How Do You Qualify For A Mortgage

How to Qualify for a Mortgage Down Payment. If the borrower routinely pays bills late then a lower credit score is expected.

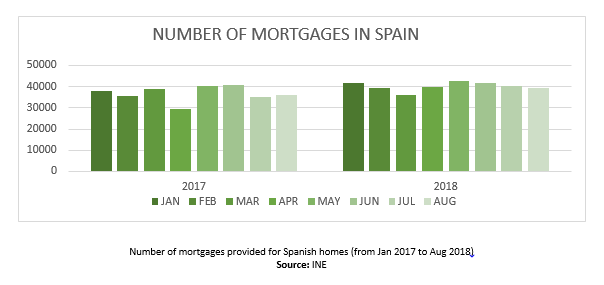

Do You Qualify For A Mortgage Vlc Invest

Do You Qualify For A Mortgage Vlc Invest

The higher the borrowers credit score the easier it is to obtain a loan or to pre-qualify for a mortgage.

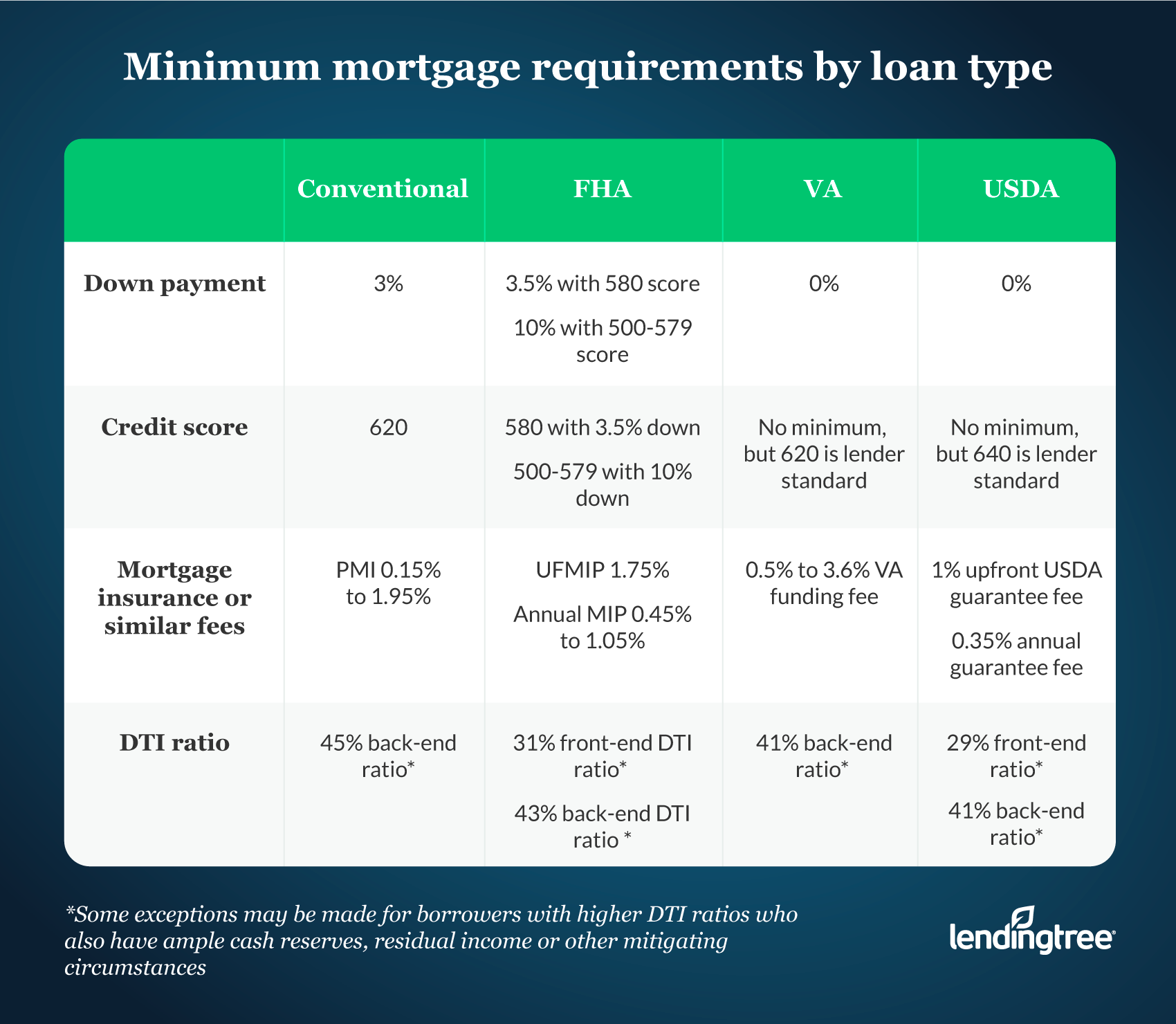

How do you qualify for a mortgage. Start collecting all the documents you will need for the mortgage application process. An FHA loan is a government-backed loan with lower debt income and credit standards. You should consider an FHA loan if your score is lower than 620.

Lenders look at the Loan to Value Ratio LTV when underwriting the loan. There are two. You can do this online either through a paid subscription service or one of the free online services currently available.

If your income is lower than this you may need to do one of the following. Our mortgage qualifying calculator was designed to help you determine how much you can borrow how much income you need to qualify for your desired mortgage and what your total monthly payment will be for the loan. This includes your credit score income debt-to-income ratio and your down payment.

What you need to apply for a mortgage. Well also talk about different types of home loans and their unique requirements as well as other important information you need to know about qualifying for a mortgage. It includes bill payment history and the number of outstanding debts in comparison to the borrowers income.

Divide your loan amount by the homes. Make sure there is no incorrect information about you. So to calculate if you have the required income for a mortgage the lender takes your projected monthly mortgage payment adds to it your minimum monthly payments for credit cards and any other loans plus legal obligations like child support or alimony and compares it to your monthly income.

Look for a cheaper home save a higher downpayment or look for a lender which will lend to higher DTI limits. Our guide will introduce you to the basic mortgage qualifying process and discuss essential financial aspects you should prepare for. Youll need to have a FICO credit score of at least 620 points to qualify for most types of loans.

The calculator uses information such as your mortgage rate down payment loan term closing costs property taxes as well as homeowners insurance. Traditionally lenders like a down payment that is 20 percent of the value of the home. If your monthly income is higher than 522506 or your annual income is above 6270068 you should qualify.

Pre Approval And Pre Qualify For A Mortgage Loan

Pre Approval And Pre Qualify For A Mortgage Loan

Mortgage Pre Qualification Vs Mortgage Pre Approval The Truth About Mortgage

Mortgage Pre Qualification Vs Mortgage Pre Approval The Truth About Mortgage

Do I Qualify For A Mortgage The Truth About Mortgage

Do I Qualify For A Mortgage The Truth About Mortgage

How Do I Qualify For A Mortgage Loan

How Do I Qualify For A Mortgage Loan

How To Qualify For A Mortgage Sunset Mortgage Of Alabama

How To Qualify For A Mortgage Sunset Mortgage Of Alabama

Do I Qualify For A Mortgage Texaslending Com

Do I Qualify For A Mortgage Texaslending Com

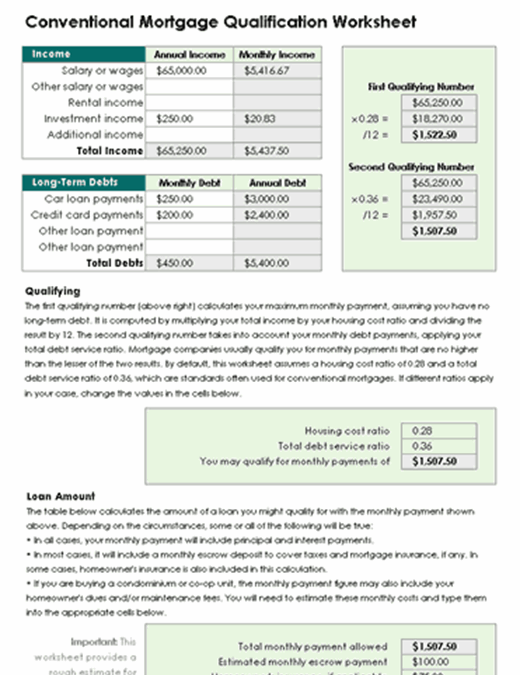

Mortgage Qualification Worksheet

Mortgage Qualification Worksheet

2021 Minimum Mortgage Requirements Lendingtree

2021 Minimum Mortgage Requirements Lendingtree

Qualify For Mortgage The Basics

Qualify For Mortgage The Basics

5 Factors That Qualify You For A Mortgage Total Mortgage Blog

5 Factors That Qualify You For A Mortgage Total Mortgage Blog

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

:max_bytes(150000):strip_icc()/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg) 5 Things You Need To Be Pre Approved For A Mortgage

5 Things You Need To Be Pre Approved For A Mortgage

What You Need To Know About Qualifying For A Mortgage

What You Need To Know About Qualifying For A Mortgage

Comments

Post a Comment