530 Credit Score Auto Loan With Cosigner

For example people with credit scores below 580 take out roughly 12 of car loans versus only 6 of mortgages according to 2017 Equifax data. 530 Credit Score Car Loan With Cosigner - CreditReps You will have trouble qualifying a car loan with a 530 credit score.

530 Credit Score Auto Loan With Cosigner Car Loan With 530 Credit Score

530 Credit Score Auto Loan With Cosigner Car Loan With 530 Credit Score

A cosigners credit score income and debt to income DTI ratio all matter to a lender and must be checked by the lender before the loan application is approved.

530 credit score auto loan with cosigner. As Auto Credit Express explains on its website only one cosigner is allowed to sign on a car loan. Excellent credit -- ranging from 740 to 850 -- wins you the lowest auto rate. Credit cards and auto loans offer the best approval odds for someone with a 530 credit score.

So make sure that the income details which you provide are correct accurate and fully verifiable as it will have bearing on the type of interest rates that you will be offered. My credit score is only 530 but my cosigners score is 693. If you have bad credit your cosigner and needs to have excellent credit.

Generally lenders will require a potential cosigner to have a credit rating score of 700 or above. Credit scores range from 300 to 850. Thats 12637 in interest and around 701 in monthly payments.

The same goes for co-borrowers since you can only have two names on a vehicle title. Apply for 530 Credit Score Auto Loan with Cosigner Lenders will review the information provided by you in your request form. As of the first quarter of 2020 borrowers with the highest credit scores were on average nabbing interest rates on new cars below 4.

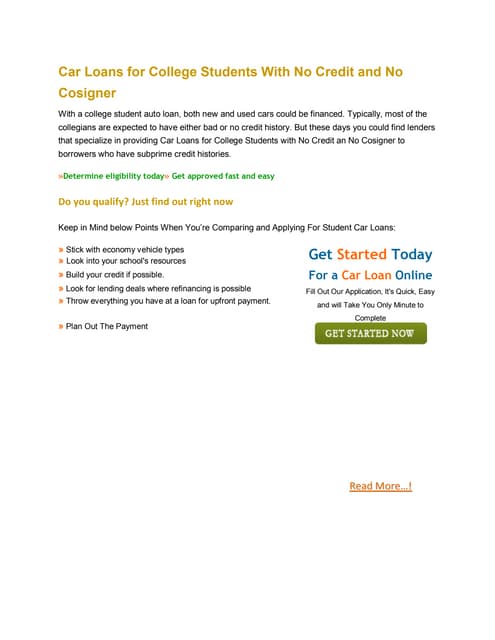

Cosigners Credit Score and Income Requirements. Because you are so close to receiving super prime credit score rates it may make sense to consider spending 30 60. Individuals with a 530 FICO credit score pay a normal 148 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 300-499 were charged 175 in interest over a similar term.

You can find a full breakdown by account type in. I have a 530 credit score my cosigner 693 how much is the interest rate going to be on a 17552 car loan. Experians quarterly State of the Automotive Finance Market takes a look at the average auto loan interest rate paid by borrowers whose scores are in various credit score ranges.

Cosigners and Approval Odds. Lenders look at score ranges or tiers when classifying a score as excellent goodaverage or badpoor. Although there might not be a required credit score a cosigner typically will need credit in the very good or exceptional range670 or better.

Though this varies from lender to lender on the average for example an individual with a credit score within the range of 720-850 will be charged an APR of 9 for a personal loan a person with a credit of 530 will get an APR as high as 19 2524. The cosigner must have enough available income to pay for the loan in case the primary borrower cant meaning they must have enough room in their budget aside from their other bills and loans to cover the payment. Although there is no hard and fast number your cosigners credit score has to be it does need to be in the good range.

If you have 5000 and want to buy a car that is 15000 you can take out an auto loan for 10000 to help you finance this purchase. This is because the cosigner promises to make the car loan payments if youre unable to and they also help by attaching their good credit score to your loan. Even though cosigners are not on the car title and dont have any rights to the car lenders only allow one cosigner on a loan.

Im 19 with a 530 credit score can I go to a credit union or bank and get a personal loan of 3000 for college expenses with a cosignerdad. Once you get the loan you use the money to buy the car. When you ask a cosigner to sign onto an auto loan youre lowering your risk as a bad credit borrower.

All the calculation and examples below are just an estimation. It may in your best interest to have a cosigner or co-borrower to help carry the load but only go this way if necessary. Calculating an Auto Loan Rate When you shop for an auto loan your rate will be determined based on a few different factors.

A credit score in that range generally qualifies someone to be a cosigner but each lender will have its own requirement. When applying for an auto loan with a co-signer down payment the term of your loan and your co-signers credit score all affect how interest rates are calculated. Im going to be buying my first car and im planning on putting 10 down about 1750.

If you financed at 10 without a cosigner for the same terms youd pay a total of 50488 for the vehicle. In this case its 80 a month and more than 5700 total. This is obviously just an example but you can see that a cosigner can save you a lot.

You can expect to pay high-interest rates. A car loan is similar to any other type of loan in that you have access to money you otherwise do not have. People with this range of credit score and higher are generally very financially responsible and pay their bills and obligations on time.

A higher score earns you a lower interest rate saving you money over the life of a loan. This means at the very least a credit score of 670 or higher is most likely required by most lenders in. With a credit score between 530 and 539 you are going to qualify for prime loans at a higher interest rate than if you were able to increase your credit score to 530.

530 Credit Score Auto Loan In 2020 Sell Car Car Loans Credit Score

530 Credit Score Auto Loan In 2020 Sell Car Car Loans Credit Score

Best New Used Rates With A 530 Auto Loan Credit Score 2021

Best New Used Rates With A 530 Auto Loan Credit Score 2021

530 Credit Score Auto Loan With Cosigner Car Loan With 530 Credit Score

530 Credit Score Auto Loan With Cosigner Car Loan With 530 Credit Score

Best New Used Rates With A 530 Auto Loan Credit Score 2021

Best New Used Rates With A 530 Auto Loan Credit Score 2021

Car Loans For College Students With No Credit And No Cosigner

Car Loans For College Students With No Credit And No Cosigner

Credit Score Of 530 Home Loans Auto Loans More Go Clean Credit

Credit Score Of 530 Home Loans Auto Loans More Go Clean Credit

What Is A Good Credit Score Experian

What Is A Good Credit Score Experian

530 Credit Score Car Loan With Cosigner Creditreps

530 Credit Score Car Loan With Cosigner Creditreps

3 Auto Loans With Cosigners Optional 2021 Badcredit Org

3 Auto Loans With Cosigners Optional 2021 Badcredit Org

530 Credit Score Auto Loan With Cosigner Car Loan With 530 Credit Score

530 Credit Score Auto Loan With Cosigner Car Loan With 530 Credit Score

Best New Used Rates With A 530 Auto Loan Credit Score 2021

Best New Used Rates With A 530 Auto Loan Credit Score 2021

530 Credit Score Car Loan With Cosigner Creditreps

530 Credit Score Car Loan With Cosigner Creditreps

Tips On How To Obtain A Vehicle Loan Together Together With Your Cred

Tips On How To Obtain A Vehicle Loan Together Together With Your Cred

What S The Minimum Credit Score For A Car Loan Credit Karma

What S The Minimum Credit Score For A Car Loan Credit Karma

Comments

Post a Comment