Are Credit Cards Secured Or Unsecured

These kinds of credit cards are designated for people with bad credit or no credit. The criteria that determine your credit limit includes your credit score debt-to-income ratio payment history and the number of credit cards or other credit accounts you have open.

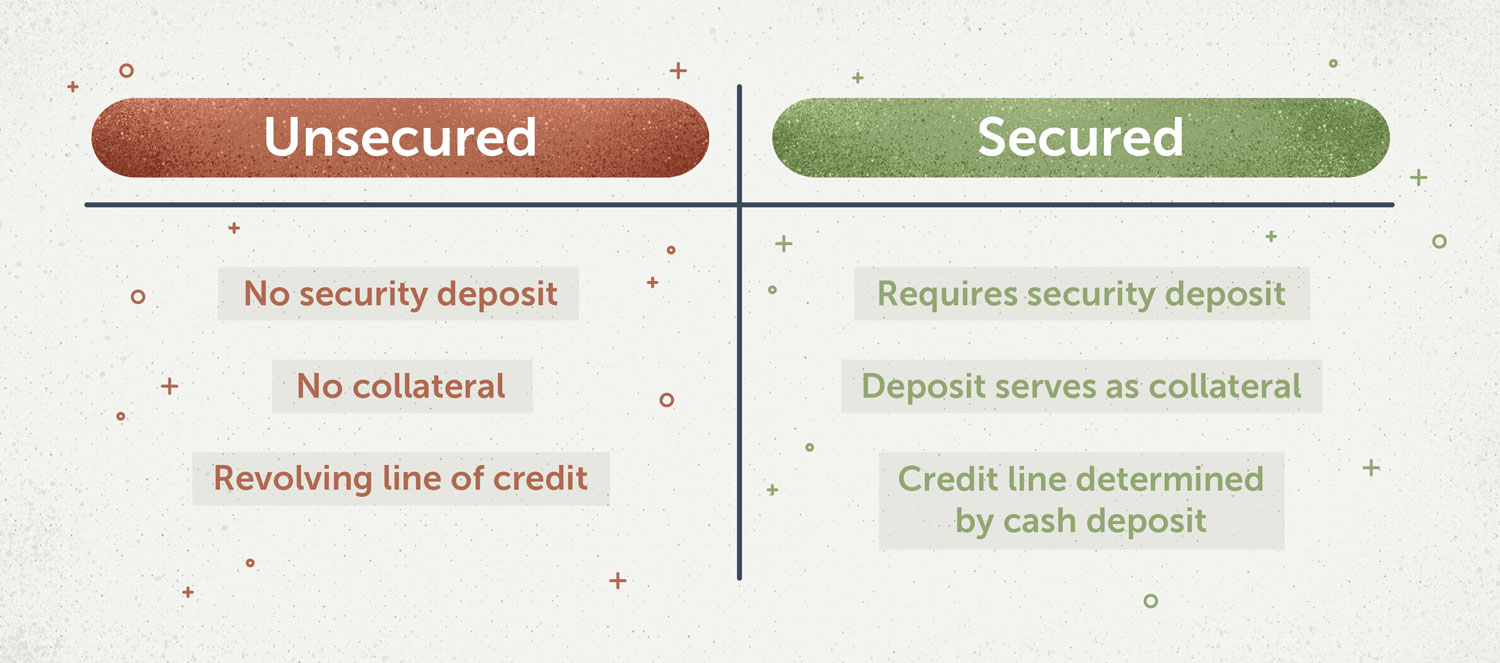

Differences Between An Unsecured Credit Card And Secured Card

Differences Between An Unsecured Credit Card And Secured Card

Secured credit cards are useful if youre looking to build or improve your credit score and credit history.

:max_bytes(150000):strip_icc()/secured-vs-unsecured-credit-card-final-89a160834c364a43a0913e67176e0215.png)

Are credit cards secured or unsecured. In some cases you may need to request your card be converted while other issuers will do it automatically. Banks prefer to issue secured credit cards to people who dont have an established credit history or who dont have a good credit score. Those with poor or no credit however might consider a secured card.

It requires the applicant to put some form of collateral. Secured credit cards do require a security deposit but they offer the safest and most affordable way to build or rebuild your credit by making monthly on-time payments. Lenders require a security deposit before issuing the credit card.

The deposit is proportional to the available credit to you. All together an unsecured credit card is preferable. Hope this is helpful.

Loans and other financing methods available to consumers generally fall under two main categories. They are not as common as unsecured credit cards and not all banks may even offer such cards. Unsecured cards for those with less than perfect credit tend to be costly and risky.

Conscientious use of unsecured cards helps build your credit as it does with secured cards. When it comes to getting credit you may hear about it being secured or unsecured See examples of the two types of credit learn how collateral fits in and get to know the pros and cons of each. What is the difference between secured and unsecured credit.

What is the Difference between an Unsecured and a Secured Credit Card. We offer a secured credit card to help rebuild credit because other institutions are promoting prepaid cards which charge high fees and do not rebuild credit. When businesses or consumers are first establishing their credit or their credit has a less than ideal track record it may be more difficult to get approved for an unsecured card.

The next step is getting an unsecured card with a credit line. A secured card simply means that the card is backed by a cash deposit that you must supply beforehand. Many secured credit card issuers will convert your card to an unsecured card after youve demonstrated 12 months of on-time payments and improved your credit score.

The primary difference between the two is the presence or absence of. These credit cards are issued against some form of collateral generally a Fixed Deposit FD held with the issuing bank or financial institution. The purchase APR annual percentage rate and charges like the annual fee are commonly lower.

An unsecured line of credit is not guaranteed by any asset for instance a credit card. Whether you decide on an unsecured or a secured credit card depends on your personal financial needs. A secured line of credit is guaranteed by an asset called collateral such as a home or a car.

If your secured card doesnt offer this option you can still apply for an unsecured credit card once your credit. Secured and unsecured debt. No security deposit is required.

If are found. The amount of time to wait before graduating to an unsecured credit card can vary by issuer. Secured Credit Cards.

Unsecured credit cards require no upfront security deposit. A secured card can be a stepping stone to an unsecured card. Most of us would rather have an unsecured credit card because.

You may be able to add money to the deposit amount to increase your. Secured cards are meant to help you build your credit so that you can eventually graduate to an unsecured. Generally when you initiate a secured card the amount of deposit is your credit limit.

Our community was not being served so we stepped in to fill the gap. Those with relatively healthy credit might want an unsecured card for perks such as a cash back or travel credits. This is where secured credit cards come into play.

Individual lending agencies establish the credit limit and interest rate for unsecured credit cards. However a secured credit card is rarely a customers first choice. A secured credit card is best for people with a spotted credit history or no credit history at all.

We do not have the economies of scale or size to offer an unsecured credit card at this time. Some cards are secured while others are unsecured. The credit limit is almost always higher than a secured card and it is not tied to a deposit.

Lenders do not require a security deposit for these credit cards. Your secured card offers a credit limit equal to the amount of your refundable deposit until you get approved to graduate to an unsecured credit card. If not it remains secured.

Differences Between Secured and Unsecured Credit Cards.

Unsecured Cards Vs Secured Cards 5 Things You Need To Know America S Largest Black Owned Bank Oneunited Bank

Unsecured Cards Vs Secured Cards 5 Things You Need To Know America S Largest Black Owned Bank Oneunited Bank

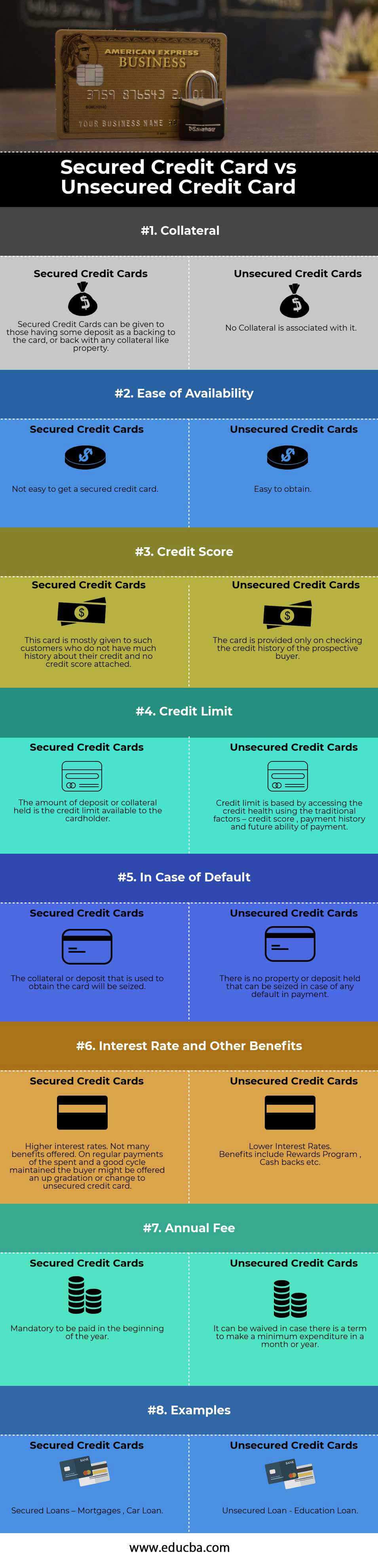

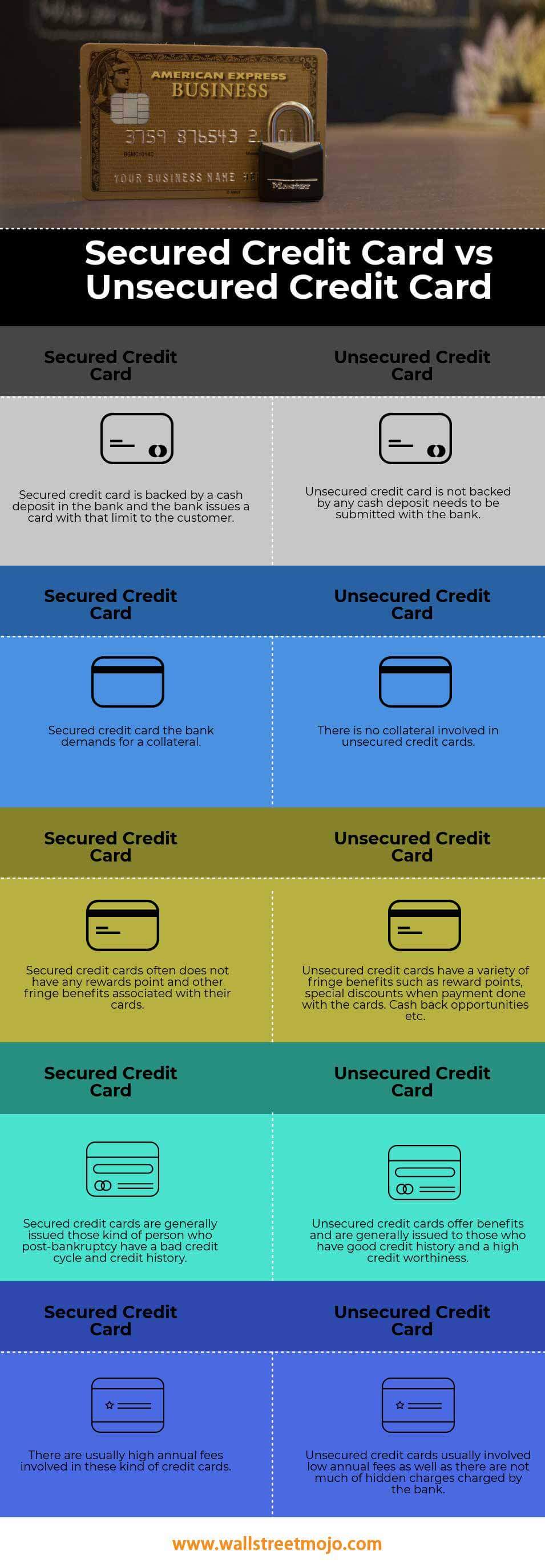

Secured Vs Unsecured Credit Card Top 8 Differences With Infographics

Secured Vs Unsecured Credit Card Top 8 Differences With Infographics

Secured Vs Unsecured Credit Card Top 8 Differences With Infographics

Secured Vs Unsecured Credit Card Top 8 Differences With Infographics

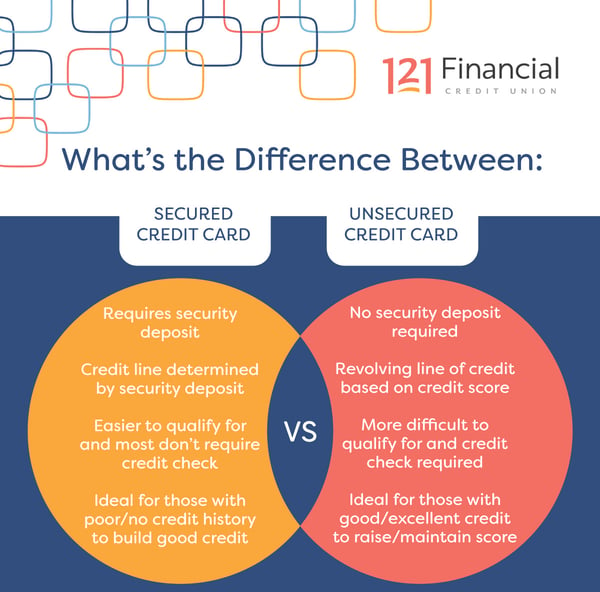

Secured Vs Unsecured Credit Cards Which One Should You Get

Secured Vs Unsecured Credit Cards Which One Should You Get

What Is A Secured Credit Card And How Does It Work

What Is A Secured Credit Card And How Does It Work

Secured Credit Cards Vs Unsecured Credit Cards Money Under 30

Secured Credit Cards Vs Unsecured Credit Cards Money Under 30

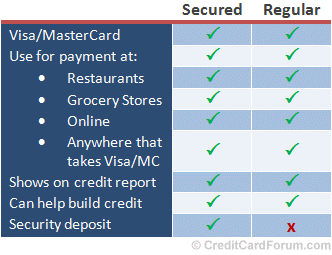

How Does A Secured Credit Card Compare To A Regular Credit Card America S Largest Black Owned Bank Oneunited Bank

How Does A Secured Credit Card Compare To A Regular Credit Card America S Largest Black Owned Bank Oneunited Bank

Credit Cards For Bad Credit Lexington Law

Credit Cards For Bad Credit Lexington Law

Secured Vs Unsecured Credit Cards What S The Difference

Secured Vs Unsecured Credit Cards What S The Difference

:max_bytes(150000):strip_icc()/secured-vs-unsecured-credit-card-final-89a160834c364a43a0913e67176e0215.png) Secured Vs Unsecured Credit Card What S The Difference

Secured Vs Unsecured Credit Card What S The Difference

What Is A Secured Credit Card And Do You Need One Mintlife Blog

What Is A Secured Credit Card And Do You Need One Mintlife Blog

How To Switch From A Secured To An Unsecured Credit Card

How To Switch From A Secured To An Unsecured Credit Card

Secured Vs Unsecured Credit Cards Top 5 Differences

Secured Vs Unsecured Credit Cards Top 5 Differences

What Is A Secured Credit Card And How Does It Work

What Is A Secured Credit Card And How Does It Work

Comments

Post a Comment