Can You Deduct Mortgage Interest

3 A higher limitation of 1 million or 500000 each if married filing separately applies if youre deducting mortgage interest from indebtedness that was incurred before December. If you have a home loan the mortgage interest deduction allows you to reduce your taxable income by the amount of interest paid on the loan during.

If Gop Scales Back The Mortgage Interest Deduction Californians Would Be Hit Hardest Los Angeles Times

Can I Deduct Mortgage Interest.

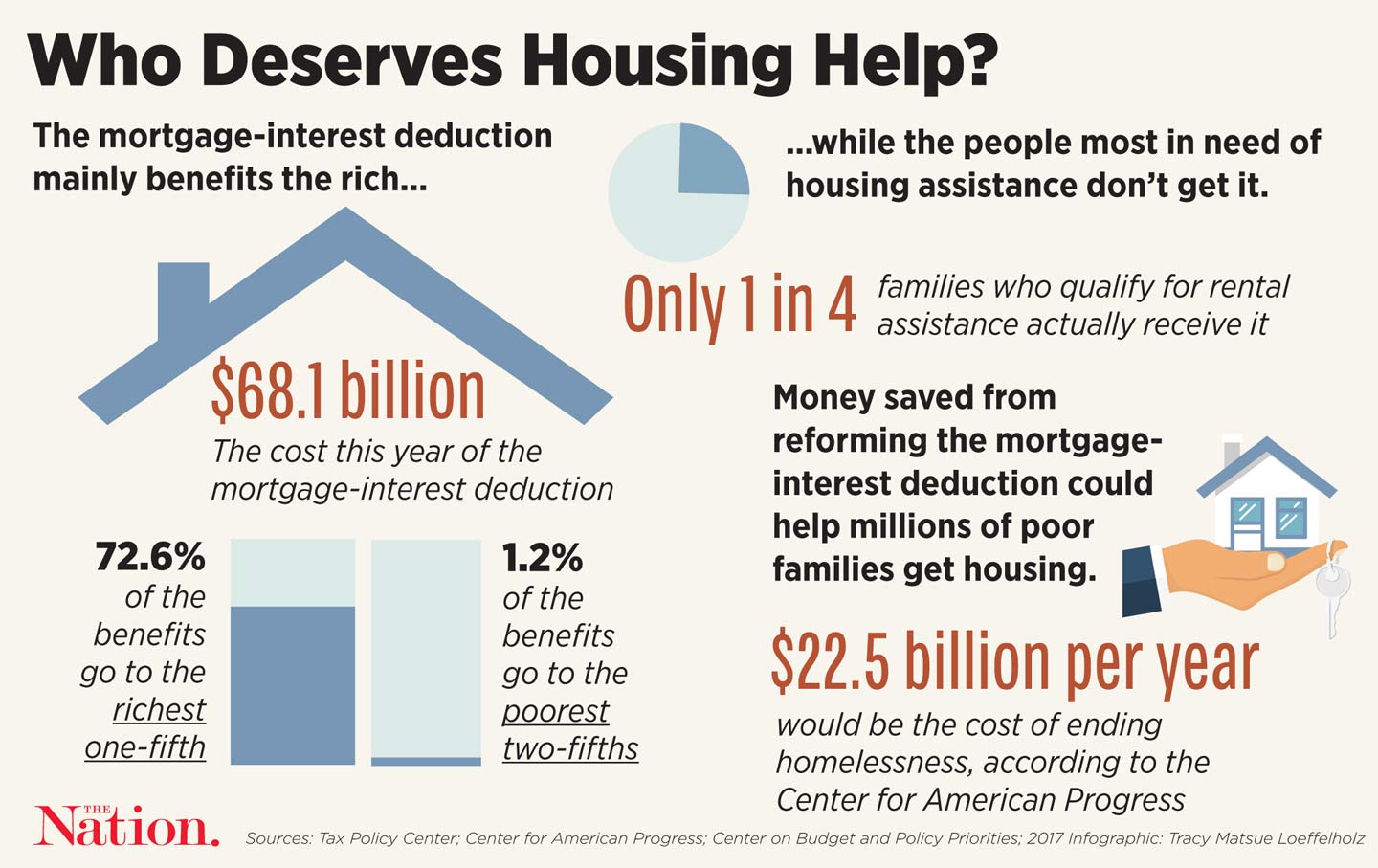

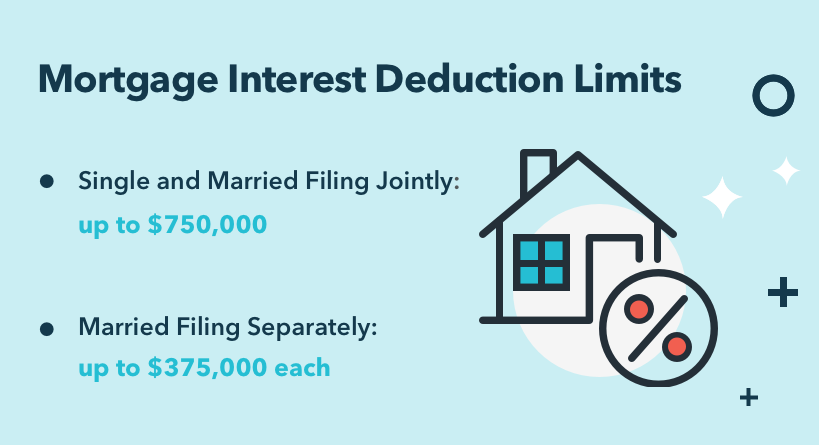

Can you deduct mortgage interest. However you cant deduct interest when the property you buy produces nontaxable income such as tax-exempt bonds. For married taxpayers that are filing a separate return this limit is now 375000 down from 500000. Most homeowners can deduct all their mortgage interest.

The mortgage cant be in someone elses name unless its your spouse and youre filing a joint tax return. If your home acquisition debt exceeds the limit for your filing status you wont be able to deduct all of the mortgage interest and points. Borrowers can deduct home mortgage interest on the first 750000 of indebtednessor 375000 if theyre married but filing separate returnsaccording to the Internal Revenue Service.

In most cases you can deduct all of your home mortgage interest. For tax years prior to 2018 the maximum amount of debt eligible for the deduction was 1 million. The mortgage interest deduction is a tax incentive for homeowners.

This itemized deduction allows homeowners to count interest they pay on a loan related to building purchasing or improving their primary home against their taxable income lowering the amount of taxes they owe. You must also have a. Depending on the age of a mortgage its accumulated annual interest can make for a fairly significant tax deduction.

For example homeowners can deduct mortgage interest when filing their taxes. However if your mortgage debt is above a certain amount the deductible interest is proportional to the amount of your mortgage that falls within the threshold. Beginning in 2018 the maximum amount of debt is limited to 750000.

Bankrate provides a FREE mortgage tax deduction calculator and other mortgage interest calculators to help consumers figure out how much interest is tax deductible. Youre entitled to deduct only the mortgage interest that you personally paid regardless of who received the Form 1098 from the lender. Deductible mortgage interest is any interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve your home.

In other words if your mortgage or mortgages are used to buy build or improve your primary andor second home making it home acquisition. From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. However you can carry forward your disallowed investment interest to.

How much you can deduct depends on the date of the mortgage the amount of the mortgage and how you use the mortgage. But if you had a loan. Mortgage interest deductions are applicable for any interest you incur from properties you own most notably your primary residence.

As noted in general you can deduct the mortgage interest you paid during the tax year on the first 1 million of your mortgage debt for your primary home. In any year you cannot deduct more in investment interest than you earned in investment income. You may take mortgage interest deductions on vacation properties and secondary homes but there are special situations that you might want to consider.

If you can deduct all of the interest on your mortgage you may be able to deduct all of the points paid on the mortgage.

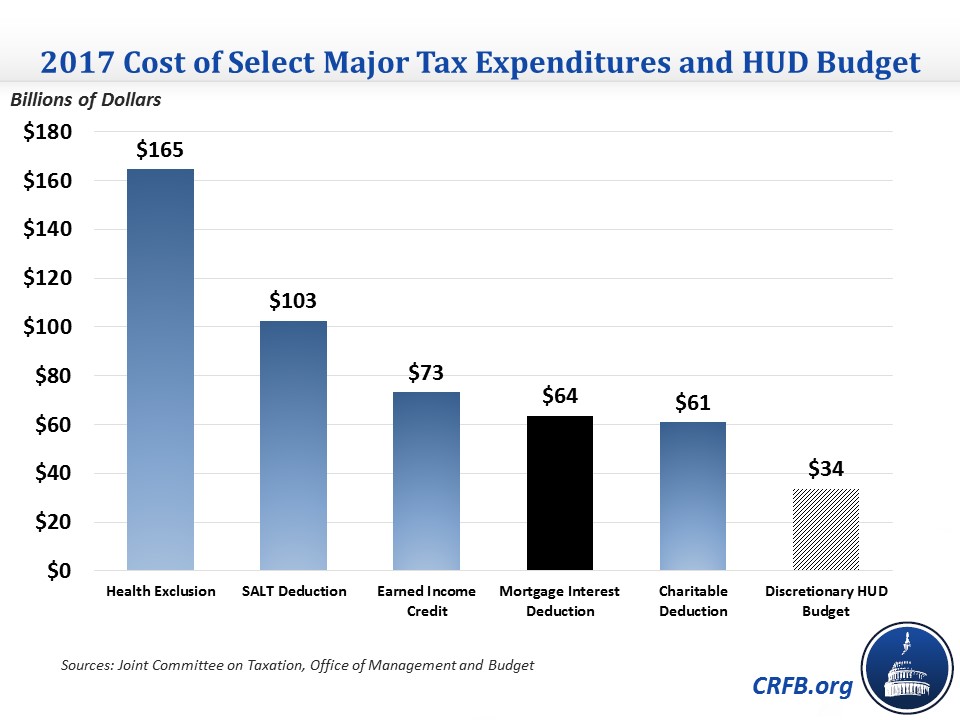

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Tax Deductions For Home Mortgage Interest Under Tcja

Tax Deductions For Home Mortgage Interest Under Tcja

/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png) How The Mortgage Interest Tax Deduction Works

How The Mortgage Interest Tax Deduction Works

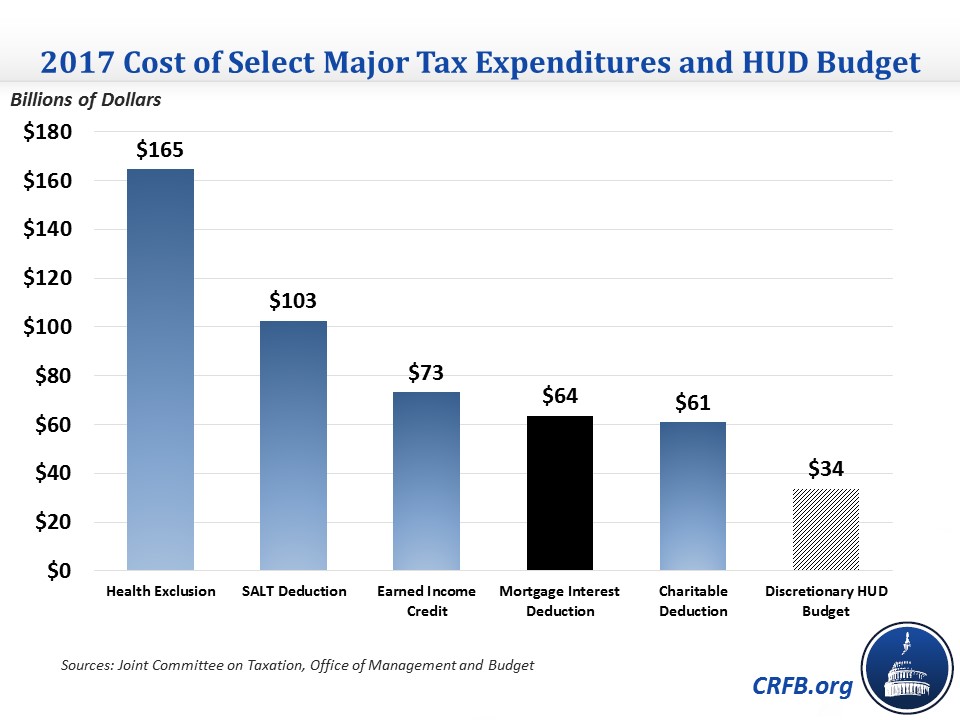

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Calculate Your Mortgage Interest Deduction The Right Way Deduction Mortgage Interest Mortgage Loan Property Tax

Calculate Your Mortgage Interest Deduction The Right Way Deduction Mortgage Interest Mortgage Loan Property Tax

What Is The Mortgage Interest Deduction Mintlife Blog

What Is The Mortgage Interest Deduction Mintlife Blog

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Tax Deduction What You Need To Know

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

What Is The Mortgage Interest Deduction And How Does It Work

What Is The Mortgage Interest Deduction And How Does It Work

Comments

Post a Comment