States That Don T Tax Military Retirement

New Hampshire doesnt tax wages but does tax dividends and interest. No taxes on military retirement income in New York.

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch

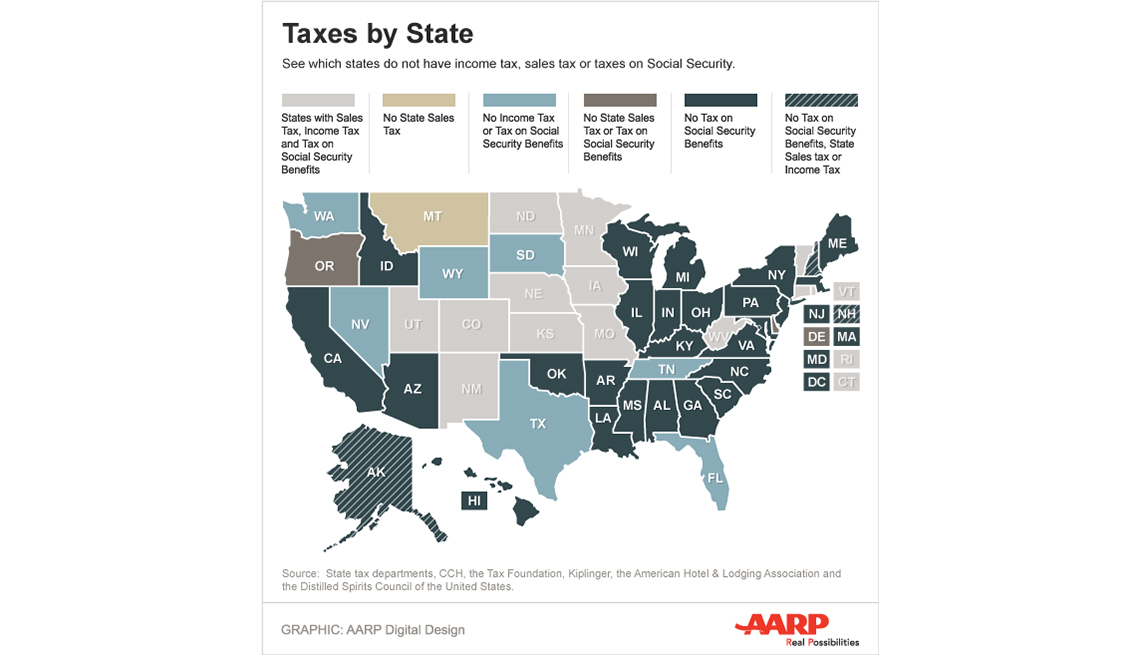

Those include Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming.

States that don t tax military retirement. As an example Arizona will exempt military retirement pay from taxation for earnings of 2500 and less. Highest marginal tax rate. States while property taxes are in the middle of the pack.

Tax giveaways like this reduce revenue without regard to the states other obligations to Vermonters. 51 Zeilen Military retirement pay is not considered earned income and no Social Security is. 585 for all taxpayers regardless of status.

New Hampshire dividend and interest taxes only South Dakota. Fully tax military retirement pay. 20 states exempt military retirement income.

Vermont also has some of the highest income tax rates overall just so you know. Not to pick on Vermont. Then there are 13 states that partially exempt military retirement pay.

In addition the following states dont require military members to pay state income tax on military retirement pay because there is simply no state income tax collected. The 7 states that fully tax military retirement. Overall Illinois is one of the least tax-friendly states for retirees.

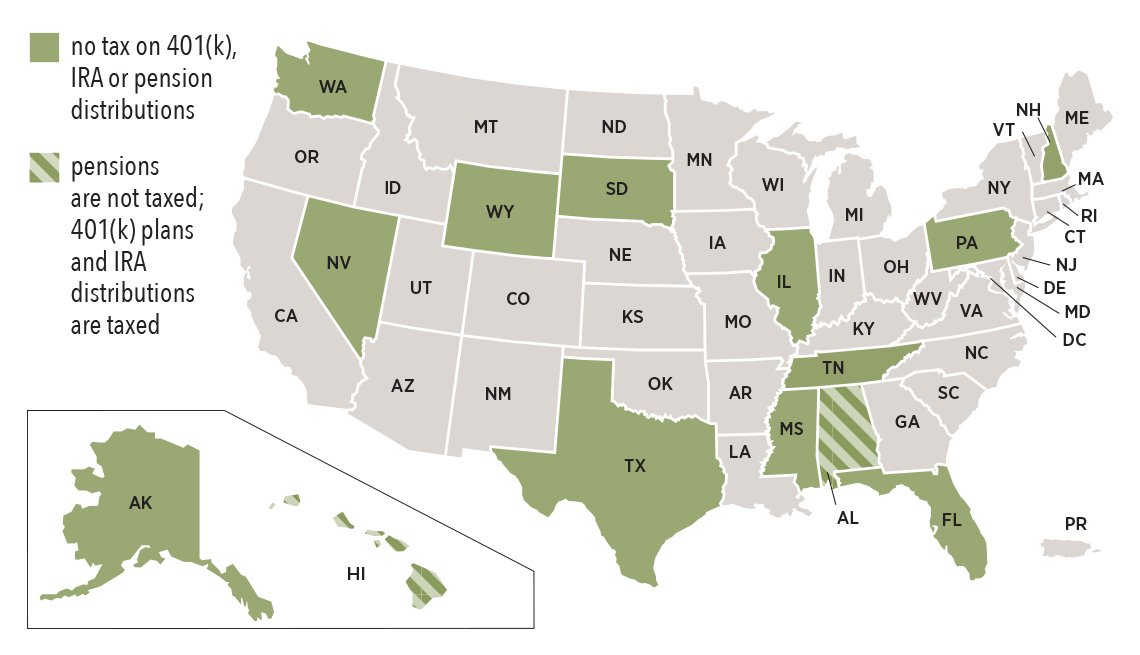

No state income tax. For residents still working on their 2020 state income tax return Utah doesnt offer any special tax breaks for military retirees and its retirement-income tax credit is limited. These myths could wreack your retirement but they dont have to But 14 states dont tax pension payouts and eight dont tax income at all.

State Tax Information for Military Members and Retirees Alabama. If you dont live in those 14 states you still may avoid paying taxes on all or some of your pension. Tennessee dividend and interest taxes only.

However its the only Midwestern state that completely exempts 401. These states are considered among the least-friendly to retired veterans because of their state income taxes. Tennessee doesnt tax wages but does tax dividends and interest.

In addition to having no retirement income tax Alaska also doesnt charge sales tax on goods and services. Connecticut No tax on military retirement Delaware No tax on military retirement up to 2000 under age 60 12500 ages 60 Florida No state income tax Georgia Tax deductions on military retirement of up 65000. Military retirees with 5 years of creditable service before August 12 1989 are exempt from state income taxes on military retirement pay or military survivors benefits.

According to Wolters Kluwer a tax publishing company 27 states tax some but not all of retirement or pension incomeTypically these states tax pension income only above a. Legal residents are eligible for the Permanent Fund Dividend. States That Dont Have Military State Income Taxes.

States Without Personal Income Tax Alaska Florida Nevada South Dakota Texas Washington and Wyoming do not have a personal income tax. Alabama Arkansas Connecticut Hawaii Illinois Iowa Kansas Louisiana Maine Massachusetts Michigan Minnesota Missouri New Jersey New York North Dakota Ohio Pennsylvania West Virginia and Wisconsin dont tax military retirement income. However what Alaska does have is some of the highest property taxes in the country.

2 Florida Floridas sales tax is far above the average for US. California Utah Vermont Virginia and Washington DC. For example we need to support and secure our state workers and teachers retirement.

Senator Eyes Tax Exemption For Military Retirement Social Security Nebraska News Journalstar Com

States That Offer The Biggest Tax Relief For Retirees

States That Offer The Biggest Tax Relief For Retirees

States That Won T Tax Your Retirement Distributions

States That Won T Tax Your Retirement Distributions

States That Won T Tax Your Retirement Distributions

States That Won T Tax Your Retirement Distributions

State By State Guide To Taxes On Retirees

State By State Guide To Taxes On Retirees

November 2014 Newsletter The Aarc

States That Don T Tax Military Retirement Pay Rapidtax Military Retirement Pay Military Retirement Retirement

States That Don T Tax Military Retirement Pay Rapidtax Military Retirement Pay Military Retirement Retirement

Which States Don T Tax Military Retirement Pay Military Pension State Taxes Military Retirement Pay Military Retirement Pensions

Which States Don T Tax Military Retirement Pay Military Pension State Taxes Military Retirement Pay Military Retirement Pensions

States That Won T Tax Your Military Retirement Pay

States That Won T Tax Your Military Retirement Pay

Military Retirement And State Income Tax Military Com

Military Retirement And State Income Tax Military Com

States That Don T Tax Social Security Military Benefits

States That Don T Tax Social Security Military Benefits

8 Of The Best States For Military Retirees 2021 Edition Ahrn Com

8 Of The Best States For Military Retirees 2021 Edition Ahrn Com

States That Won T Tax Your Military Retirement Pay

States That Won T Tax Your Military Retirement Pay

States That Don T Tax Military Retirement Ourmilitary Com

States That Don T Tax Military Retirement Ourmilitary Com

Comments

Post a Comment