Baillie Gifford Funds

Baillie Gifford Funds Baillie Gifford Funds is a company that sells mutual funds with 18124M in assets under management. The average expense ratio from all mutual funds is 066.

Baillie Gifford The Fund That Still Believes In Elon Musk Financial News

Baillie Gifford The Fund That Still Believes In Elon Musk Financial News

They seem very similar even.

Baillie gifford funds. 10000 of all the mutual funds are no load funds. The first of four Baillie Gifford funds in the top 10 close to two thirds of the portfolio was in US equities with Tesla and Teladoc big winners. The average manager tenure for all managers at Baillie Gifford Funds is 845.

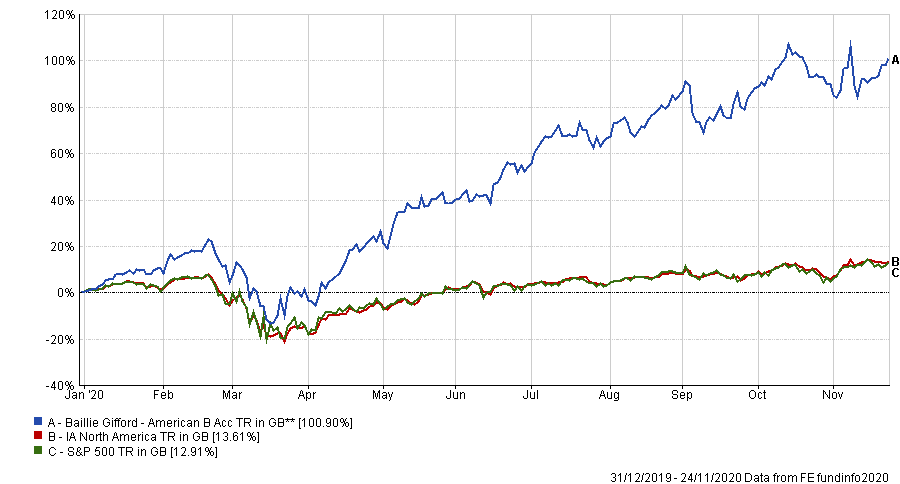

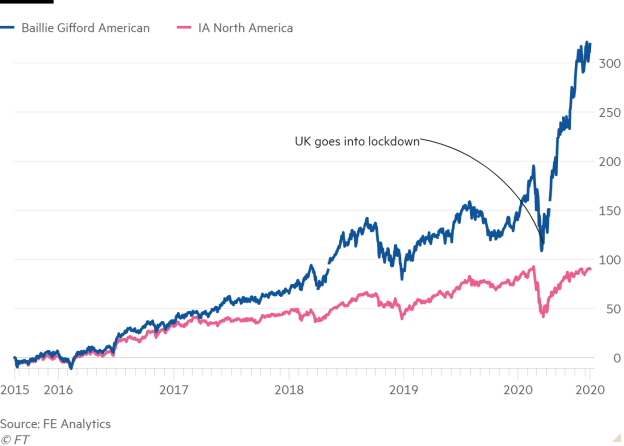

Its no flash in the pan though as their long-term record is arguably even more impressive. The various investment trusts and funds run by Baillie Gifford are dominating the performance charts this year. Combined their popular range of 33 funds are responsible for managing more than 44 billion of client assets and some have consistently been the top performers in their sectors.

Baillie Gifford Funds. Its a genuinely long-term investment manager and that alone will serve its clients well. Combined their popular range of 33 funds are responsible for managing more than 44 billion of client assets and some.

Baillie Gifford Funds. The Baillie Gifford Mutual Funds are distributed by Baillie Gifford Funds Services LLC. Of the 33 Baillie Gifford unit trust funds analysed 576 received a high 4- or 5-star performance rating.

The partnerships high-profile funds are major shareholders in prominent global companies including Tesla Amazon Tencent Netflix and Alibaba. In addition the Baillie Gifford Multi-Year Awards fund cannot support applications where the grant request is less than 25 of the total costs. Most investments are unlikely to provide the returns hoped for as stock market rises are driven by a small number of companies over the long run according to the managers of Baillie Gifford.

About Baillie Gifford funds. Shares in Baillie Giffords technology-oriented funds slumped in London trade on Thursday as investors exit the sector with interest rates spiking. In June 2020 assets under management and advice were valued at 262 billion.

But to see its first-half performance as a reason for investing in BG funds makes no sense whatsoever. See Baillie Gifford US Equity Growth Fund performance holdings fees risk and. This information and other information about the Funds can be found in.

Why Ive cracked and bought a Baillie Gifford fund for the first time. See Baillie Gifford US Equity Growth Fund BGGSX mutual fund ratings from all the top fund analysts in one place. Baillie Giffords assets under management have soared in the past year from around 197 billion in March to almost 300 billion near the end of the year.

Baillie Gifford Funds Start a new discussion Reply to discussion. 1 times Was thanked. The oldest fund launched was in 2003.

Scottish Mortgage Investment Trust SMT is just one of its widely held global equity portfolios while the firm has leading funds in the US Asia Europe and corporate bond space. Of the 33 Baillie Gifford unit trust funds analysed 576 received a high 4- or 5-star performance rating. Baillie Gifford is an investment management firm which is wholly owned by partners all of whom work within the firm.

UK supermarket delivery firm Ocada was another. Baillie Gifford is one of the UKs leading independently owned investment management firms. Of the 11 investment trusts run by Baillie Gifford 10 are in profit for 2020.

Founded in 1908 based in Edinburgh and with 130 billion funds under. The Silver-rated trust Scottish Mortgageis known for its large stakes in disruptors and its penchant for tech stocks areas which thrived amid a. Thankfully Baillie Gifford is not in the myopic majority.

Baillie Giffords success has made it a common sight in portfolios. 3 times in 3 posts Does anyone know what the difference between BG International and BG Global Alpha growth is. The stunning success of Baillie Giffords global US and Asia funds last year has raised concerns some investors are too exposed to the fortunes of the Edinburgh-based partnership.

Whats more the company is. News editor Rob Langston reveals why he has added a Baillie Gifford fund despite past concerns that the. 05 April 2021 210532UTC 1.

Please read through What we cant fund page these exclusions apply to all Foundation Scotland funds. Baillie Giffords Edinburgh Worldwide Investment Trust came second top in the Morningstar list with an 8644 gain with Baillie Giffords Monks Investment Trust in fifth place with 4071. Investors should carefully consider the objectives risks charges and expenses of the Funds before investing.

It was founded in Edinburgh Scotland in 1908 and still has its headquarters in the cityIt has corporate offices in New York and London.

Baillie Gifford Uk Growth Trust S New Image Starts To Pay Off This Is Money

Baillie Gifford Uk Growth Trust S New Image Starts To Pay Off This Is Money

Baillie Gifford Positive Change Buying Into The Future Investors Chronicle

Baillie Gifford Positive Change Buying Into The Future Investors Chronicle

Baillie Gifford Ernennt Co Managerin Des European Fund People Aktuell Investrends Ch

Baillie Gifford Ernennt Co Managerin Des European Fund People Aktuell Investrends Ch

Four Funds To Hold Alongside Baillie Gifford American

Four Funds To Hold Alongside Baillie Gifford American

Baillie Gifford Attracts 1bn Inflows In Record Month Ftadviser Com

Baillie Gifford Attracts 1bn Inflows In Record Month Ftadviser Com

The Best Performing Ia Global Fund Of The Past 3 Years Is An Esg Fund

The Best Performing Ia Global Fund Of The Past 3 Years Is An Esg Fund

Bold Tech Bets Transform Baillie Gifford Into Uk S Fastest Growing Fund Group Financial Times

Bold Tech Bets Transform Baillie Gifford Into Uk S Fastest Growing Fund Group Financial Times

Baillie Gifford American Has A 10 Year Plan For Growth This Is Money

Baillie Gifford American Has A 10 Year Plan For Growth This Is Money

Baillie Gifford And Liontrust Rake In Record Sales As Investors Pile Into Active And Sustainable Funds Portfolio Adviser

Baillie Gifford And Liontrust Rake In Record Sales As Investors Pile Into Active And Sustainable Funds Portfolio Adviser

Baillie Gifford Worldwide Us Equity Growth Fund C Ie00bf0d7y67

Baillie Gifford Funds Surge In Popularity With Trustnet Readers After Sector Topping 2020

Baillie Gifford Funds Surge In Popularity With Trustnet Readers After Sector Topping 2020

Comments

Post a Comment