What Does Apr Mean On A Home Loan

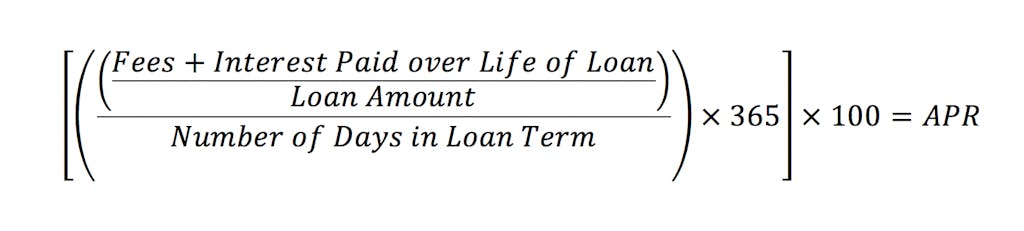

The annual percentage rate APR is the amount of interest on your total mortgage loan amount that youll pay annually averaged over the full term of the loan. A high APR means that you will be.

Apy Vs Apr And Interest Rates What S The Difference Ally

Apy Vs Apr And Interest Rates What S The Difference Ally

It is a numeric representation of your interest rate.

What does apr mean on a home loan. Unlike an interest rate however it includes other charges or fees such as mortgage insurance most closing costs discount points and loan origination fees. How does APR work. Like an interest rate the APR is expressed as a percentage.

It takes into account the interest rate and additional charges of a credit offer. APRC stands for annual percentage rate of charge. The interest rate is the cost of borrowing the principal.

If you dont pay back the loan you could lose your home. This makes it possible for you to compare different loan products with different fees and costs to determine which will cost you the least over the term of the loan. With mortgages the APR is slightly higher than the.

Whenever you have a balance on the loan or credit youll be required to make payments toward the balance as well as additional payments to pay the APR. Youll see APRs alongside interest rates in. In other words its.

The annual percentage rate usually shown next to the advertised and called APR or nominal interest rate is always higher than the actual or effective loan interest rate because it annualizes the fees and costs associated with the loan. APRC is designed to show you as a percentage the annual cost of a loan including fees and other costs. BUT WHAT DOES APR MEAN.

All lenders have to tell you what their APR is before you sign a credit agreement. Comparing APRs is most useful if. APR is the annual percentage rate of interest you are charged to borrow money.

The APR is a number that helps you to understand the interest rates that are charged on different credit cards loans and other credit products so you can decide which rate is best. Your car loan APR is a measure of the total amount of interest you will pay on your financing over a one year term. An annual percentage rate APR is a broader measure of the cost of borrowing money than the interest rate.

Annual percentage rate APR is the official rate used to help you understand the cost of borrowing. When you receive an interest rate quote from your lender it may be expressed in interest rate per term. APR or annual percentage rate is a calculation that includes both a loans interest rate and a loans finance charges expressed as an annual cost over the life of the loan.

The APR is almost always higher than the interest rate including other costs associated with borrowing the money. The APR is the yield to maturity on all. The APR reflects the interest rate any points mortgage broker fees and other charges that you pay to get the loan.

A lower APR could translate to lower monthly mortgage payments. For that reason your APR is usually higher than your interest rate. This does not tell you how much interest you will pay per year in annual percentage rate APR.

APR stands for annual percentage rate. All loan products must show the APR rate so you are able to compare them fairly. The annual percentage rate or APR is the amount it costs a lender to offer you a loan or credit.

With credit cards the APR and interest rate are the same. APR is the annual cost of a loan to a borrower including fees. Its used to compare mortgages and other loans that are secured against an asset your house for example.

The federal Truth in. When a loan is advertised with a representative APR it means that at least 51 of customers receive a rate that is the same as or lower than the representative APR although not everyone within the 51 will necessarily get the same rate. For mortgages the APR is a measurement of the interest youll pay on a loan after all of the fees and costs are taken into account.

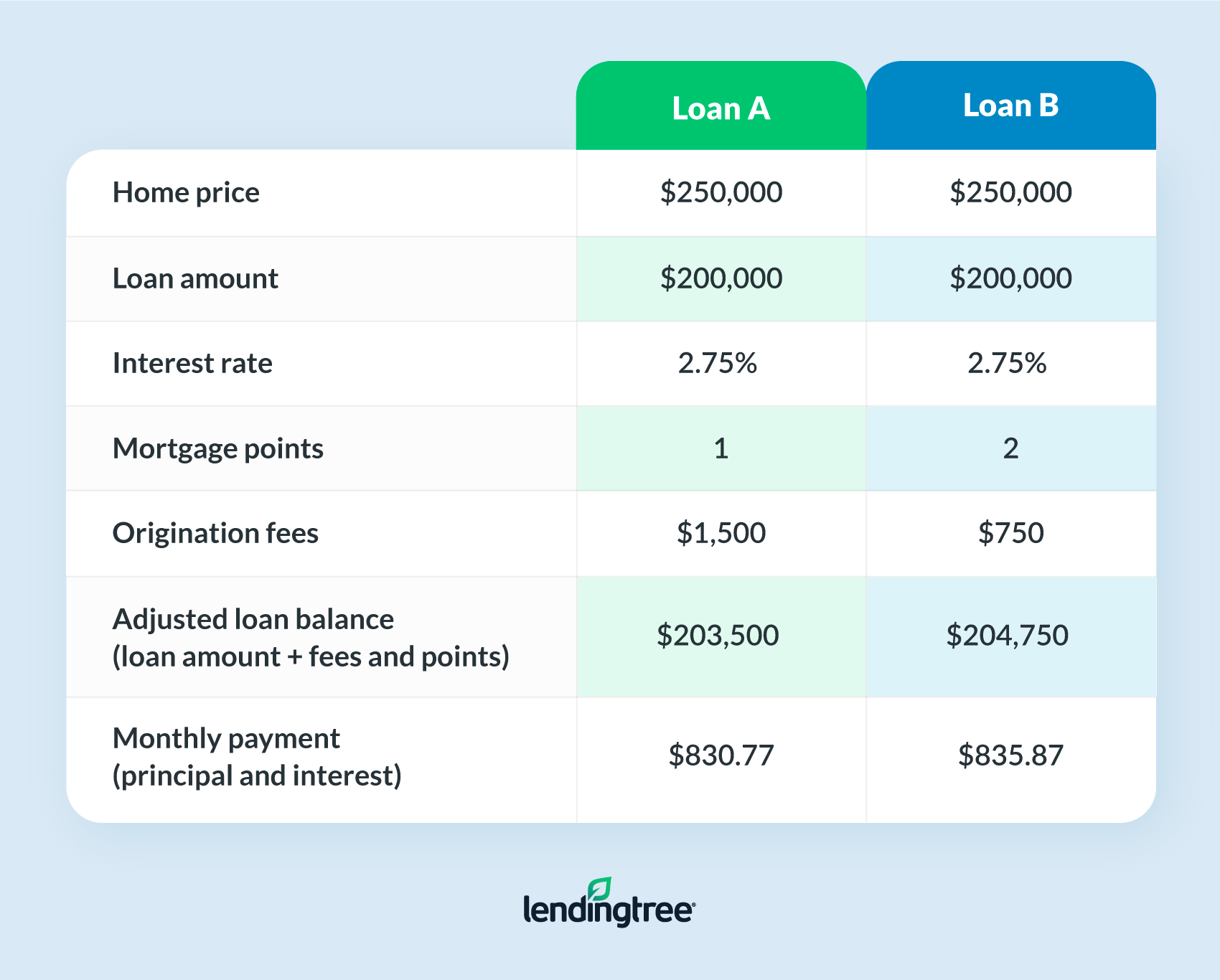

APR is a tool that lets you compare mortgage offers that have different combinations of interest rates discount points and fees.

Annual Percentage Rate Wikipedia

Annual Percentage Rate Wikipedia

Different Types Of Mortgage Loans

Different Types Of Mortgage Loans

What Is Apr Mortgage Apr Mls Mortgage

What Is Apr Mortgage Apr Mls Mortgage

/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png) What Apr Tells You About A Loan

What Apr Tells You About A Loan

Apr Vs Interest Rate What S The Difference Lendingtree

Apr Vs Interest Rate What S The Difference Lendingtree

Mortgage What Is Apr Wells Fargo

Mortgage What Is Apr Wells Fargo

Apr Vs Interest Rate Why It S So Important The Lenders Network

Apr Vs Interest Rate Why It S So Important The Lenders Network

What Is Apr And Why Is It Important Credit Karma

What Is Apr And Why Is It Important Credit Karma

What Is Apr Mortgage Apr Mls Mortgage

What Is Apr Mortgage Apr Mls Mortgage

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Are Interest Rates How Does Interest Work Credit Org

What Are Interest Rates How Does Interest Work Credit Org

Apr Vs Interest Rate Why It S So Important The Lenders Network

Apr Vs Interest Rate Why It S So Important The Lenders Network

/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png) How A Credit Score Influences Your Interest Rate

How A Credit Score Influences Your Interest Rate

Comments

Post a Comment