Additional Mortgage Payments

For example they copy the amount of their standard monthly payment and make 13 payments per year instead of 12. A few examples to show just how.

The Power Of Extra Mortgage Payments The Truth About Mortgage

The Power Of Extra Mortgage Payments The Truth About Mortgage

But before you make additional mortgage payments make sure to ask your lender about prepayment penalty.

Additional mortgage payments. You may think 50 or 100 a month is a small sum but no amount is too small. Before overpaying your mortgage check that your lender allows you to overpay it penalty-free and if there are any limits as to how much you can overpay. If you use this strategy please be aware that on occasion banks have been known to not credit your extra principal payments directly towards reducing your principal loan balance.

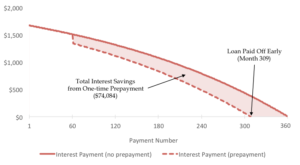

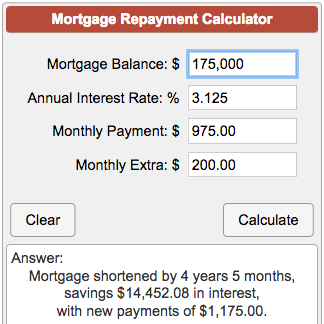

For example if you pay 1300 per month normally you may pay an extra 200 to the principal for a total payment of 1500. Allow homeowners to enroll in mortgage payment forbearance programs through June 2021. Using our 100 example if you started making extra payments in year six of your 30-year mortgage month 61 youd only save 1509521 and shed just 78 months off your mortgage.

Many people choose to make extra principal payments on their mortgage to reduce their debt and eliminate the need to have a mortgage expense earlier than their mortgage term. As you can see its not that hard to save a ton of money via extra mortgage payments but it also matters when you start making those additional payments. Whatever extra you pay today is extinguished debt not accruing any further interest forever.

Or you can do so at more frequent intervals during the. Making extra mortgage payments are a good way to reduce your interest charges and shorten your term. This calculator assumes you reduce the mortgage debt which is the main benefit of overpaying.

This is because the principal or outstanding balance is larger. Ensure that any overpayment you make goes to reduce the debt so shortening the term rather than reducing your monthly payments. An additional principal payment is a supplementary payment applied directly to your mortgage loan principal amount.

Others prefer to use a sudden influx of money such as a bonus or inheritance to pay down debt instead of. Paying extra on your mortgage means that you make additional payments to your principal loan balance beyond your regular payments. Its a viable option if you have extra income but cannot afford to refinance to a shorter term.

Two benefits of making extra mortgage payments As you may know making extra payments on your mortgage does NOT lower your monthly payment. Power Realty AdvisorsLocated in Hingham MAServing Greater Boston The South ShoreThe power of additional mortgage payments. Additional payments to the principal just help to shorten the length of the loan since your payment is fixed.

It exceeds the scheduled monthly amount. The amount of time saved on the current loan schedule by making additional payments toward the principal mortgage balance. When you prepay your mortgage it means that you make extra payments on your principal loan balance.

Take the first step and get prequalified. You can make additional payments applied to your principal at the time your mortgage payment is normally due or earlier. Paying expensive penalty fees defeats the purpose of gaining savings on extra payments.

Paying additional principal on your mortgage can. Thus possibly saving you on interest and helping you to pay off your mortgage early. Enter your loan information and find out if it makes sense to add additional payments each month.

6 Zeilen One of the most common ways that people pay extra toward their mortgages is to make bi-weekly. Some people like to make one additional mortgage payment per year. Extra Payments Calculator Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan.

Additional mortgage payments have the biggest impact during the first years of the loan. Additional Principal Payment Extra payments applied to the mortgage above the monthly requirement. Calculate your loan payment and more Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

Homeowners dont always catch this. Extend forbearance programs for an additional six months for those who already entered a.

How Does Prepaying Your Mortgage Actually Work Sensible Financial Planning

How Does Prepaying Your Mortgage Actually Work Sensible Financial Planning

Additional Payment Calculator Extra Principal Payments On Mortgage

Additional Payment Calculator Extra Principal Payments On Mortgage

/how-do-i-make-extra-payments-on-my-loans-2385993-Final-37d8f0ec56174885a783a241a3045332.png) How Do I Make Extra Principal Payments On My Loans

How Do I Make Extra Principal Payments On My Loans

Extra Payment Mortgage Calculator For Excel

Extra Payment Mortgage Calculator For Excel

Repaying Your Mortgage Abn Amro

Repaying Your Mortgage Abn Amro

Mortgage Calculator With Amortization Schedule Extra Etsy In 2021 Mortgage Loan Calculator Mortgage Calculator Tools Amortization Schedule

Mortgage Calculator With Amortization Schedule Extra Etsy In 2021 Mortgage Loan Calculator Mortgage Calculator Tools Amortization Schedule

Should You Make Extra Mortgage Payments Compare Pros Cons

Should You Make Extra Mortgage Payments Compare Pros Cons

Biweekly Mortgage Calculator Calculate Accelerated Bi Weekly Home Loan Payment Savings

Biweekly Mortgage Calculator Calculate Accelerated Bi Weekly Home Loan Payment Savings

Mortgage The Components Of A Mortgage Payment Wells Fargo

Mortgage The Components Of A Mortgage Payment Wells Fargo

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Comments

Post a Comment