Schwab Vs Ameritrade

TD Ameritrade is a toss-up thats going to land you with a great stock broker no matter which one you choose. How does it compare to TD Ameritrade.

Charles Schwab Vs Td Ameritrade Comparison Investormint

Charles Schwab Vs Td Ameritrade Comparison Investormint

For options trading both Charles Schwab and Robinhood charge the same base fee of 0.

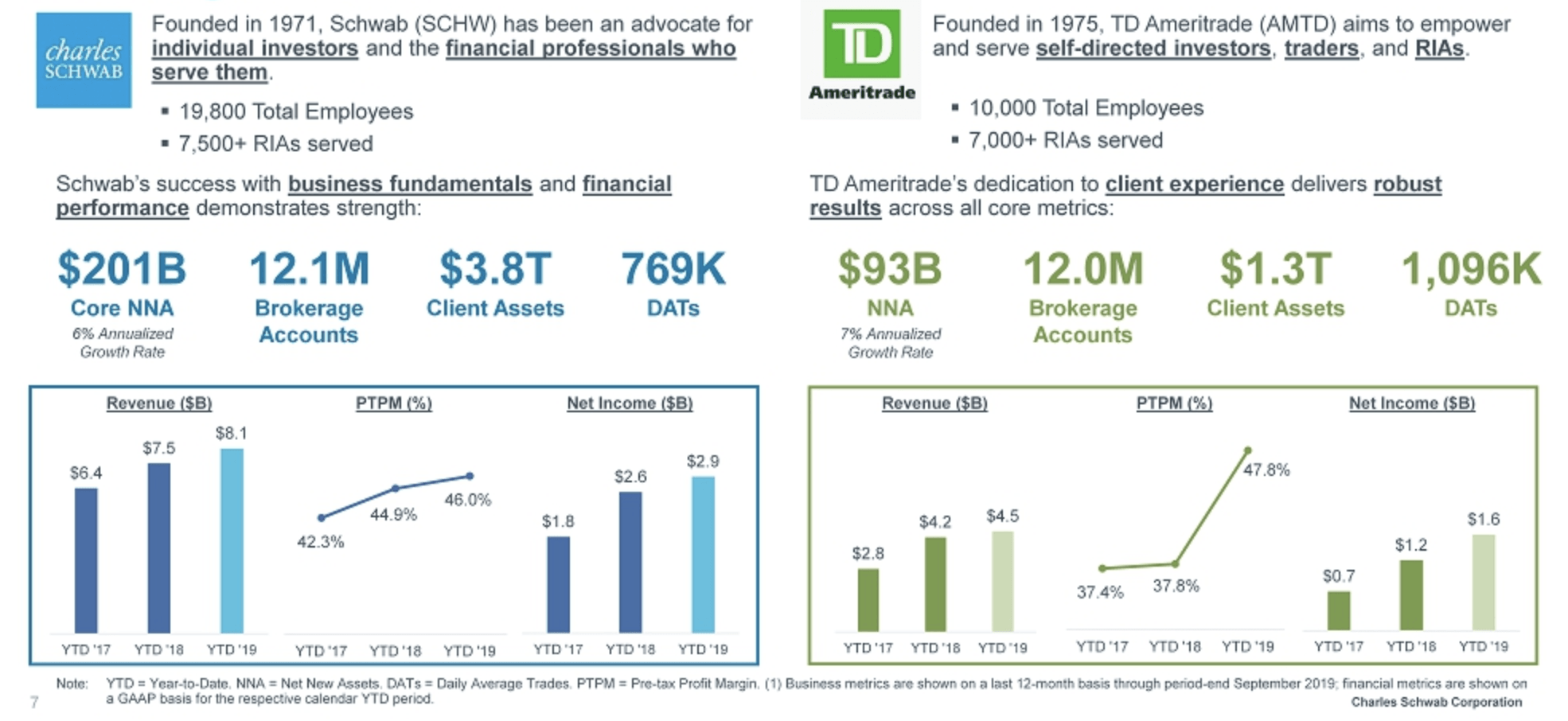

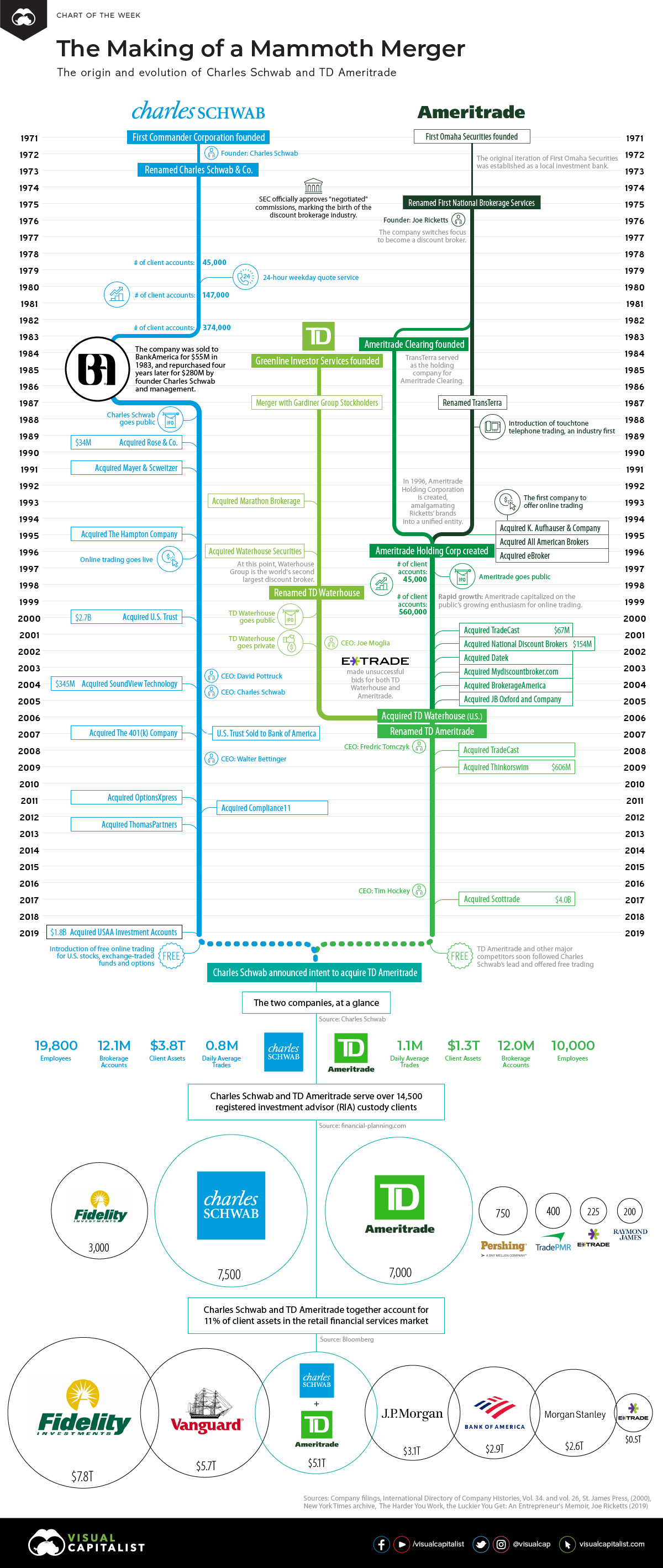

Schwab vs ameritrade. Oct 7 2020 802AM EDT Charles Schwab SCHW has concluded the acquisition of TD Ameritrade Holding for roughly 22 billion. Which Bank is Better. They both offer user-friendly platforms high-quality research.

Read our comparison chart below. In addition to the debit accounts Schwab and TD Ameritrade both offer credit cards. Both Schwab and TD Ameritrade have websites and downloadable platforms packed with features news feeds helpful research and educational tools to.

The acquisition is moving forward as planned with shareholders and US Justice Department officials both voting in favor of the merger. TD Ameritrade vs Charles Schwab Fees Commissions TD Ameritrade and Charles Schwab both offer free trading of stocks and ETFs Exchange-traded funds in addition to low costs for some mutual funds bonds and in the case of TD Ameritrade low forex fees. Both Schwab and Ameritrade.

TD Ameritrade has a Visa Signature card while Schwab offers two American Express cards. Charles Schwab to acquire TD Ameritrade. In 2019 Charles Schwab announced its plans to acquire TD Ameritrade in a transaction valued at 26 billion.

Charles Schwab and Ally Invest are the best ranking firms in customer service. TD Ameritrade and Fidelity also got very high ratings in this category. TD Ameritrade vs Charles Schwab.

For example TD Ameritrade has incorporated four hundred technical indicators far more than the number we found on Schwabs platform. Each option contract then costs 065 at Charles Schwab and 0 at Robinhood. After testing 11 of the best online brokers over three months TD Ameritrade 100 is better than Charles Schwab 9587.

Ameriprise is definitely behind the pack in this category while TD Ameritrade provides professional. Despite this small selection there are 3462 that come with no transaction fee and no load. TD Ameritrade Charles Schwab and Tastyworks are all popular brokerages that cater to different needs.

While Charles Schwab. There is no minimum deposit no maintenance fee and no inactivity fee. Charles Schwab brokerage account offers a zero dollar commission and access to their incredible research p.

Charles Schwab offers stock and ETF trades at 0 commission and options trading at 0 commission 065 per contract. Charles Schwab vs TD Ameritrade Brokerage Review. Read our comparison chart below.

For a complete commissions summary see. For more variety of options see our list of the best bank account bonuses savings account offers. More on Charles Schwab.

TD Ameritrade is a good online broker for long-term investors. As full-service trading platforms Schwab and Ameritrade offer. One of them may be a good fit for you.

Arguably the only significant difference is that Ameritrade charges 225 per contract to trade futures while Schwab charges 150. This led to creation of a behemoth in online brokerage space with combined. This online broker also has more than 100 branch locations.

All the companies in this review except Vanguard and Ameriprise created easy-to-use powerful trading tools that will satisfy everyone but day-traders. Charles Schwab vs. TD Ameritrades early redemption fee and transaction fee are both 4999.

How does it compare to Charles Schwab. While TD Ameritrade offers ATM fee refunds inside the United States Schwab customers get reimbursed for worldwide withdrawals. Charles Schwab and TD Ameritrade offer very similar online trading platforms.

Charles Schwab or TD Ameritrade. In this video I will show you Comparison between Charles Schwab vs TD AmeritradeIam signed with affiliate programs and companies shown in the video. Lets get down to the nuts and bolts.

Charles Schwab offers investors a wide array of services and tools including a top-notch mobile app. Until then both platforms will. TD Ameritrade delivers 0 trades fantastic trading platforms excellent market research industry-leading education for beginners and reliable customer service.

Charles Schwab and Robinhood both cost 0 per trade. There is no minimum deposit no maintenance fee and no inactivity fee. The process is expected to take 18 to 36 months to complete.

This online broker also has more than 100 branch. The maximum timeframe is 35 years 15 more years than Schwab delivers. TD Ameritrade and Schwab both appeal to a wide range of investment needs while Tastyworks is a more niche offering for active traders.

While TD Ameritrade offers 0 commission online stock ETF and option trades. TD Ameritrade provides an electronic trading platform for the purchase and sale of financial securities. The brokers screener returned just 5785 funds.

TD Ameritrade offers 0 commission online stock ETF and option trades. Fewer mutual funds will be found at Schwab.

Td Ameritrade Vs Charles Schwab 2021

Td Ameritrade Vs Charles Schwab 2021

Td Ameritrade And Best Canabis Stock Schwab Free Trade Etf List

Td Ameritrade And Best Canabis Stock Schwab Free Trade Etf List

Td Ameritrade Vs Charles Schwab 2021

Td Ameritrade Vs Charles Schwab 2021

Td Ameritrade Vs Charles Schwab Cheapest Broker Revealed

Td Ameritrade Vs Charles Schwab Cheapest Broker Revealed

The Making Of A Mammoth Merger Charles Schwab And Td Ameritrade

The Making Of A Mammoth Merger Charles Schwab And Td Ameritrade

Td Ameritrade Charles Schwab What To Know Td Ameritrade

Td Ameritrade Charles Schwab What To Know Td Ameritrade

/CharlesSchwabvs.TDAmeritrade-5c61bb24c9e77c00010a4e01.png) Charles Schwab Vs Td Ameritrade

Charles Schwab Vs Td Ameritrade

Charles Schwab Vs Td Ameritrade Which One Wins Finder Com

Charles Schwab Vs Td Ameritrade Which One Wins Finder Com

The Making Of A Mammoth Merger Charles Schwab And Td Ameritrade

The Making Of A Mammoth Merger Charles Schwab And Td Ameritrade

Charles Schwab Vs Td Ameritrade Brokerage Review Youtube

Charles Schwab Vs Td Ameritrade Brokerage Review Youtube

Td Ameritrade Vs Charles Schwab Pros Cons Compare Benzinga

Td Ameritrade Vs Charles Schwab Pros Cons Compare Benzinga

Charles Schwab Vs Td Ameritrade Which Is Better

Charles Schwab Vs Td Ameritrade Which Is Better

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)

Comments

Post a Comment