Money Market Vs Savings

The former is a type of mutual fund while the latter is a secure savings vehicle offering high interest rates. You can meet higher deposit requirements.

How Can Money Markets Fit Into Savings Synchrony Bank

How Can Money Markets Fit Into Savings Synchrony Bank

While you can often access a savings account at an ATM through your checking accounts debit card the savings account itself.

Money market vs savings. Both money market accounts and savings accounts are great for stockpiling cash. A savings account features most of the same pros and cons as a Money Market Account with a few slight differences. Money market account vs savings account.

Youll earn a modest return on your money. A money market account MMA is the child of a savings and checking account. Pick a money market account if.

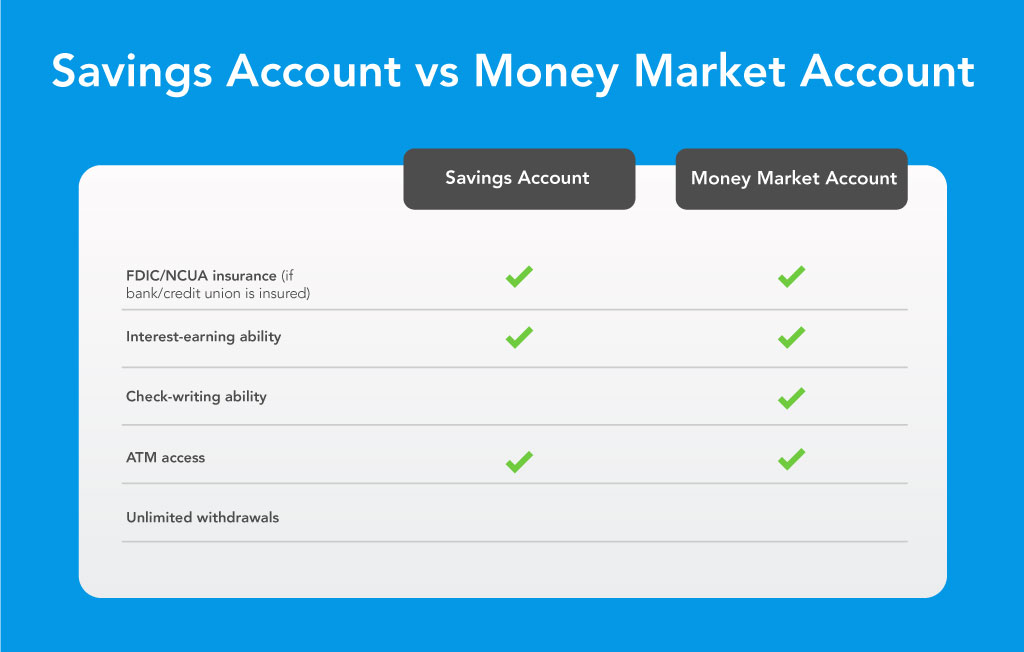

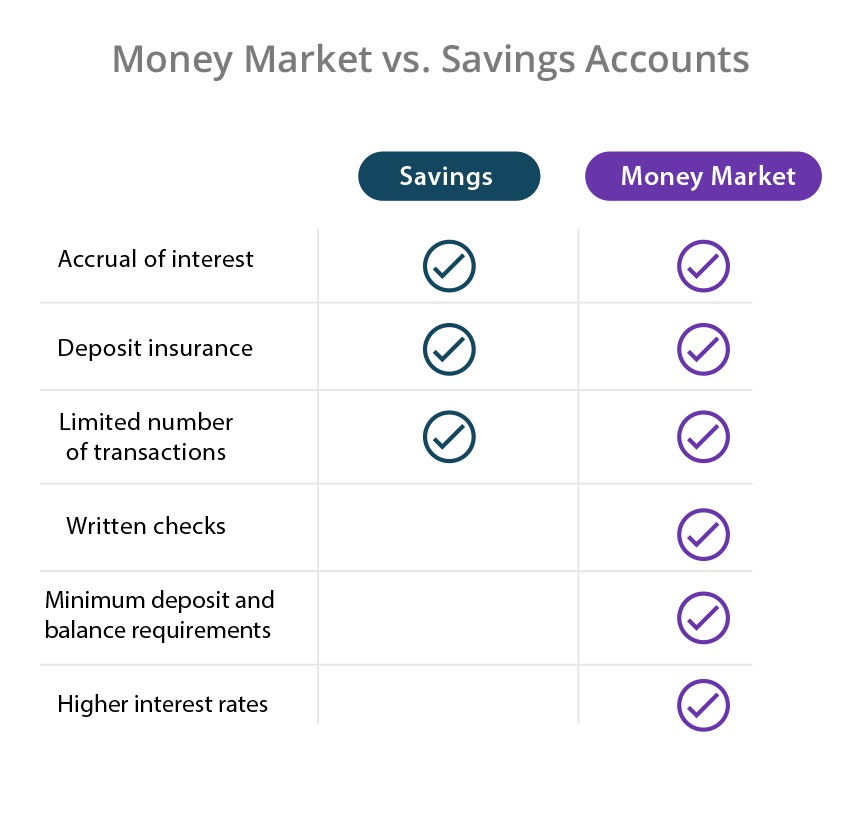

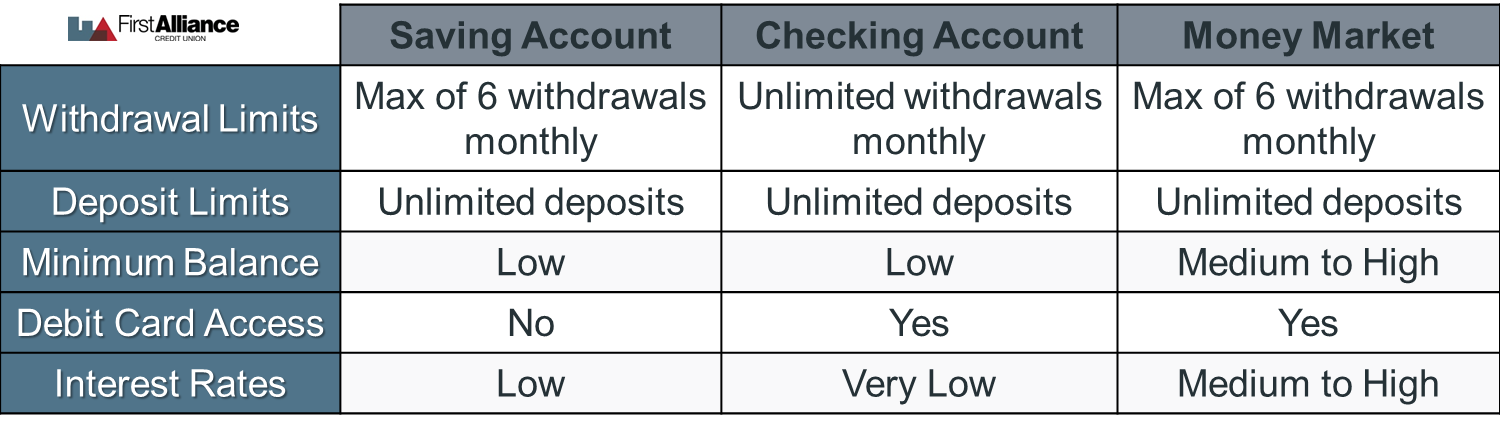

A savings account limits you to six or so transactions per month while a money market account gives you the. MMA holders also have the unique feature of being able to write a check. The main difference between a savings account and a money market account is the access you have to your funds.

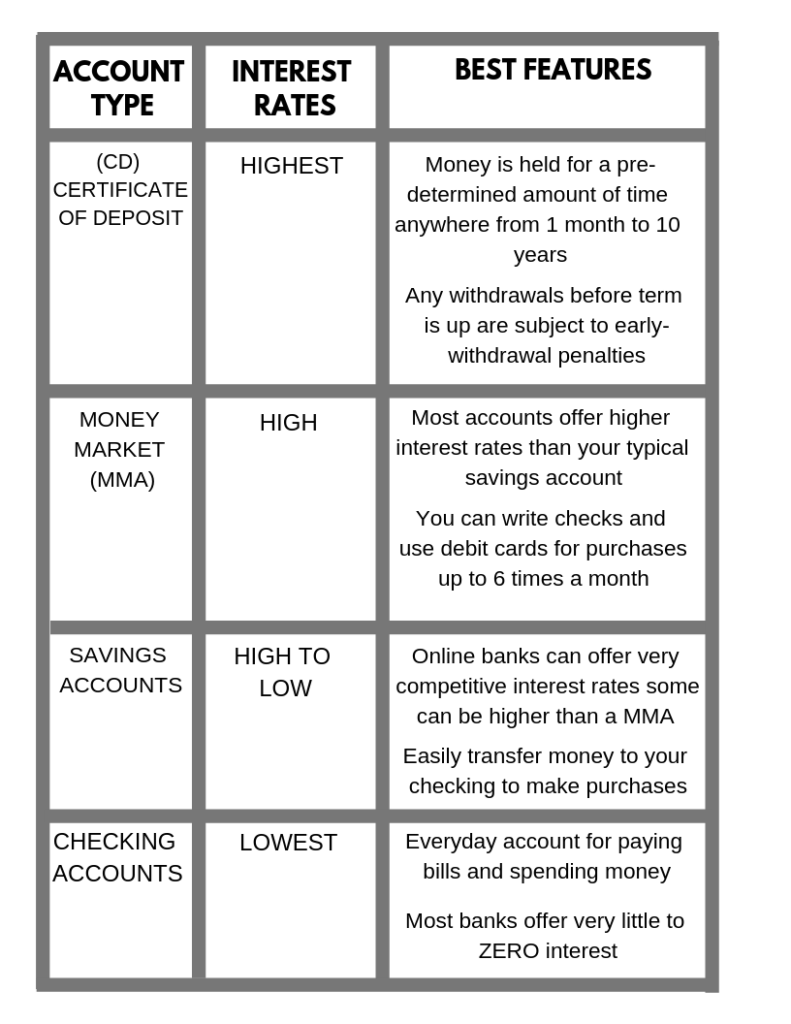

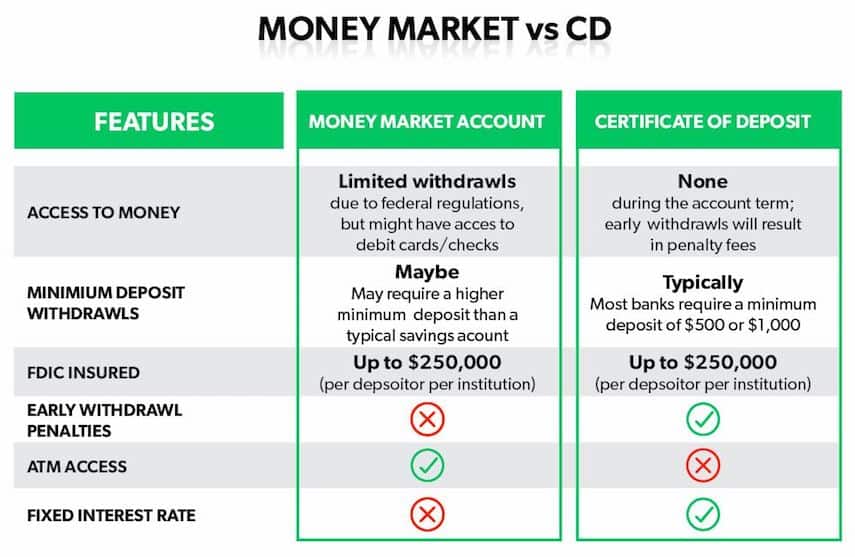

With a savings account on the other hand you usually have ATM access but you cant write checks. Money market accounts and savings accounts are more similar than money market accounts and CDs. While money market accounts can offer higher interest rates than savings accounts they can also have higher minimum deposit requirements.

MMAs are structurally almost entirely the same as a savings account except there are generally three key differences. Usually require a high minimum balance. Money market accounts are a safe and accessible place to store your money while earning a higher interest rate than a regular savings account.

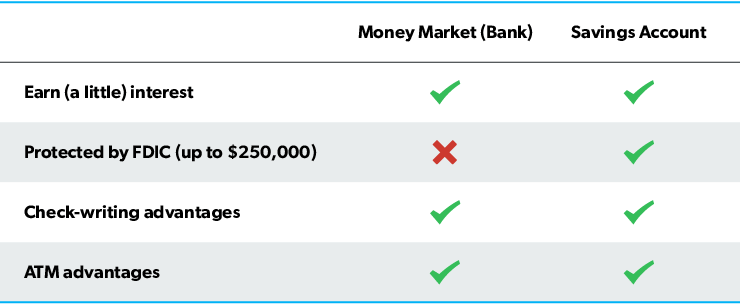

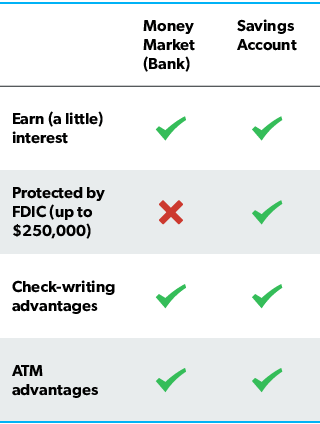

A money market account MMA is a type of savings account that is offered by a variety of financial institutions. Savings accounts and money market deposit accounts are backed by the Federal Deposit Insurance Corporation FDIC. 1 Meanwhile money market mutual funds have no such FDIC guarantee.

According to the FDIC. Money Market vs. Money market account and savings account features vary.

Money market accounts will typically offer the ability to write checks on a limited basis while most savings accounts lack that ability. With savings accounts your access is limited to electronic funds transfers or telephone withdrawals and in-person withdrawals at traditional banks. Another key difference between a money market account and a savings account.

Like Money Market Accounts savings accounts are considered safe because the FDIC insures them for up to 250000. This is noted in money market accounts inclusion of an ATM card. The minimum deposit to open a savings account and ongoing minimum balance required for savings accounts may be lower than money market accounts.

For example you may be able to open a savings account. More liquid than savings accounts. You may even be able to find savings accounts with no minimum balance requirement.

Savings accounts are very liquid meaning that you can easily transfer money between checking and savings accounts. Money market and traditional savings accounts are both effective ways to save but the best option for you depends on your situation. Typically have higher APRs than savings accounts.

Money market funds are for investing and money market accounts are for saving. What Is A Money Market Account. A money market fund is inherently different from a money market account.

How Are Money Market and Savings Accounts Similar. Whats the best way to. The primary difference between money market and savings accounts according to Tumin is check writing.

What Is the Difference Between a Savings Account and a Money Market Account. Both money market and savings accounts are interest-bearing accounts offered by banks and credit unions. Money market accounts usually allow you to write checks and use ATM and debit cards for withdrawalslike a checking account.

The primary differences between them are their flexibility. You need more flexible access to your money. The biggest difference youll find between money market accounts and savings accounts is the amount of access you can have to your money.

Most savings accounts require no minimum balance while money market accounts usually require a high minimum balancearound 1000. Generally you can access a money market account through electronic fund transfers checks debit cards and ATM withdrawals. Most money market accounts tend to pay a slightly higher interest rate than a traditional savings account which can make them more attractive for depositors.

The primary difference between a money market account and a regular savings account is how you access your funds.

What Is A Money Market Account How Does It Compare To High Yield Savings Mintlife Blog

What Is A Money Market Account How Does It Compare To High Yield Savings Mintlife Blog

Money Market Vs Savings Accounts Vs Cds Experian Savingaccounts Saving Accounts Images Money Market Account Money Market Budgeting Money

Money Market Vs Savings Accounts Vs Cds Experian Savingaccounts Saving Accounts Images Money Market Account Money Market Budgeting Money

Money Market Accounts Everything You Need To Know Five Senses Of Living

Money Market Accounts Everything You Need To Know Five Senses Of Living

Money Market Account Definition Investinganswers

Money Market Account Definition Investinganswers

Money Market Vs Savings Which Account Should I Choose Ramseysolutions Com

Money Market Vs Savings Which Account Should I Choose Ramseysolutions Com

Comparison Chart Money Market Account Vs Savings Account Checking Vs Savings Account Hd Png Download Transparent Png Image Pngitem

Comparison Chart Money Market Account Vs Savings Account Checking Vs Savings Account Hd Png Download Transparent Png Image Pngitem

Savings Account Vs Money Market Account Bushwick Flea

Savings Account Vs Money Market Account Bushwick Flea

Money Market Vs Savings Which Account Should I Choose Ramseysolutions Com

Money Market Vs Savings Which Account Should I Choose Ramseysolutions Com

What Is A Money Market Savings Account

What Is A Money Market Savings Account

Compare Interest Rates On Money Market Accounts Rating Walls

Compare Interest Rates On Money Market Accounts Rating Walls

Money Market Accounts Vs Savings Accounts Ally

Money Market Accounts Vs Savings Accounts Ally

Compare Checking Savings And Money Market Accounts Ally

Compare Checking Savings And Money Market Accounts Ally

Comments

Post a Comment