Top Tax Bracket 2020

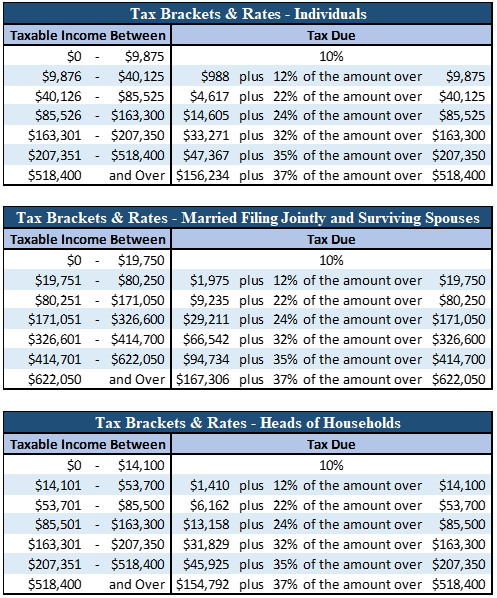

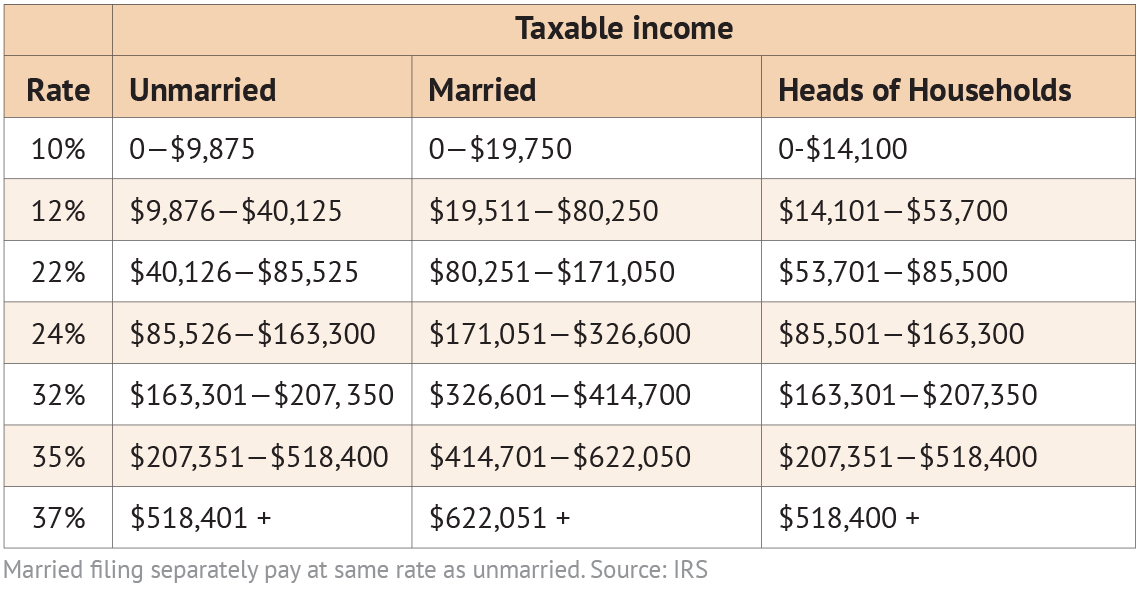

Income tax rates range anywhere from 10 to 37 depending on which tax bracket youre in. Rate percent Taxable Income Up to.

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

10 12 22 24 32 35 and 37.

Top tax bracket 2020. For 2021 the top 37 percent bracket starts at. New Yorks income tax rates were last changed. Historical Income Tax Rates Brackets.

Tax on taxable income. Employee PAYE Tax Credit. There are seven tax brackets in all.

1080 1035 45. There are seven federal tax brackets for the 2020 tax year. The 2020 federal income tax brackets on ordinary income.

Your tax bracket depends on your taxable income and. Johns tax payable would be calculated as follows. 16 Zeilen Ontario Personal Income Tax Brackets and Tax Rates.

Tax Rates 1. Rate percent Taxable Income over. Age Tax Credit if single widowed or surviving civil partner.

Assessable Income Allowable Deductions Taxable Income. The top tax rate remains 37 for individual single taxpayers with incomes greater than 518400. Bidens new proposed top tax bracket would also start at a lower income level than the current threshold.

124500 x 2 2490. For the 202122 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 100000. 500000 annual income 214368 5th bracket minimum.

The top tax rate is 37 percent for taxable income above 518400 for tax year 2020. What Are the Federal Tax Brackets for Tax Year 2020. Brackets are assigned based on taxable income and applied at each bracket.

124500 90000 34500. 130200 5700 124500. 34500 x 3 1035.

Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widower. Age Tax Credit if married or in a civil partnership. There are seven tax brackets for most ordinary income.

0 - 9875 9876 - 40125 40126 - 85525 85526 - 163300 163301 - 207350 207351 - 518400 518401. 10 tax rate up to 9875 for singles up to 19750 for joint filers 12 tax rate up to 40125. Massachusetts income tax rates were last changed one year ago for tax year 2019 and the tax brackets have not been changed since at least 2001Massachusetts tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living.

Home Carers Tax Credit max 1600. 20797 37 x 124500 90000 33562. Employed Person taking care of an incapacitated individual max 75000.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Your 2020 tax rate. Heres another example albeit perhaps not very relatable to most readers for someone in the top bracket earning 500000.

Your bracket depends on your taxable income and.

Historical Highest Marginal Income Tax Rates Tax Policy Center

Historical Highest Marginal Income Tax Rates Tax Policy Center

What You Need To Know About 2020 Taxes Advisors Management Group

What You Need To Know About 2020 Taxes Advisors Management Group

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

New 2021 Irs Income Tax Brackets And Phaseouts

New 2021 Irs Income Tax Brackets And Phaseouts

Federal Income Tax Rate 2020 21 Tax Brackets 2020 21

Federal Income Tax Rate 2020 21 Tax Brackets 2020 21

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

How Do I Calculate My Tax Bracket

How Do I Calculate My Tax Bracket

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

Your Guide To 2020 Federal Tax Brackets And Rates Incfile

Your Guide To 2020 Federal Tax Brackets And Rates Incfile

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Comments

Post a Comment