How Do Credit Cards Calculate Interest

Any fees loan insurance compound interest and other administrative fees are also calculated into the APR which is why you should run your figures through both a credit card interest rate calculator and a credit card interest calculator. Convert annual rate to daily rate Your interest rate is identified on your statement as the annual percentage rate.

:max_bytes(150000):strip_icc()/CalculateCardPayments2-544eed4848c94d4bb6f1f9956822af38.jpg) Calculate Credit Card Payments And Costs Examples

Calculate Credit Card Payments And Costs Examples

Calculate the DPR for each tier.

How do credit cards calculate interest. How to calculate credit card interest - YouTube. Click Calculate Credit Card Payoff. Figure out how many tiers apply to the outstanding amount at the end of your billing.

Calculating credit card interest is complicated which is why its best left to automation. Lets say you have a travel rewards credit card and an average daily purchase balance of 1500 at the end of your 30-day billing cycle. Convert your APR to a daily rate The majority of credit card issuers compound interest on a daily basis.

This is the amount of interest you would be charged on a card with a 3500 balance and a 25 interest rate. To calculate how much interest youll be charged youll need to know your average daily balance the number of days in your billing cycle and your APR. If you want to crunch the numbers yourself first take your APR Annual Percentage Rate and divide it by 365 the days in the year to get your daily interest rate.

With a tiered APR the credit card company applies different rates to different. Still you should know it works because your credit card APR and balance affect your budget. Understand how tiered APRs work.

The interest calculator will show you how long it will take to payoff your credit cards and the total interest youll end up paying. The amount you owe as. Simply enter in your current debt current interest rate new interest rate and the amount you can afford to pay monthly.

Do not include a dollar sign or commas in your entry. Its calculated as a percentage of the amount you have borrowed. Calculating Interest for a Tiered APR 1.

Then multiply 500 x 00149 for an amount of 745 each month. Your owed interest owed is determined by applying your APR to your. Our interest calculatorcan help determine how much you can save on credit card interest.

Put it all. Credit card companies calculate interest based on your average daily balance. Determine your average daily balance Your statement will tell you which days are included in the billing period.

Our credit card interest calculator will show you how long it. Enter your current balance on your credit card. How to Calculate Credit Card Interest If you want to calculate your credit cards interest you have to convert your APR to a daily percentage rate or DPR and apply it to each days balance.

Daily Balance x DPR x Days in the Month. That means that if you are not paying your credit card balance in full you will not only. Finally we calculate the interest charged for the billing cycle which in this example is 3500 x 06944 x 30 days or 7291.

Use the credit card interest calculator above to help work out the costs of owning a credit card and how much interest you will pay. That amount is then added to your bill. Your credit card issuer will then multiply this number by your daily balance for each day in the billing period.

The APR includes other amounts besides just the yearly interest being charged by the credit card company. Find the total amount of your current balance on your credit card statement and enter that amount in the first field. You owe 7000 on your credit card.

Your card issuer determines your minimum payment so you may need to. The minimum payment is 3 of 7000 or 210. How is credit card interest calculated.

How to calculate credit card interest 1. You also have a variable purchase APR of 1599. The interest rate on a credit card is how much it costs you to borrow money.

This alone can be a huge shock seeing youll be paying the cards for years and losing thousands to interest. Credit card interest is what are you are charged when you dont pay your credit card bill in full each month. Find your average daily balance This step is the most tedious since youll need to know what your balance was every.

Thats how much interest youll be charged for one day. To find that answer multiply 7000 by03 which is the same as 3learn more about converting percentages and decimals. This interest gets compounded which means its added to what you owe.

It works as a daily rate calculated by dividing your annual percentage rate by 365 and then multiplying your current balance by the daily rate. Enter the current interest rate charged by your credit card. Read more about low-interest credit cards here.

For example if you currently owe 500 on your credit card throughout the month and your current APR is 1799 you can calculate your monthly interest rate by dividing the 1799 by 12 which is approximately 149. Youll see how much you can save and how long it will take to pay off your debt.

Credit Card Interest Calculation Youtube

Credit Card Interest Calculation Youtube

3 Ways To Calculate Credit Card Interest With Excel Wikihow

3 Ways To Calculate Credit Card Interest With Excel Wikihow

Credit Card Interest Calculator Find Your Payoff Date Total Interest

Credit Card Interest Calculator Find Your Payoff Date Total Interest

5 Ways To Calculate Credit Card Interest Wikihow

5 Ways To Calculate Credit Card Interest Wikihow

Help On Calculating Credit Card Interest Personal Finance Money Stack Exchange

Help On Calculating Credit Card Interest Personal Finance Money Stack Exchange

/how-and-when-is-credit-card-interest-charged-960803_final-a8011c78570a428aaf59f9e39011575b.png) How And When Is Credit Card Interest Charged

How And When Is Credit Card Interest Charged

How To Create A Credit Card Payment Calculator

How To Create A Credit Card Payment Calculator

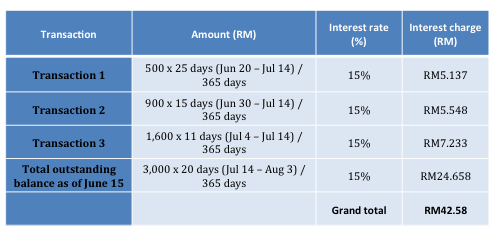

Understanding Credit Card Interest Free Period Imoney

Understanding Credit Card Interest Free Period Imoney

Credit Card Calculator Reduce Your Credit Card Debt Faster Squawkfox

5 Ways To Calculate Credit Card Interest Wikihow

5 Ways To Calculate Credit Card Interest Wikihow

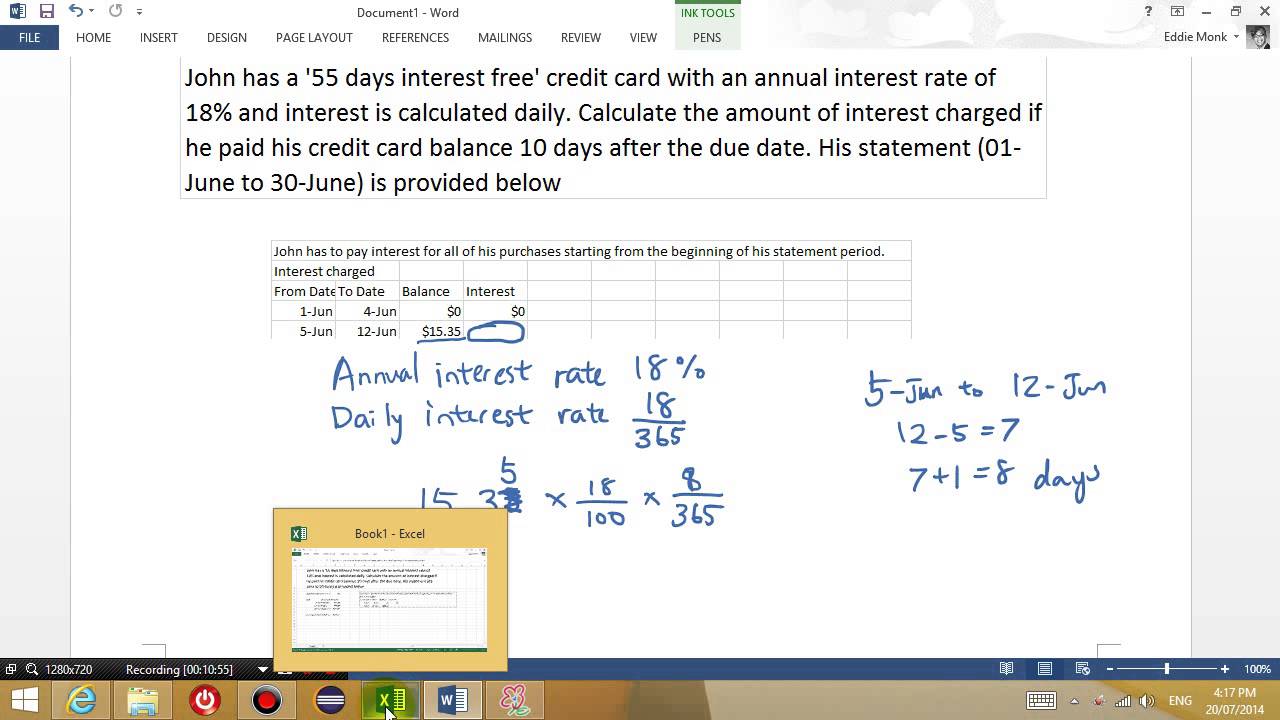

How To Calculate Credit Card Interest Youtube

How To Calculate Credit Card Interest Youtube

Calculating Credit Card Payments In Excel 2010 Youtube

Calculating Credit Card Payments In Excel 2010 Youtube

Comments

Post a Comment