United Bank Cd Rates

This makes them a better fit for smaller deposits because you do not get a rate increase for adding more money. 5 Zeilen This post contains links from our advertisers and we may receive compensation when you click these.

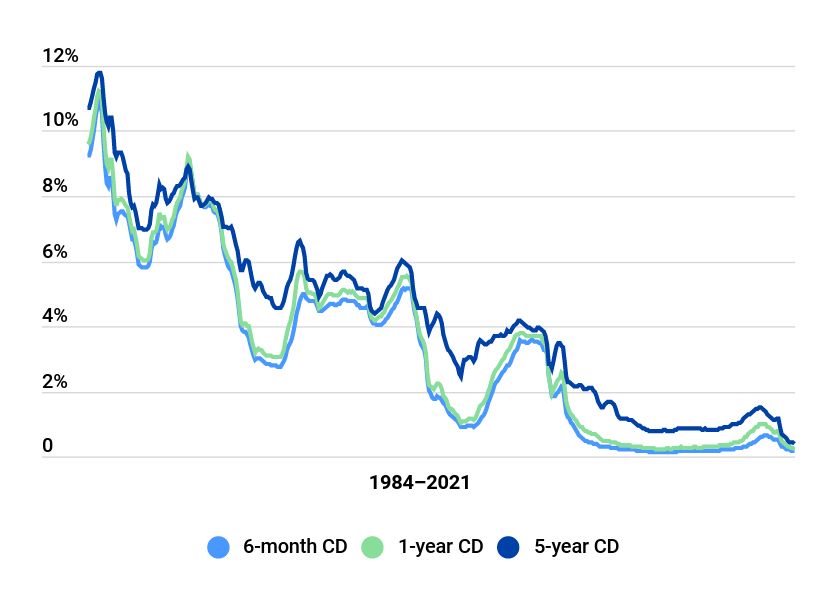

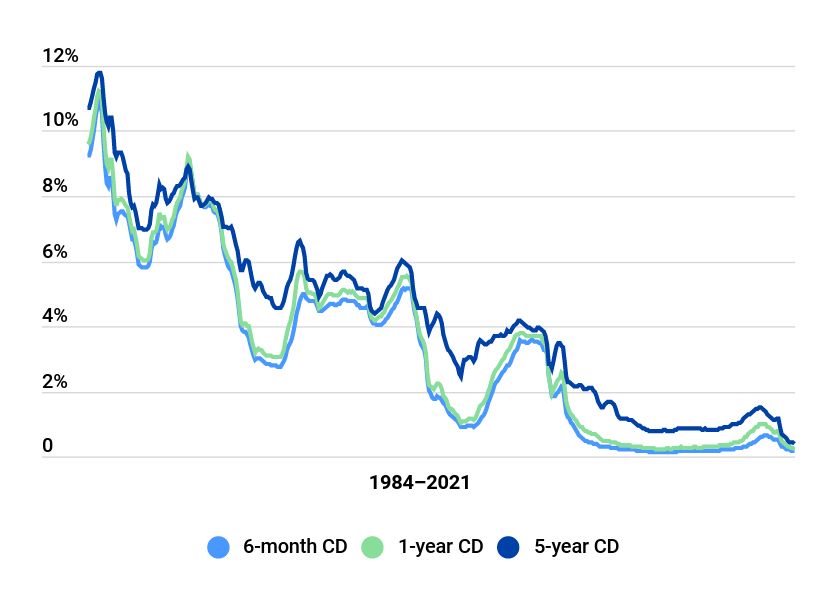

Historical Cd Interest Rates 1984 2021 Bankrate

Historical Cd Interest Rates 1984 2021 Bankrate

Still if you want to build a retirement nest egg youll need a decent interest rate.

United bank cd rates. 7 Zeilen Certificate of Deposit Rates. Long-term increases in deposits shows a banks ability to raise funds to grow its loans and assets. Early withdrawal fees could result in a reduction in earnings.

The interest rate and APY are variable and are subject to change at any time before or after account opening at our discretion without notice. Loan and asset growth may rise or fall depending on a banks strategy for growth. Rates are effective as of 031221.

Low minimum opening deposit of 500. 5 Zeilen BankUnited does not have many CD options but does have good interest rates. No Penalty CD minimum opening deposit of 5000.

Sharp rises and falls in assets deposits and loans can be problematic indicating a loosening. However Peoples United is offering a 200 for the 6-month term only and has pretty low rates for the other term lengths. Please contact a BankUnited representative for additional details.

An early withdrawal penalty may be imposed. For deposits over 250000 you can choose to consolidate all your CDs with FDIC coverage. Rates are subject to change without notice.

Your investment is safe secure and insured up to at least 250000 by. It is nice that you can open these IRAs for a small deposit. The IRA CDs only take 500 while the Variable IRA only needs 100.

Rates are subject to change at any time and are not guaranteed until the CD is open. NEW AUTO LOANS. A CD is a great choice if you are looking for a greater return on your investment and do not need immediate access to your money.

How BankUniteds CD rates compare. These certificates automatically renew upon maturity at current rates. The rest of its IRA CD rates are far too low.

Minimum to open the account is 250000. The maximum opening deposit for a Saver CD is 50000 per household and the maximum monthly transfer is 500. Long term certificates with terms of 1-5 years are available.

Annual Percentage Yield APY is accurate as of August 24 2020 and is based on the minimum opening deposit of 50000 and quarterly compounding assuming principal and interest remain on deposit. Minimum loan amount of 10000 and must pay 10 down payment from purchase price excluding taxes registration etc. Select from a range of maturities and earn a competitive interest rates.

We also like that you can open a CD and earn the full interest rate with a deposit of only 1000. Best 2-Year CD Rates Rate Term Minimum. Certificates have fixed rates and terms and require a minimum deposit.

We can also help you build a CD portfolio to save you time and put your money to work for you. They pay a much better interest rate than what you would earn at the large national banks. Maximum opening deposit per account is 25000000.

SILAC Secure Savings Elite 2. A minimum deposit of 50000 is required to open a Certificate of Deposit account. How 36 month Step-Up CDs work.

An initial deposit of 100 is required to open a Saver CD as well as a monthly transfer from a United Bank Checking Account of at least 25. Lafayette Federal Credit Union. CD will automatically renew at maturity into a standard CD closest in length to the initial term which may be shorter or longer than the initial term at the then current standard rate in effect at the time of renewal unless you instruct us otherwise.

Minimum rate is 450 and Maximum rate cap is 18. Customers have a ten 10 calendar day grace period at maturity to make additions withdrawals or other changes without incurring a penalty. 150 retirement fee if credit line is closed within 18 months.

MAC Federal Credit Union. Substantial penalty for early withdrawal. The initial interest rate will be in effect for two years.

How United Banks IRA CD rates compare. A 1500 monthly maintenance fee will be assessed if the daily balance falls below 250000. As of December 31 2020 Shore United Bank had assets of 1932470000 loans of 1440368000 and deposits of 1717357000.

Current CD Rates from United Bank 6 Month CD 040 9 Month CD 050 12 Month CD 055 18 Month CD 055 24 Month CD 080 24 Month Option CD 065 36 Month CD 101 48 Month CD 111 60 Month CD 131. Peoples United Bank CD Rates CDs are a certificate issued by a bank to a person depositing money for a specified length of time and usually the longer of a term is the higher APY rate you make. You select the term from 1 year to a maximum of 5 years and the beginning balance and as long as you have a United Bank Checking Account monthly contributions to your CD.

The BankUnited CDs are definitely respectable. A 1500 early closeout fee will be assessed if the account is closed. The two United Bank IRA CD specials are very competitive especially the 30 month option.

Invest as little as 100000 and receive competitive interest rates guaranteed for the term you select.

People S United Bank Cd Rates 1 70 Apy 6 Month Cd Ct Me Ma Nh Ny Vt

People S United Bank Cd Rates 1 70 Apy 6 Month Cd Ct Me Ma Nh Ny Vt

People S United Bank Reviews And Rates

People S United Bank Reviews And Rates

United Bank Explore Business Savings Solutions

United Bank Explore Business Savings Solutions

Personal Certificates Of Deposit United Community Bank

Personal Certificates Of Deposit United Community Bank

Historical Cd Interest Rates 1984 2021 Bankrate

Historical Cd Interest Rates 1984 2021 Bankrate

Here Are 6 Things Consumers Need To Know About M T Bank Corp Buying Bridgeport Based People S United Bank Hartford Courant

Here Are 6 Things Consumers Need To Know About M T Bank Corp Buying Bridgeport Based People S United Bank Hartford Courant

First United Bank Limited Cd Offer For Oklahoma City Ok

First United Bank Limited Cd Offer For Oklahoma City Ok

United Bank Ga Reviews And Rates Georgia

United Bank Ga Reviews And Rates Georgia

Here Are The Top Cd Rates Of April 2021

United Bank Cd Rates Smartasset Com

United Bank Cd Rates Smartasset Com

People S United Bank Cd Rates Smartasset Com

People S United Bank Cd Rates Smartasset Com

United Bank Review Smartasset Com

United Bank Review Smartasset Com

Comments

Post a Comment