What Are Closing Costs For

Schedule Closing at the End of the Month. When it comes to home buying and finances there are two main upfront costs to think about the down payment and closing costs.

What Are Mortgage Closing Costs Commerce Bank

What Are Mortgage Closing Costs Commerce Bank

This fee covers the cost for the lender to process your application.

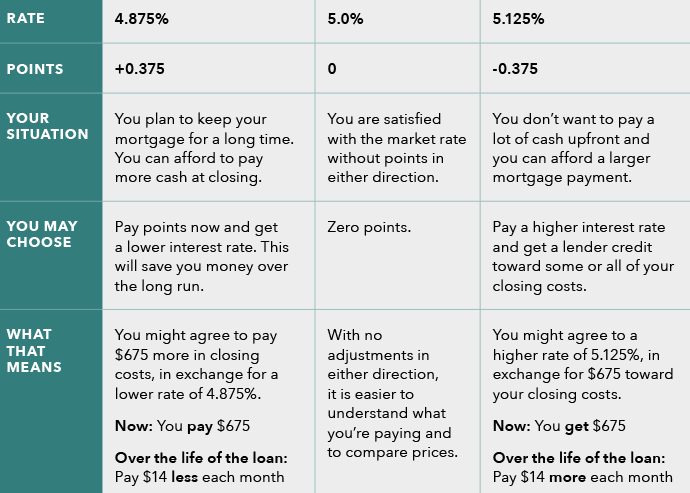

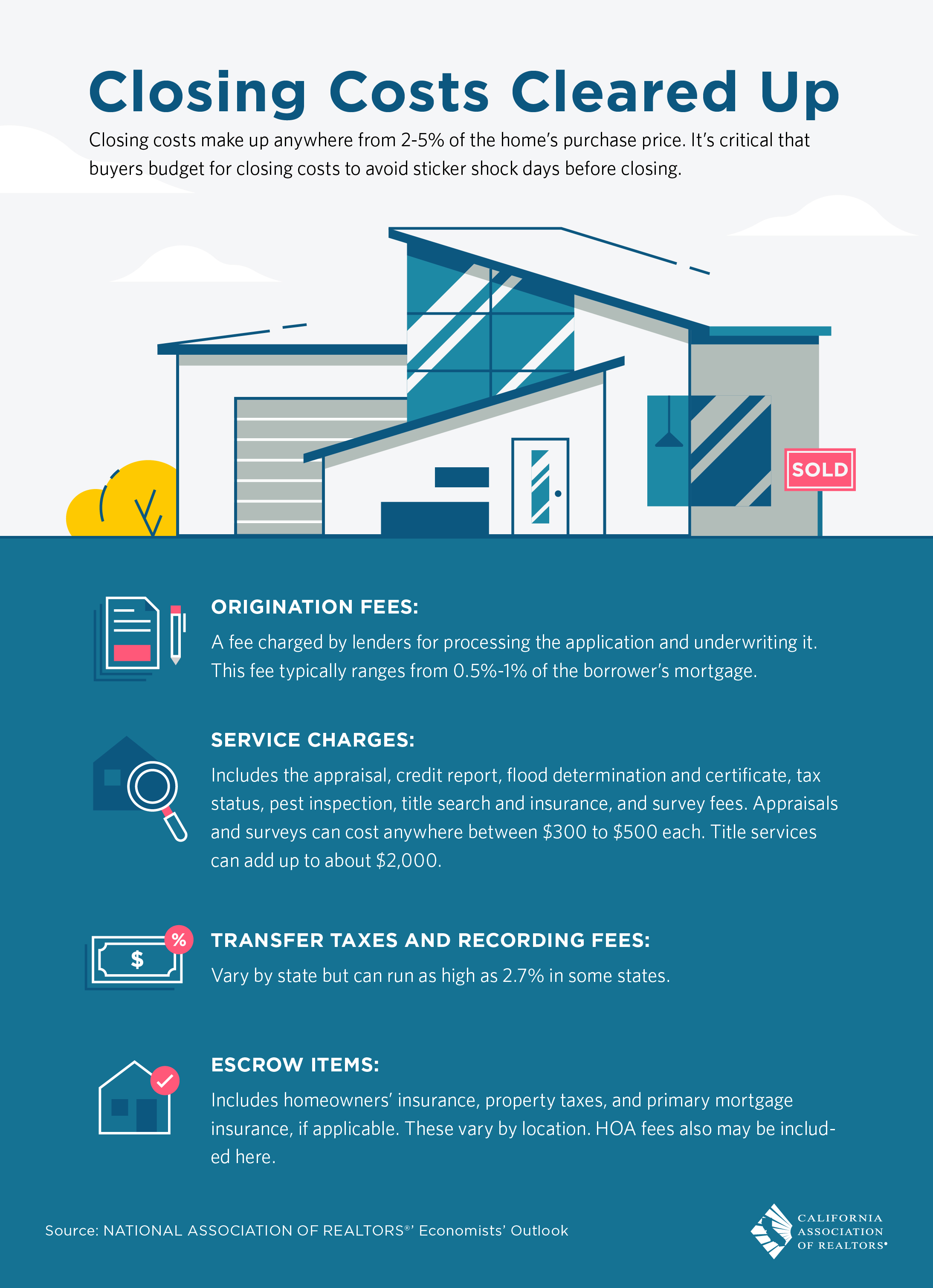

What are closing costs for. A closing date near or at the end of the month. Because buyers tend to use the majority of their savings on their down payment closings costs are often financed through lender credits which lower upfront costs in exchange for higher monthly mortgage payments. The best guess most financial advisors and websites will give you is that closing costs are typically between 2 and 5 of the home value.

By definition the costs associated with the sale of a building closing on a property in the real estate slang are referred to as closing costs Both the buyer and the seller have such expenses. What fees can you expect at closing. Before submitting an application.

This is paid to the appraisal company to confirm the fair market value of the home. This guide only addresses the sellers typical expenses such as. Average closing costs for a.

Closing costs can result in tax-deductible expenses that you dont incur in a regular year of homeownership and those extra expenses can push you over the threshold to where it makes financial. True enough but even on a 150000 house that means closing costs could be anywhere between 3000 and 7500 thats a huge range. The buyer closing cost of 531556 equals 03 the cost of the home 1750000 which is not bad.

Put simply closing costs are the various fees eg. Around 10 of your homes sales price when everything is said and done. This applies to lenders and third-party services such as homeowners insurance policies and title.

This pays for an attorney to. What is included in closing costs. Lenders charge these fees in exchange for creating and servicing your loan.

As a seller you incur quite a bit of cost to sell your home. Closing Costs for Buyers. In this blog well be talking all things closing costs.

How to Reduce Closing Costs Shop Around. Transfer taxes are the taxes imposed by your state or local government to. Closing costs cover things like your home appraisal and searches on your homes title.

When buyers get a mortgage on a property their lender wants to know the property is worth more than. The total buyer cost would be closer to 8500 instead of 531556. All of the items weve covered above will be deducted from your proceeds on the sale so you wont need to bring cash to your closing unless your property is underwater that means you owe more on it than its worth.

Inspections are done to check the state of a property before the lender issues a. The specific closing costs. What Are Closing Costs.

Taxes commissions paid in the process of finalizing a closing on a home. What is Included in Closing Costs. Closing costs also known as settlement costs are the fees you pay when obtaining your loan.

Closing costs are processing fees you pay to your lender. Transfer taxes recording fees and property taxes are key parts of a sellers closing costs. Particularly what they are and how you can prepare for them ahead of time.

If the buyer were to go with a lender she would have to pay the lender title fee mortgage origination fee and more. 52 Zeilen Closing costs are fees that borrowers pay to finalize a home mortgage. While each loan situation is different most closing costs typically fall into four categories.

Closing costs are due at closing when the buyers funds are available for payment and disbursement and the closing documents are all signed around. For example closing costs that amount to 5 of a 300000 home would cost 15000. Closing costs are the fees and charges in excess of the purchase price of the property due at the closing of a real estate transaction Both buyers and sellers may be subject to various closing.

Closing costs are typically about 3-5 of your loan amount and are usually paid at closing. Closing costs for refinancing are costs you must pay when you secure a new refinance loan to pay off your existing home mortgage.

Closing Costs For New Jersey Home Buyers 5 Things To Know

Closing Costs For New Jersey Home Buyers 5 Things To Know

How Much Are Closing Costs For Buyers And Sellers

How Much Are Closing Costs For Buyers And Sellers

How To Estimate Closing Costs Assurance Financial

How To Estimate Closing Costs Assurance Financial

Closing Costs Explained Home Closing 101

Closing Costs Explained Home Closing 101

How To Estimate Closing Costs Assurance Financial

How To Estimate Closing Costs Assurance Financial

What Are Closing Costs Here S All You Need To Know

What Are Closing Costs Here S All You Need To Know

4 Things To Know About Closing Costs New Dwelling Mortgage

4 Things To Know About Closing Costs New Dwelling Mortgage

What Are Closing Costs Ramseysolutions Com

What Are Closing Costs Ramseysolutions Com

How To Calculate Closing Costs On A Home Real Estate

How To Calculate Closing Costs On A Home Real Estate

.png)

Comments

Post a Comment