2020 Federal Income Tax Tables

The Wage Bracket Method tables cover only up to approximately 100000 in annual wages. IRS Use OnlyDo not write or staple in this space.

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

And the taxable income from 53701 to 62116 would be taxed at 22.

2020 federal income tax tables. 2020 Individual Income Tax Brackets The federal tax brackets are broken down into seven 7 taxable income groups based on your filing status. This is the tax amount they should enter in the entry space on Form 1040 line 16. Individual Income Tax Return 2020 Department of the TreasuryInternal Revenue Service 99 OMB No.

24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Forms 1040 and 1040-SR. Check only one box. The tax rates for 2020 are.

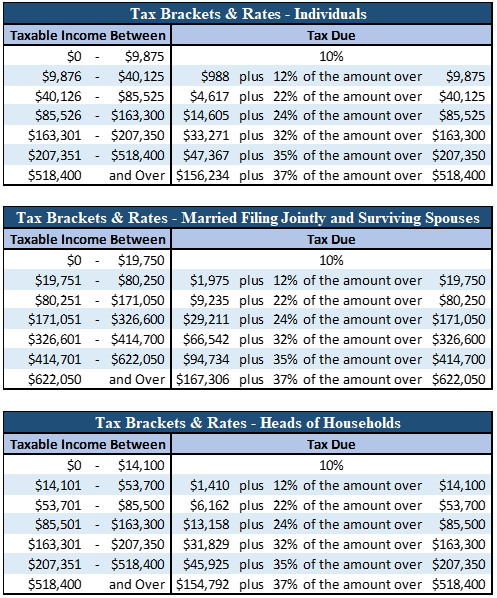

Sep 16 2020 Cat. Taxable income from 14101 to 53700 would be taxed at 12. Federal Personal Income Tax Brackets and Tax Rates in 2020.

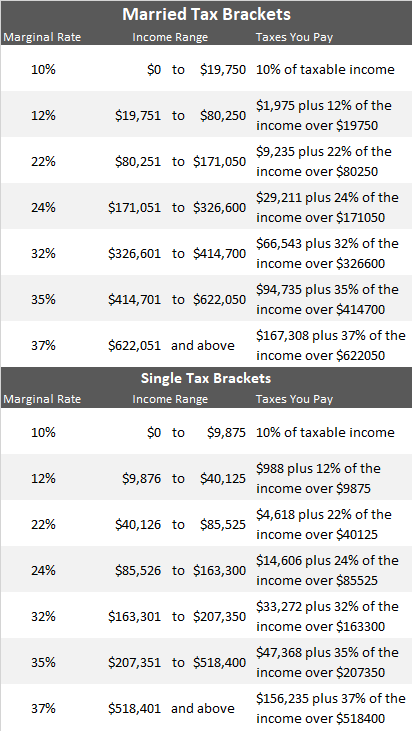

The table provides the two most common filing statuses. Instructions for Schedule 2. While the marginal rates remain the same as 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Rate For Single Individuals For Married Individuals Filing Joint Returns For Heads of Households. The Internal Revenue Service adjusted the tax tables against inflation for 2019 taxes that are due on April 15 2020. Capital Gains rates will not change for 2020 but the brackets for the rates will change.

MUST be removed before printing. Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the. Instructions for Schedule 1.

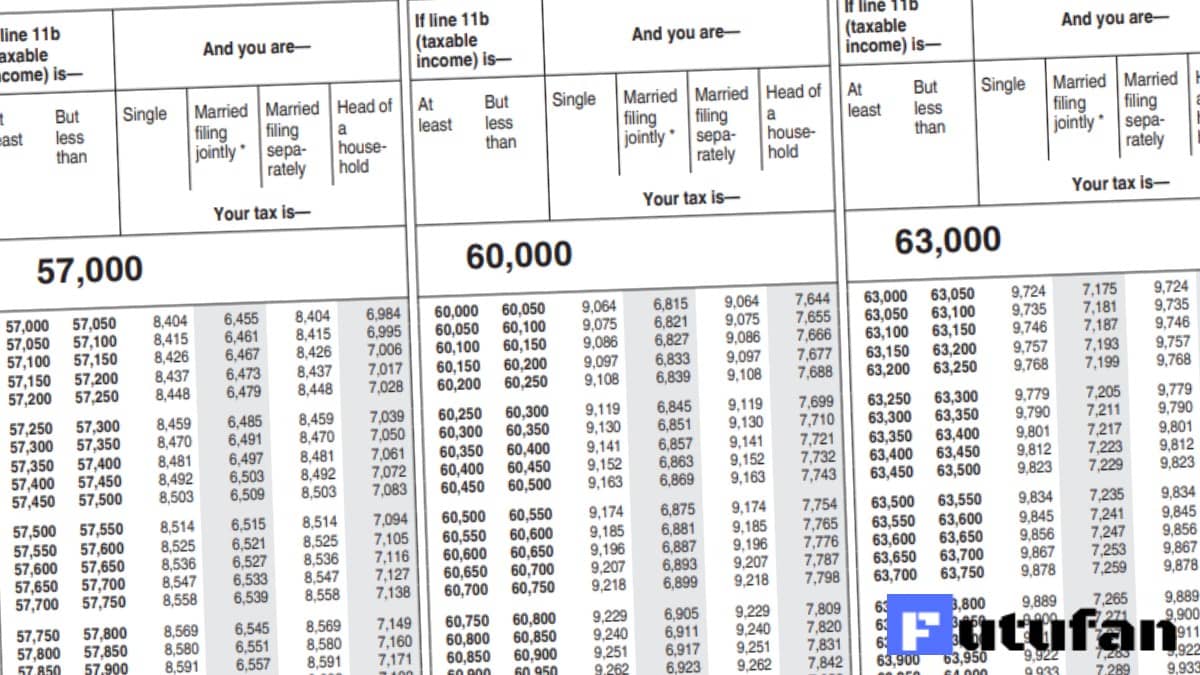

The amount shown where the taxable income line and filing status column meet is 2644. Single Married filing jointly. Major Categories of Federal Income and Outlays for Fiscal Year 2019.

Their taxable income on Form 1040 line 15 is 25300. For 2020 there are seven bracket of federal tax 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent which after that will be matched with your filing status and also taxable income as a worker. Tables for Percentage Method of Withholding.

For Wages Paid in 2020 The following payroll tax rates tables are from IRS Publication 15 T. Instructions for Schedule 3. Chart 1 2021 federal tax rates and income thresholds.

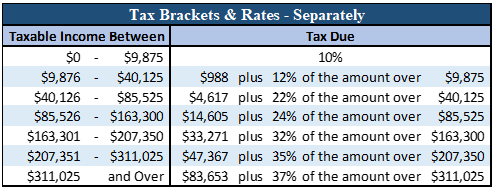

Federal tax rates for 2021 15 on the first 49020 of taxable income plus 205 on the next 49020 of taxable income on the portion of taxable income over 49020 up to 98040 plus 26 on the next 53939 of taxable income on the portion of taxable income over 98040 up to 151978 plus. First they find the 2530025350 taxable income line. For those who file either Married Filing Separate or Head of Household an abbreviated table is below showing the income ranges for each tax bracket.

Married Filing Jointly and Single Individuals. Disclosure Privacy Act and Paperwork Reduction Act Notice. 2020 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households.

7 Zeilen 2020 Federal Tax Tables with 2021 Federal income tax rates medicare rate FICA and. If you compute payroll manually your employee has submitted a Form W-4 for 2020 or later and you prefer to use the Wage Bracket method use the worksheet below and the Wage Bracket Method tables that follow to figure federal income tax withholding. Also included in the table is the actual income taxes you will owe based on your income level.

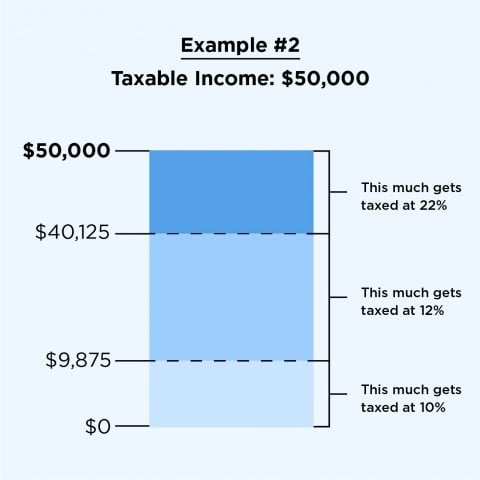

You might check the withholding tax in 2020 on the complying with tables. The first 14100 would be taxed at 10. 10 12 22 24 32 35 and 37.

Annual taxable income From To Federal tax rate R Constant K. Page 1 of 25 1415 - 16-Sep-2020 The type and rule above prints on all proofs including departmental reproduction proofs. If you cant use the Wage Bracket Method tables because taxable wages exceed the amount from the last bracket of the table.

Income Tax Brackets and Rates In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Married filing separately MFS Head of. Brown are filing a joint return.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518400 and higher for single filers and 622050 and higher for married couples filing jointly. Next they find the column for married filing jointly and read down the column. The tables include federal withholding for year 2020 income tax FICA tax Medicare tax and FUTA taxes.

Here is how your income would be taxed.

Irs Tax Tables 2020 2021 Federal Tax Brackets

Irs Tax Tables 2020 2021 Federal Tax Brackets

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg) Where To Find And How To Read 1040 Tax Tables

Where To Find And How To Read 1040 Tax Tables

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

Here S A Breakdown Of The New Income Tax Changes

Here S A Breakdown Of The New Income Tax Changes

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

Historical Highest Marginal Income Tax Rates Tax Policy Center

Historical Highest Marginal Income Tax Rates Tax Policy Center

Comments

Post a Comment