Federal Id Number Online

First check to see if you received an email or physical letter from the IRS confirming your EIN when you first applied. The respective General Directorate for Residency and Foreigners Affairs will hand over the returned ID card to Federal Authority for Identity and Citizenship FAIC which had issued the card.

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

If you own and operate a business you may be required to obtain a Federal Employer Identification Number EIN and should consider doing so even if not required.

Federal id number online. The online application process is available for all entities whose principal business office or agency or legal residence in the case of an individual is located in the United. You may apply for an EIN online if your principal business is located in the United States or US. If you open the return and discover that the number has been replaced with asterisks for security purposes contact.

Generally businesses need an EIN. You may apply for an EIN in various ways and now you may apply online. Its a good idea to print out a copy of the application form IRS SS-4 before you begin the application process.

Ask the IRS to search for your EIN by calling the Business Specialty Tax Line at 800-829-4933. XX-XXXXXXXXX to business entities operating in the United States for the purposes of identification and. The person applying online must have a valid Taxpayer Identification Number SSN ITIN EIN.

Filing online using the IRS EIN Assistant online application is the easiest way. A federal tax ID lookup is a method of searching for a businesss information using their tax identification number FTIN or EIN6 min read. You can get your number immediately using the online or phone option.

Wir zeigen Ihnen wo Sie die Nummer finden. An Employer Identification Number EIN is also known as a federal tax identification number and is used to identify a business entity. It will be in either your email or in a letter depending on how you applied.

You can find the number on the top right corner of your business tax return. Everything You Need to Know. Your previously filed return should be notated with your EIN.

Get a EIN Employer Identification Number or Federal Employer Identification Number FEIN and have your new business up and running in minutes. You need it to pay federal taxes hire employees open a bank account and apply for business licenses and permits. You are limited to one EIN per responsible party per day.

Refer to Employer ID Numbers for more information. Second check your prior tax returns loan applications permits or. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

Find a previously filed tax return for your existing entity if you have filed a return for which you have your lost or misplaced EIN. Your companys EIN is like a Social Security number for your business and thus very important. Work through the application questions so you have all the answers youll need.

Its free to apply for an EIN and you should do it right after you register your business. For more information regarding the Emirates ID you could contact EIDA via the Ask Hamad service or the phone by calling on 6005-30003. Click here to email an EIN Expert Our trained EIN specialists are available Monday through Friday from 7AM - 10PM EST.

Our online application is available anytime 247365 Our service will process your application for an EINTax ID number SS-4 Form with the IRS to obtain your Tax ID Number and deliver it to you quickly and securely via email. An employer identification number also called an EIN or federal tax ID number is a unique numerical identifier that is assigned to businesses by the IRS principally for tax purposes. It is also used by estates and trusts which have income which is required to be reported on Form 1041 US.

Commonly referred to as a federal tax ID number an EIN is similar to a social security number for your business. Income Tax Return for Estates and Trusts. Our EIN form is simplified for your ease of use accuracy and understanding saving you time.

The Internet EIN application is the preferred method for customers to apply for and obtain an EIN. Once the application is completed the information is validated during the online session and an EIN is issued immediately. US Internal Revenue Service 3rd Party Designee.

Employer Identification Number EIN. Möchten Sie ohne Visum in die USA einreisen müssen Sie zuvor Ihre nationale Identitätsnummer angeben. Get a federal tax ID number Your Employer Identification Number EIN is your federal tax ID.

Federal Tax ID for a Business. Federal Tax ID Lookup. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately.

The Employer Identification Number EIN also known as the Federal Employer Identification Number FEIN or the Federal Tax Identification Number FTIN is a unique nine-digit number assigned by the Internal Revenue Service IRS format.

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Number How To Get Federal Tax Id Number Biryuk Law Firm

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) Differences Among A Tax Id Employer Id And Itin

Differences Among A Tax Id Employer Id And Itin

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

:max_bytes(150000):strip_icc()/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) How To Find Your Employer Identification Number Ein

How To Find Your Employer Identification Number Ein

Federal Tax Id Numbers Lookup Free

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

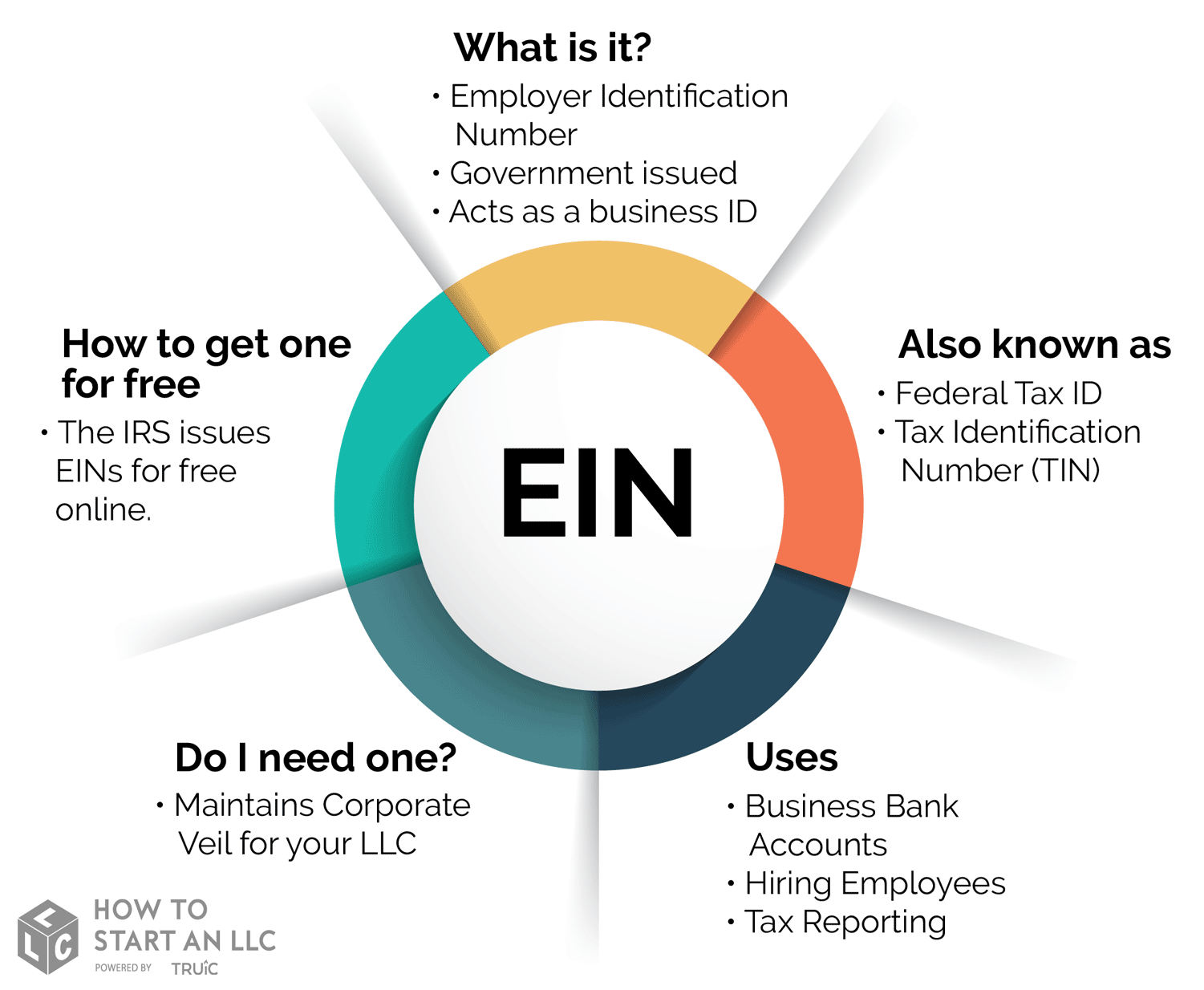

Ein Number What Is An Ein Truic

Ein Number What Is An Ein Truic

Employer Identification Number And Tax Identification Number

Employer Identification Number And Tax Identification Number

How Do I Find My Federal Tax Id Number Online

How Do I Find My Federal Tax Id Number Online

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Comments

Post a Comment