Is There A Limit On Charitable Donations For 2020

This measure will increase the limit to 30. Qualifying taxpayers can deduct up to a certain amount in charitable gifts without itemizing as long as the donations.

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

Charitable Contributions for Non-Itemizers The Taxpayer Certainty and Disaster Tax Relief Act allows those who dont itemize their deductions a deduction of up to 300 for cash contributions made during 2021.

Is there a limit on charitable donations for 2020. Married couples filing jointly are allowed a deduction of up to 600 for the cash contributions they make during 2021. If your Gift Aid payments add up to 100 in 2019 to 2020 the grossed-up value of your donation to charity would be 100 10080 125. To qualify for this higher limit the gifts must go directly to the charities.

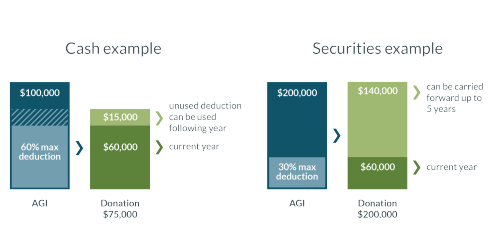

Formerly set at 60 the limitation for cash contributions to certain public charities has now been raised to 100 of an individuals AGI for 2020. The election allows the taxpayer to limit the 2020 charitable deduction to an amount less than 100 of the charitable contribution base so that taxable income does not become negative due to nonbusiness itemized deductions. The CARES Act lifts the 60 of AGI limit for cash donations made in 2020 although theres still a 100 of AGI limit on all charitable contributions.

In other words the amount of charitable donations you could deduct as recently as 2019 generally could not. Now taxpayers who do not itemize can take advantage of a new above-the-line deduction of up to 300 for amounts contributed to charity in 2020. For wealthy clients who might be in a position to make a donation in excess of 100 of their AGI their 2020 charitable deduction will be limited to a maximum of 100 of their AGI.

Higher rate relief due to you would be. This means the deduction lowers both adjusted gross income and taxable income translating into tax savings for those making donations to qualifying tax-exempt organizations. Usually the limit is 60 of adjusted gross income or AGI found on your tax return.

The new law temporarily lifts the limits on charitable giving from 60 of a taxpayers AGI to 100 for 2020. As in the past. Other than the temporary 300 exception for 2020 and 2021 in order to deduct a charitable contribution you must itemize your taxes.

For the 2020 and 2021 tax years theres an exception to this rule. That means itemizers can deduct more of. Additionally there is a unique opportunity this year for clients with charitable contribution carryforwards to 2020.

Under this new change individual taxpayers can claim an above-the-line deduction of up to 300 for cash donations made to charity during 2020. You do not need to. This is an increase from 2020 when the contribution was limited to 300.

In 2020 you can deduct cash gifts of up to 100 of your adjusted gross income rather than the usual 60 limit. The CARES Act which went into effect this spring established a new above-the-line deduction for charitable giving. Any giving beyond this 100 limitation may be carried over and used in the next five years.

This provision excludes giving to. You can write off up to 300 in cash donations on your 2020. If You Are a Corporation The CARES ACT allows your entity to take a tax deduction of up to 25 of their Adjusted Tax Income for contributions to qualifying charities starting in 2020.

Currently the Gift Aid Small Donations Scheme GASDS only applies to donations of 20 or less made by individuals in cash or by contactless payment. Finally the CARES Act had implications for very large charitable givers in that it lifts the limit on the amount of charitable gifts that can be deducted by itemizers in 2020 from 60 of the. For taxpayers who have not itemized deductions they received no tax benefit as a result of charitable giving.

Get 300 Tax Deduction For Cash Donations In 2020 2021

Get 300 Tax Deduction For Cash Donations In 2020 2021

Why 2020 Is An Especially Good Year To Give Schwab Charitable Donor Advised Fund Schwab Charitable

Why 2020 Is An Especially Good Year To Give Schwab Charitable Donor Advised Fund Schwab Charitable

/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif) Donations To Charities Are Still Tax Deductible

Donations To Charities Are Still Tax Deductible

Cares Act Expands Tax Deductions For Charitable Giving Kiplinger

Cares Act Expands Tax Deductions For Charitable Giving Kiplinger

Charitable Intentions Methods To Maximize Your Impact And Minimize Taxes Fi3 Advisors

Charitable Intentions Methods To Maximize Your Impact And Minimize Taxes Fi3 Advisors

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg) Tips On Charitable Contributions Limits And Tax Breaks

Tips On Charitable Contributions Limits And Tax Breaks

Claiming A Charitable Donation Without A Receipt H R Block

Claiming A Charitable Donation Without A Receipt H R Block

A 300 Charitable Deduction Explained

A 300 Charitable Deduction Explained

/tax-deduction-for-charity-donations-3192983_FINAL-9f9aa78932ec47ac960c8bacad155a17.gif) Donations To Charities Are Still Tax Deductible

Donations To Charities Are Still Tax Deductible

Charitable Deductions On Your Tax Return Gifts As A Tax Return Deduction

Charitable Deductions On Your Tax Return Gifts As A Tax Return Deduction

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

Charitable Tax Deductions 7 Questions Answered Fidelity Charitable

Charitable Tax Deductions 7 Questions Answered Fidelity Charitable

9 Ways To Reduce Your Taxable Income Fidelity Charitable

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Comments

Post a Comment