Current Federal Reserve Interest Rate

The constant maturity yield values are read from the yield curve at fixed maturities currently 1 3 and 6 months and 1 2 3 5 7 10 20 and 30 years. Federal Reserve System FED The central bank of the United States is the FED.

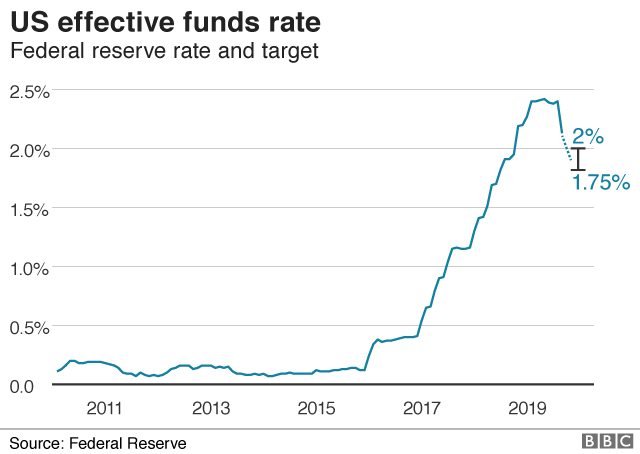

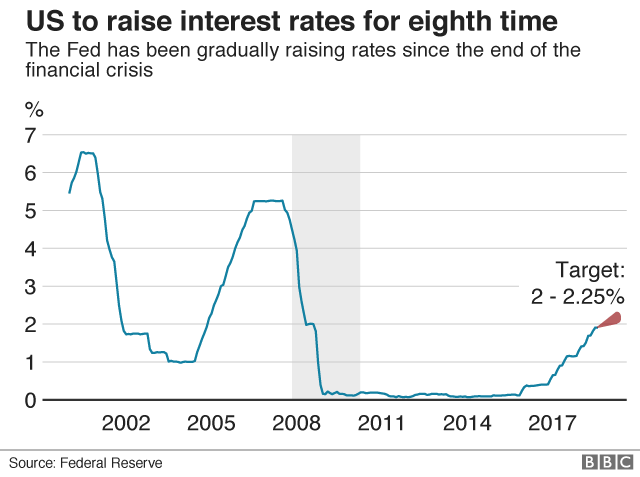

Us Fed Cuts Interest Rates For Second Time Since 2008 Bbc News

Us Fed Cuts Interest Rates For Second Time Since 2008 Bbc News

FED stands for Federal Reserve System but this is also referred to as the Federal Reserve for short.

Current federal reserve interest rate. The current federal funds rate as of April 08 2021 is 007. 2014 2015 2016 2017 2018 2019 2020 000 075 150 225 300. Prime rate federal funds rate COFI Updated.

Generally the rate is set approximately three percentage points higher than the federal funds rateso for example with the rate currently at 025 a banks prime interest rate might be 325. H15 Selected Interest Rates - last released Monday April 26 2021 RSS Help Preformatted package. Even for consumers who dont have excellent credit the prime interest rate is an important figure.

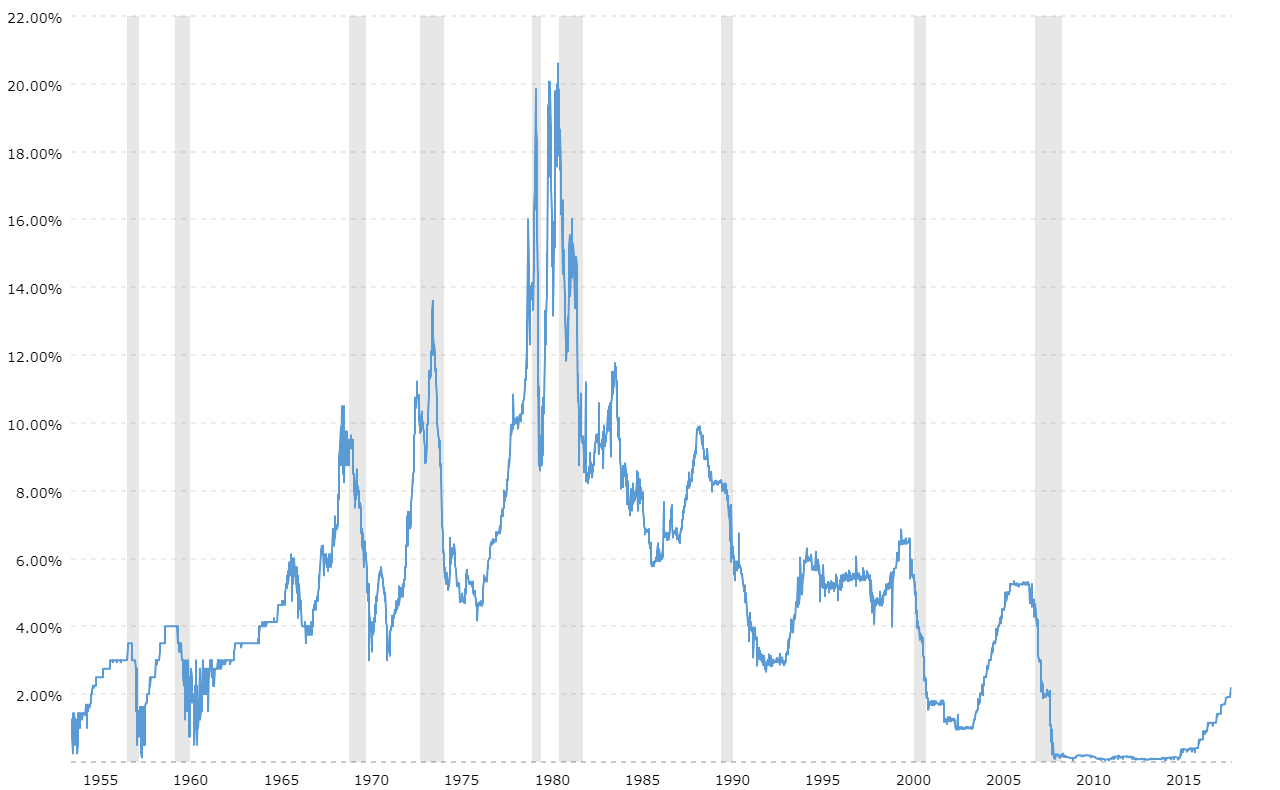

It remained there until December 2015. These market yields are calculated from composites of quotations obtained by the Federal Reserve Bank of New York. When the economy grows quickly the FOMC will increase interest rates to keep inflation in check.

At its March 16-17 2021 meeting the FOMC said it would maintain the target fed funds rate at a range of 0 to 025. At this time the FED has adopted an interest rate range of 000 to 025. The current federal reserve interest rate or federal funds rate is 0 to 025 as of March 16 2020.

Download graph and track economic data. Fed Funds Rate Current target rate 000-025 025 What it means. In January 2020 the Federal Reserve kept the target range at 15 to 175 because the economy was moving toward a 2 inflation rate.

In a bold emergency action to support the economy during the coronavirus pandemic the Federal Reserve on Sunday announced it would cut its target interest rate near zero. The interest rate at which banks and other depository institutions lend money to each other usually on an overnight basis. In March 2021 the Federal Reserve maintained its target for the federal funds rate at a range of 0 to 025.

The interest rate on required reserves IORR rate is determined by the Board and is intended to eliminate effectively the implicit tax that reserve requirements used to impose on depository institutions. The Fed sets a target for the fed funds rate. The interest rate on excess reserves IOER rate is also determined by the Board and gives the Federal Reserve an additional tool for the conduct of monetary policy.

The FOMC meets eight times a year to set this range and can use the tools of the Federal Reserve System to make sure that the actual rate the Effective Fed Funds Rate is kept within their desired range. The Federal Reserves approach to the implementation of monetary policy has evolved considerably since the financial crisis and particularly so since late 2008 when the FOMC established a near-zero target range for the federal funds rate. In the long-term the United States Fed Funds Rate is projected to trend around 025 percent in 2022 according to our econometric models.

Board of Governors of the Federal Reserve System. Treasury Constant Maturities csv All Observations 39 MB. Most Frequently Asked Questions About the Fed Banking and the Financial System Money Interest Rates and Monetary Policy Credit Loans and Mortgages Currency and Coin Economy Jobs and Prices Federal Open Market Committee Regulations All Questions.

From the end of 2008 through October 2014 the Federal Reserve greatly expanded its holding of longer-term securities through open market purchases with the goal of putting downward pressure on longer-term interest rates. This method provides a yield for a 10-year maturity for example even if no outstanding security has exactly 10 years remaining to maturity. 1 By law banks set their own effective fed funds rate.

Although the FED is an independent government institution the American central bank. Money Banking Finance Interest Rates 1143 economic data series FRED. Looking forward we estimate Interest Rate in the United States to stand at 025 in 12 months time.

This week Month ago Year ago. Prior to March 2020 the last time the Fed cut interest rates to this level was December 2008. The Fed heavily influences this rate using open market operations the reserve requirement and the discount rate.

When the economy meets expectations the committee maintains current interest rates.

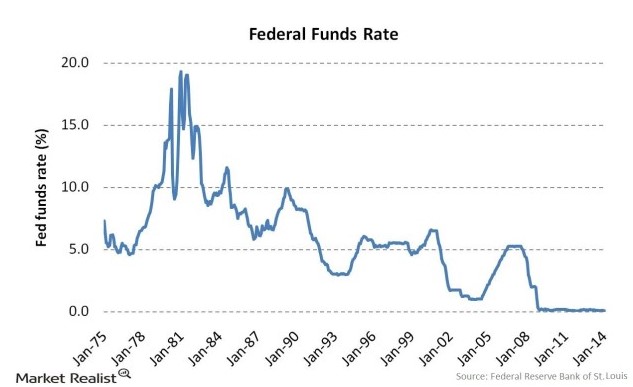

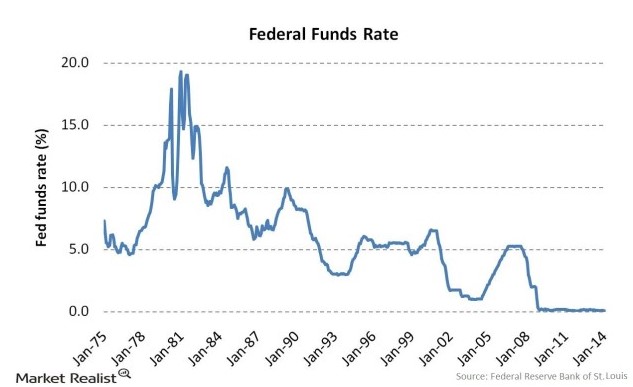

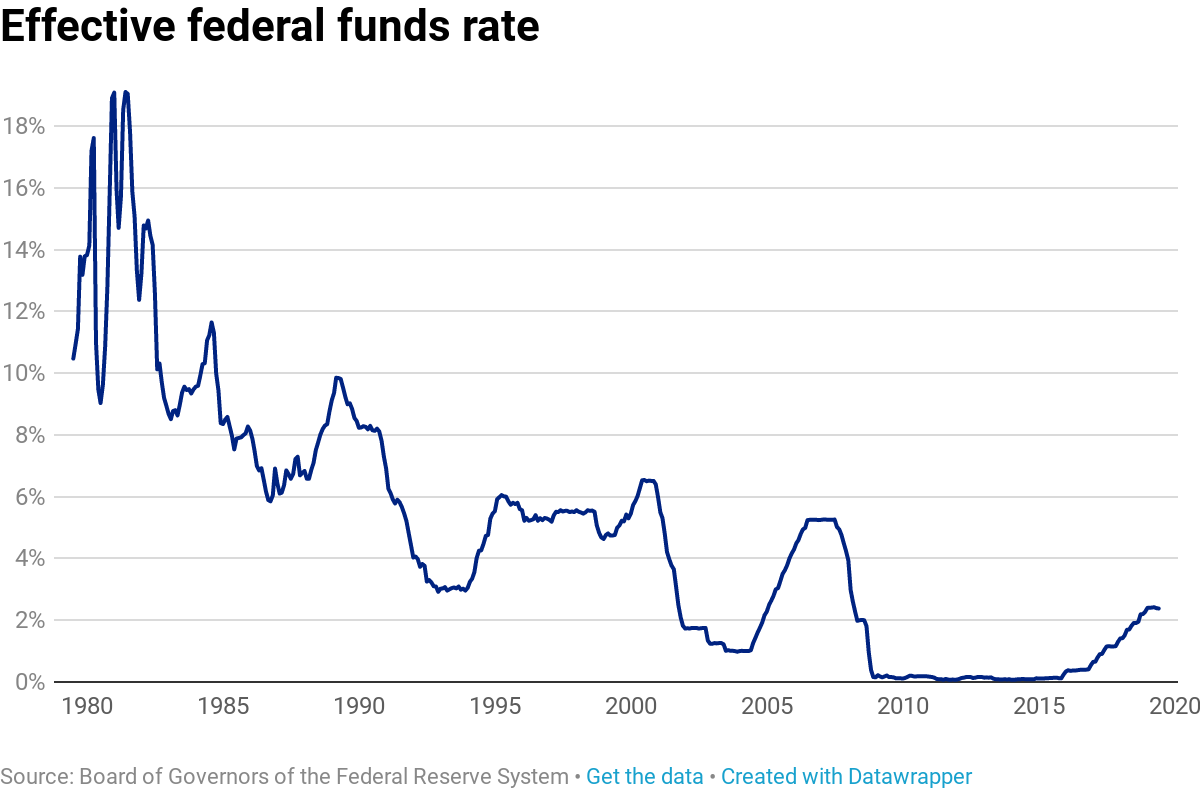

Federal Funds Rate 62 Year Historical Chart Macrotrends

Federal Funds Rate 62 Year Historical Chart Macrotrends

Federal Reserve Interest Rates Snbchf Com

Federal Reserve Interest Rates Snbchf Com

Why The Federal Reserve Cut Interest Rates The New York Times

Why The Federal Reserve Cut Interest Rates The New York Times

Effective Federal Funds Rate Fedfunds Fred St Louis Fed

Effective Federal Funds Rate Fedfunds Fred St Louis Fed

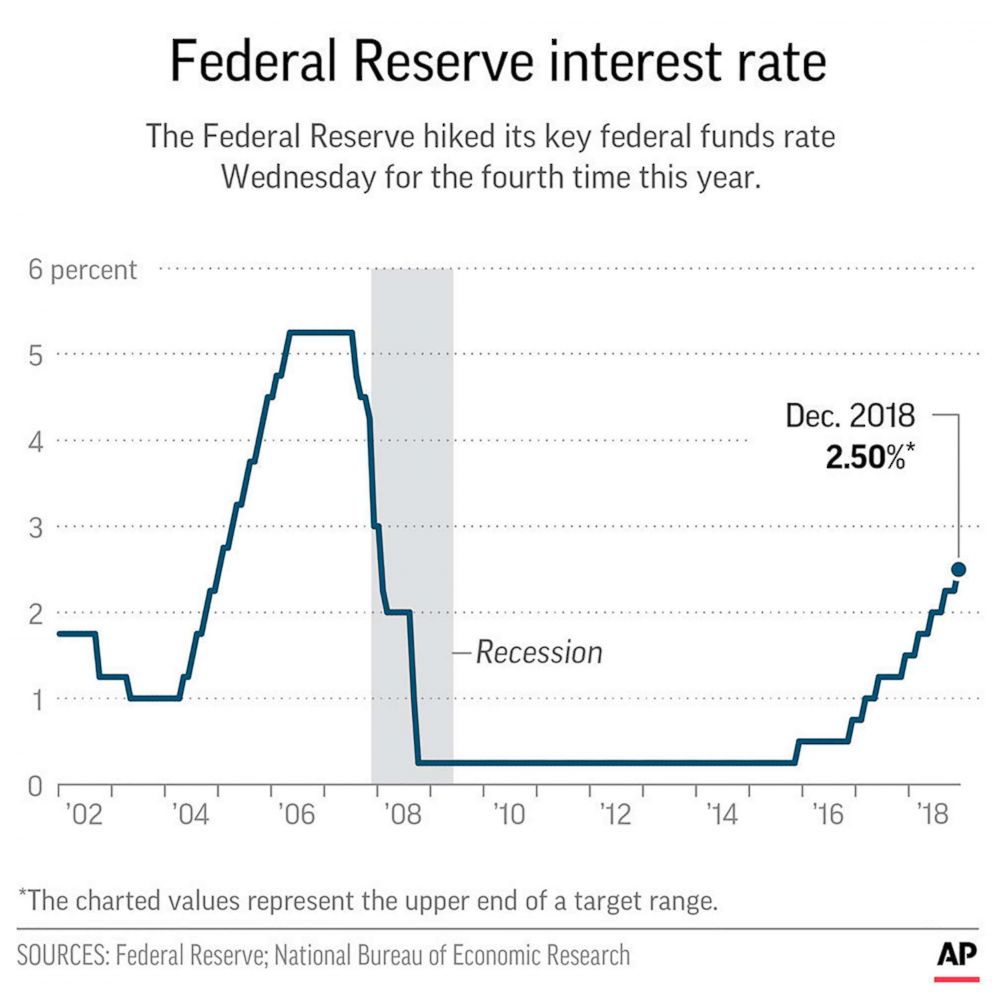

Fed Cuts Interest Rates By Another Quarter Point The New York Times

Fed Cuts Interest Rates By Another Quarter Point The New York Times

Markets Are Convinced The Fed Will Cut Interest Rates The Economist

Markets Are Convinced The Fed Will Cut Interest Rates The Economist

Federal Reserve Raises Interest Rates Again Bbc News

Federal Reserve Raises Interest Rates Again Bbc News

Federal Reserve Cuts Interest Rates For Third Time In 2019 The New York Times

Federal Reserve Cuts Interest Rates For Third Time In 2019 The New York Times

What Is The Federal Reserve And How Do Interest Rates Affect Me Abc News

What Is The Federal Reserve And How Do Interest Rates Affect Me Abc News

Federal Funds Rate 62 Year Historical Chart Macrotrends

Federal Funds Rate 62 Year Historical Chart Macrotrends

Comments

Post a Comment