governments eg the IRS.

For businesses tax liabilities are short-term. Your income tax liability is determined by your earnings and filing status. If that line is 0 you had no tax liability.

Its called a zero liability tax return and heres what you need to know about it. ZERO tax libability means you PAID no taxes not that you had high tax withholding. Both individuals and businesses can have tax liabilities.

According to the IRS 70 of all taxpayers are eligible to file their taxes free. The zero-liability policy that all major credit card issuers. No tax liability means a taxpayers total tax was zero in the prior.

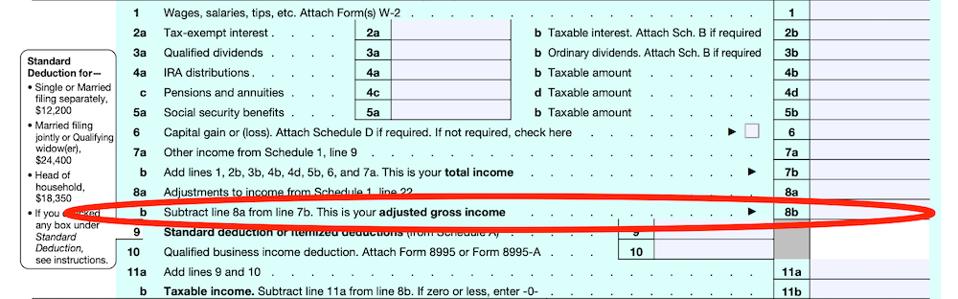

A non-refundable tax credit is a tax credit that can only reduce a taxpayers liability to zero. As it pertains to your 2016 return Line 63 on your Form 1040 would show your Total Tax. Take a look at the following TurboTax article to learn more about tax liability.

Taxable events include earning taxable income having sales receiving or issuing payroll etc. It does NOT necessarily mean you had NO income. When you dont owe taxes to the federal government at tax time you still have to file a return.

Your tax liability isnt based on your overall earnings but on your taxable income after you take deductions and claim tax credits. A condition in a credit card agreement stating that the card holder is not responsible for unauthorized charges. Tax liabilities are incurred when income is earned there is a gain on the sale of an asset or another taxable event occurs.

Your tax liability is the total amount of tax on your income minus any non-refundable credits such as child tax credit savers credit dependent care credit to name a few. 1 Any amount that remains from the credit is automatically forfeited by the taxpayer. This can also include additional taxes like self-employment tax household employment tax and tax penalties such as the 10 early distribution penalty for IRAs.

When you have a tax liability you have a legally binding debt to your creditor. The same is true for sellers when it comes time to file sale tax returns to states even if there are no sales to report. A tax liability might also be called a tax obligation A tax authority -- such as a local state or national government -- imposes taxes upon individuals organizations and corporations to fund social programs and administrative roles.

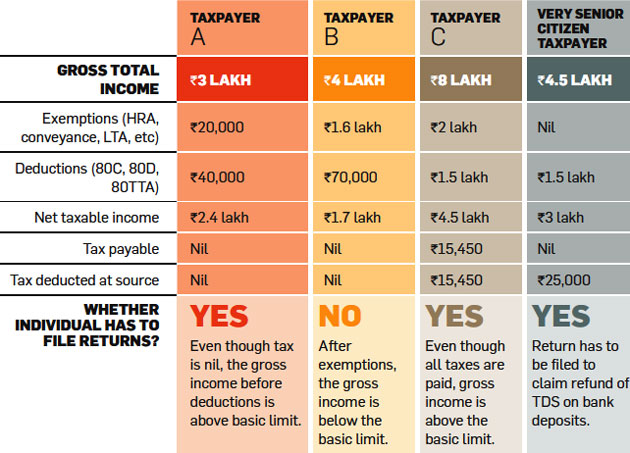

You had no tax liability for the prior year if your total tax was zero or you didnt have to file an income tax return. No tax liability means a taxpayers total tax was zero in the prior year or they did not have to file a tax return. Your total tax was zero if the line labeled total tax on Form 1040 US.

Your tax liability is the amount of taxes you owe to the IRS or your state government. Check out the ultimate guide to filing your taxes for free. So its worth looking into your options.

Am I Exempt From Federal Withholding H R Block

Am I Exempt From Federal Withholding H R Block

Taxation In South Africa Wikipedia

Taxation In South Africa Wikipedia

What Is A Tax Liability Ramseysolutions Com

What Is A Tax Liability Ramseysolutions Com

What Are The Tax Brackets H R Block

What Are The Tax Brackets H R Block

It S About Your Total Tax Liability Not Your Refund Tax Policy Center

It S About Your Total Tax Liability Not Your Refund Tax Policy Center

You Don T Have To Pay Federal Income Tax If You Make This Much Money Marketwatch

You Don T Have To Pay Federal Income Tax If You Make This Much Money Marketwatch

Income Tax Return Filing Ten Rules You Must Follow While Filing Income Tax Returns

Income Tax Return Filing Ten Rules You Must Follow While Filing Income Tax Returns

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

It S About Your Total Tax Liability Not Your Refund Tax Policy Center

It S About Your Total Tax Liability Not Your Refund Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

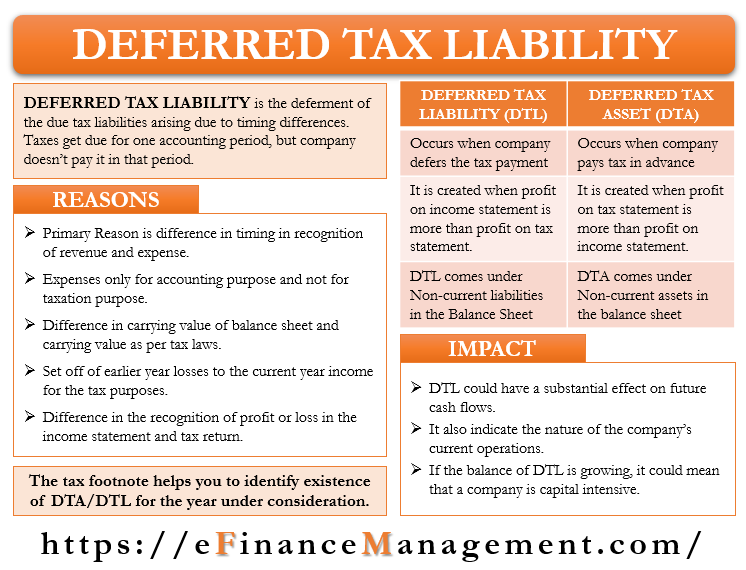

Deferred Tax Liabilities Meaning Example Causes And More

Deferred Tax Liabilities Meaning Example Causes And More

Http Www Nasfaa Org Uploads Documents 2020 21 Tax Transcript Decoder Pdf

/GettyImages-975814434-34641614c9cf4aef92168a1531b11c99.jpg)

Comments

Post a Comment