Roth Limits 2020 Income

You can contribute a reduced amount if your income is between. Up to the limit.

What Is A Backdoor Roth Ira Conversion Medicare Life Health

What Is A Backdoor Roth Ira Conversion Medicare Life Health

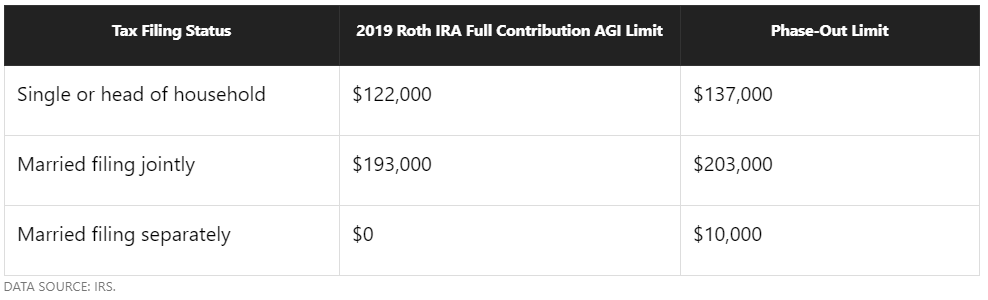

Single head of household or married filing separately and you did not live with your spouse at any time during the year.

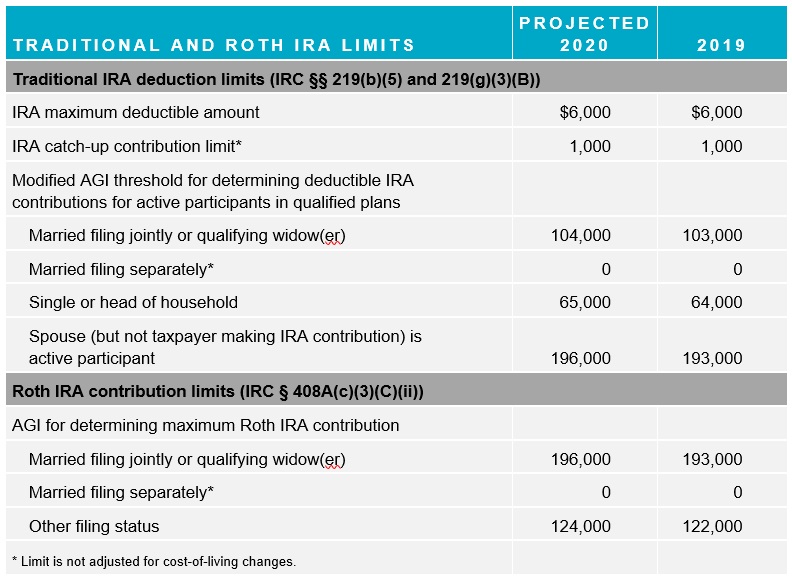

Roth limits 2020 income. Married filing jointly or qualifying widower. Thats not the case with a Roth IRA. If your filing status is single or head of household you can contribute the full 6000 7000 if you are age 50 or older to a Roth IRA if your MAGI is 124000 or less up from 122000 in 2019.

If you are single and earn 124000 or less you can contribute up to the full amount of 6000 per year. 13 lignes If youre age 49 or younger you can contribute up to 6000. Single 124000 but 139000.

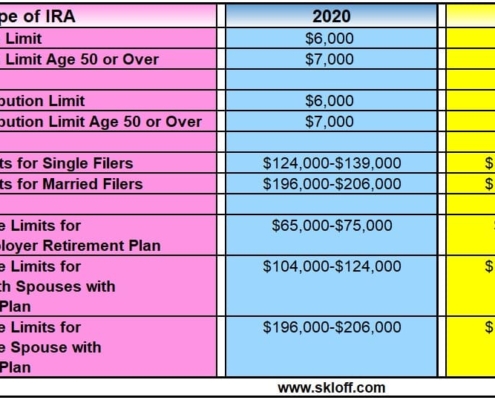

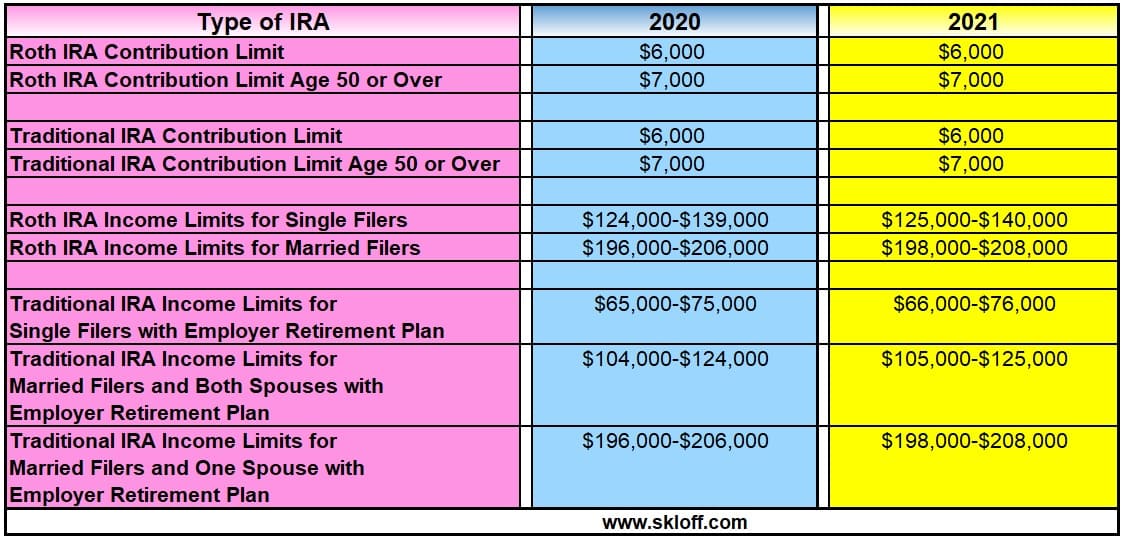

Annual Roth IRA contribution limits. You cannot contribute if you make over. The 2020 limit for contributions to Roth IRA is 6000 or 7000.

The limit for someone age 50 or older. 9 lignes married filing separately and you lived with your spouse at any time during the year. And if youre married and filing a joint return you can make a full contribution if.

The Roth IRA income limit to qualify for a Roth IRA is 139000 of modified adjusted gross income MAGI for single filers and 206000 for joint filers in 2020. The income limits for determining how much you can contribute to a Roth IRA have also increased for 2020. 124000 but 139000.

But for Roth IRA there is an additional contribution limit that is based on how much income you have in the year of deposit. Today were talking about the new Roth IRa max income limits and phase out ranges for 2020. However keep in mind that your eligibility to contribute to a Roth IRA is based on your income.

Heres a closer look at how the IRS. Joint-Filed Married 196000. If your aggregated gross income is between 124000 and 139000 you can still make contributions but with a lower value.

8 lignes The Roth IRA has contribution limits which are 6000 for 2020 and 2021. In 2020 and 2021 the Roth IRA contribution limits for most people are 6000 or 7000 if youre 50 or older. If your modified gross adjusted income MAGI is 196000 up from 193000 or less you can contribute up to the 6000 max.

But things get messier if you earn a lot of money. Single Under 124000. Whether or not you can make the maximum Roth IRA contribution for 2020 6000 annually or 7000 if youre age 50 or older depends on your tax filing status and your modified adjusted gross income MAGI.

If youre 50 years. Currently theres a yearly maximum investment of 6000 to both accounts 7000 if youre more than 50 years old. Here are the Roth IRA income limits for 2020 that would reduce your contribution to zero.

2020 Annual Income Roth IRA Contribution Limits. Roth IRA income limits for 2020 Roth IRA contribution limits for 2020 are based on your annual earnings. There are many restriction about type of income that can be used for opening an IRA account.

Youre married filing jointly or a qualifying widower with an AGI of 206000 or more You file single or head of household and have an AGI of 139000 or more. The 2020 Roth IRA income phaseout limits are as follows. Joint-Filed Married 196000 but 206000.

Roth IRA income limits. You can contribute the max limit to a Roth if your income is. If you are saving for retirement using the Roth IRA then you will.

A Roth IRA currently has an income limit of 135000 for single tax filers and 199000 for married couples joint filing. Is your income OK for a Roth IRA. In 2020 due to the CARES Act you can withdraw as much as 100000 from a Roth or traditional.

There are currently no age restrictions on a Roth IRA however there are income restrictions. Individuals making over 139000 and married couples making over 206000 in 2020 wont be able to contribute anything directly to a Roth IRA.

How To Determine Roth Ira Contribution Eligibility Ascensus

How To Determine Roth Ira Contribution Eligibility Ascensus

Eligibility For Roth Ira In 2020

Eligibility For Roth Ira In 2020

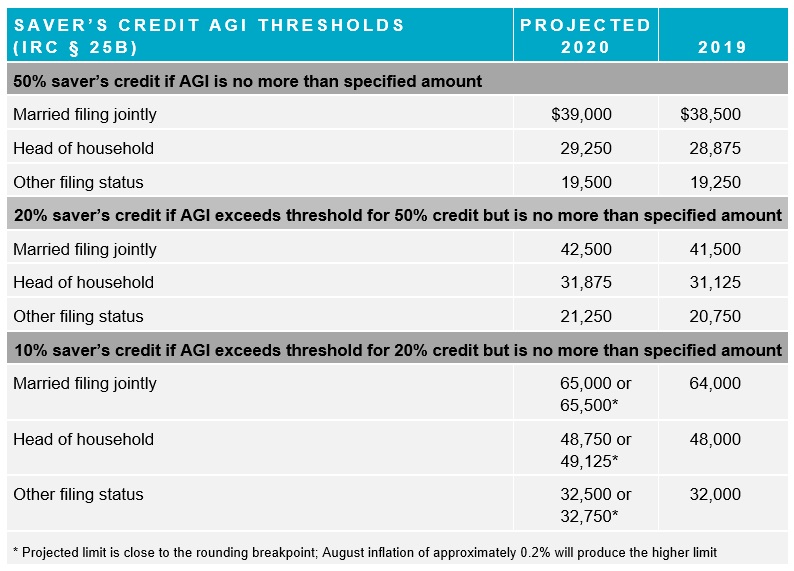

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

Roth Ira Contribution Limits Archives Skloff Financial Group

Roth Ira Contribution Limits Archives Skloff Financial Group

2019 Ira Contribution Limits Unchanged For 2020 401k And Hsa Caps Rise Investor S Business Daily

2019 Ira Contribution Limits Unchanged For 2020 401k And Hsa Caps Rise Investor S Business Daily

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Ira Contribution And Income Limits For 2020 And 2021 Skloff Financial Group

Ira Contribution And Income Limits For 2020 And 2021 Skloff Financial Group

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

Mercer Projects 2020 Ira And Saver S Credit Limits Mercer

Your 2020 Annual Contribution Limits Midatlantic Ira

Your 2020 Annual Contribution Limits Midatlantic Ira

2020 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

2020 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

The 2020 Irs And Social Security Changes You Need To Know For Retirement Great Waters Financial

The 2020 Irs And Social Security Changes You Need To Know For Retirement Great Waters Financial

Why Most Pharmacists Should Do A Backdoor Roth Ira

Why Most Pharmacists Should Do A Backdoor Roth Ira

Historical Roth Ira Contribution Limits Since The Beginning

Historical Roth Ira Contribution Limits Since The Beginning

2020 Roth Ira Contribution And Income Limits Your Go To Guide

2020 Roth Ira Contribution And Income Limits Your Go To Guide

Comments

Post a Comment