How To Calculate Your Agi

First you will have to gather your income and tax statements. How to calculate Adjusted Gross Income AGI.

How To Find Your Modified Adjusted Gross Income Novel Investor

How To Find Your Modified Adjusted Gross Income Novel Investor

Now add back some.

/how-to-calculate-your-modified-adjusted-gross-income-4047216_final-c4dcde21c50f43fd915e310e9a00a3ae.png)

How to calculate your agi. The AGI calculation depends on the tax return form you use. Depending on your tax situation your AGI can even be zero or negative. When you file a tax return you will always see a line to figure out your adjusted gross income or AGI before arriving at your taxable income number.

AGI is a calculation of income for tax purposes that measures taxable earnings while subtracting certain tax deductions. The AGI calculation is relatively straightforward. Heres how you work out your AGI.

Steps To Calculate Your AGI Adjusted Gross Income Using W-2 Form. Step one in calculating your AGI is to begin with the amount displayed in Box 1 of your form W-2 labelled Wages Tips Other Compensation Step two includes adding any additional taxable income you have for the year in order to calculate your total taxable income. Your adjusted gross income and your modified adjusted gross income are likely to be fairly close in value to one another.

The simple steps involved in calculating your AGI from the information given on W-2 are. Add up all of these sources of income to find out the final annual income. Total Income Gross Income less above-the-line deductions.

1 Determine your gross income. To calculate your AGI start with the amount shown in Box 1 of your W-2 labeled Wages Tips Other Compensation Then add any other taxable income you have for the year to calculate your total taxable income. How is the Adjusted Gross Income Calculated.

Your income will include your salary prizes lottery rents jury duty fees unemployment benefits etc. Most people now rely on online tools for calculating AGI. It consists of essential information to be reported on your federal income tax returns.

For instance the money thats withheld from your paycheck for Social Security and Medicare taxes sometimes. Take your adjusted gross income from your Form 1040. Subtract your adjustments from your total income also called above-the-line deductions You have your AGI.

Often this income will be reported to you on another form such as interest on a 1099-INT or dividends on a Form 1099-DIV. Add these together to arrive at your total income. Start with your gross income.

AGI is calculated using your gross income minus the adjustments to income The way you calculate your AGI directly impacts tax deductions your eligibility for retirement plan contributions. Adding additional incomes from other sources. How To Calculate Your Adjusted Gross Income AGI Adjusted gross income is calculated as follows.

Subtract Allowable Deductions for which you are eligible. Taking Gross Income from the W-2 form. Identify your qualified income adjustments.

Determine your gross income. How to calculate your AGI. Gross income measures total income and revenue from all sources.

Some forms allow you to take more adjustments to income than others. Tax deductibles reduces the amount of income that is subject to taxation as you subtract them from the gross income to get total taxable income. Total IRA distributions - only the taxable.

Follow these steps to quickly determine your AGI. Subtract your income adjustments from your gross income. Using income tax calculator simply add all forms of income together and subtract any tax deductions from that amount.

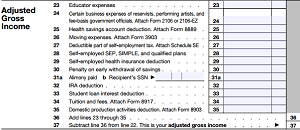

Above-the-line deductions are called above-the-line because they are on the first page of the 1040 tax form above the line where Adjusted Gross Income is calculated. Income is on lines 7-22 of Form 1040. Basically there are 3 steps to this.

Formula to calculate AGI. You can subtract only some of those items from your gross income to calculate AGI. After determining your gross income and adjusted gross income you can easily calculate your modified adjusted gross income.

Heres how to calculate your AGI. Your AGI is the total amount of income you make in a year minus certain deductible expenses. For 2020 income taxes its marked on line 11 of.

Finding Your Adjusted Gross Income. Adjusted gross income encompasses all your income including.

What Is Adjusted Gross Income Agi Gusto

What Is Adjusted Gross Income Agi Gusto

Figuring Your Irs Taxable Income Adjustable Gross Income Agi Vs Modified Adjustable Gross Income Magi Aving To Invest

Figuring Your Irs Taxable Income Adjustable Gross Income Agi Vs Modified Adjustable Gross Income Magi Aving To Invest

Calculate Adjusted Gross Income Agi Using W2 Tax Return Excel124

Calculate Adjusted Gross Income Agi Using W2 Tax Return Excel124

/how-to-calculate-your-modified-adjusted-gross-income-4047216_final-c4dcde21c50f43fd915e310e9a00a3ae.png) How To Calculate Your Modified Adjusted Gross Income

How To Calculate Your Modified Adjusted Gross Income

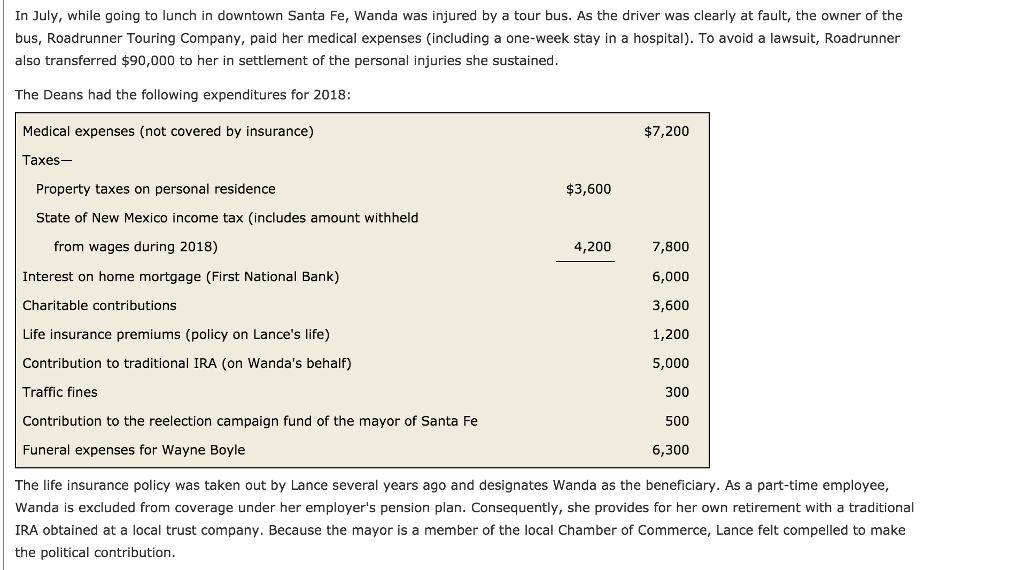

A 2 Calculate Taxable Gross Income 3 Calculate Chegg Com

A 2 Calculate Taxable Gross Income 3 Calculate Chegg Com

Student Loans And Adjusted Gross Income Agi Tips For Low Payments

Student Loans And Adjusted Gross Income Agi Tips For Low Payments

How To Calculate Adjusted Gross Income Agi For Tax Purposes

How To Calculate Adjusted Gross Income Agi For Tax Purposes

What Is Adjusted Gross Income Agi Gusto

What Is Adjusted Gross Income Agi Gusto

Income Tax Calculating Adjusted Gross Income Agi Accounting Chegg Tutors Youtube

Income Tax Calculating Adjusted Gross Income Agi Accounting Chegg Tutors Youtube

Modified Adjusted Gross Income Magi

Modified Adjusted Gross Income Magi

How To Calculate Agi From W 2 The Handy Tax Guy

How To Calculate Agi From W 2 The Handy Tax Guy

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

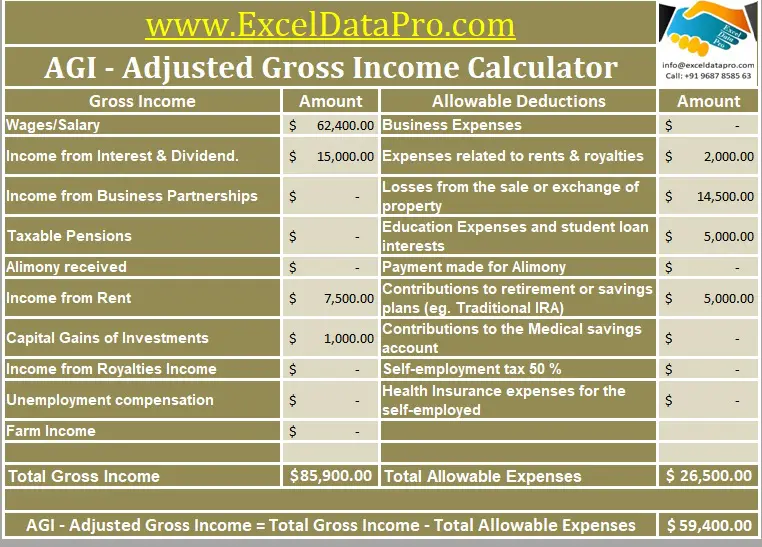

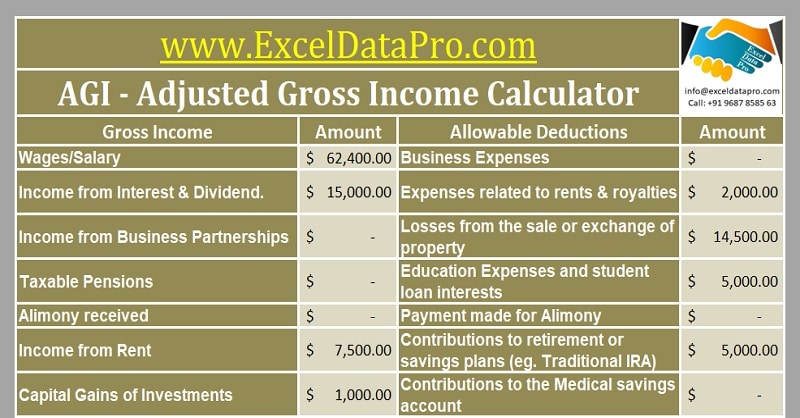

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Comments

Post a Comment