Special Purpose Acquisition Company List

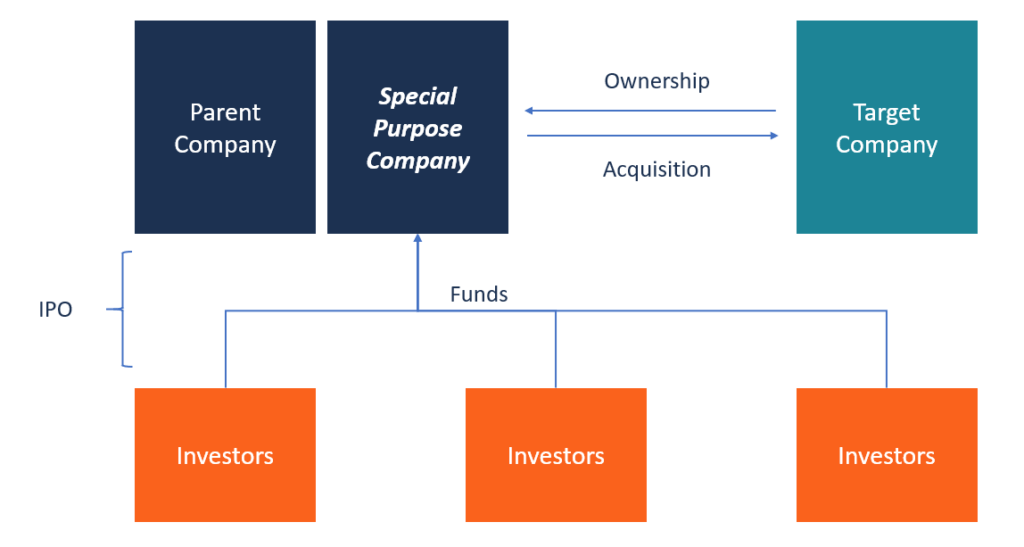

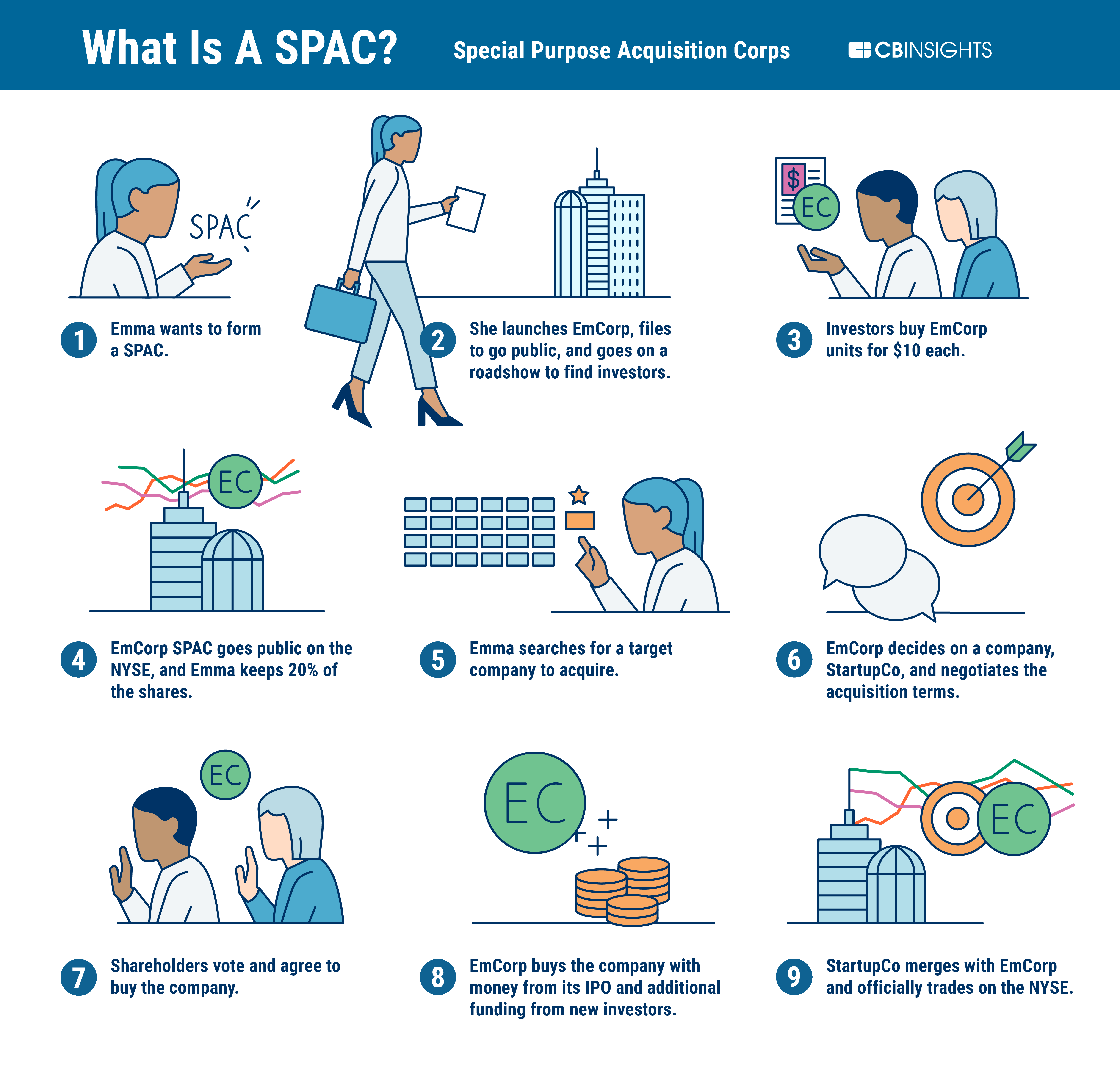

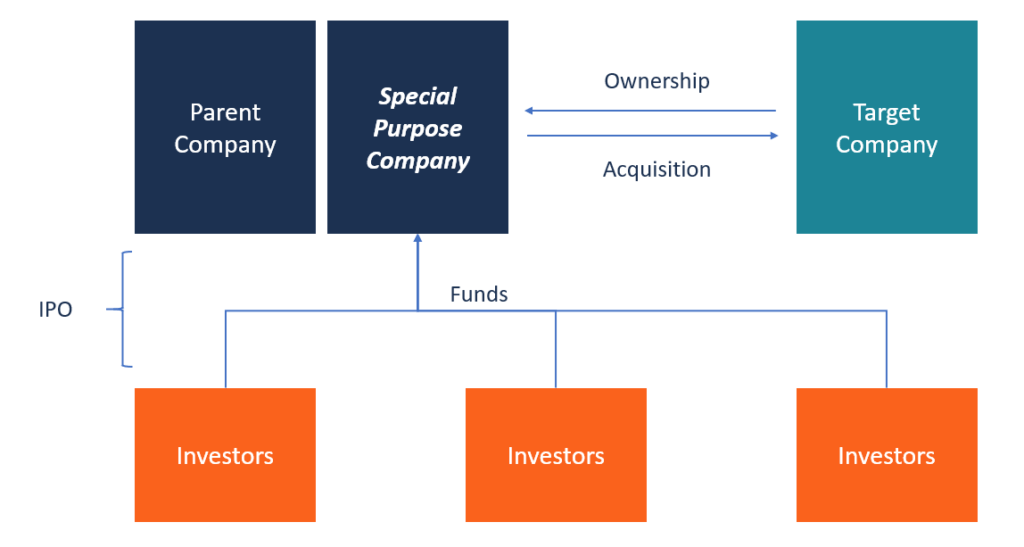

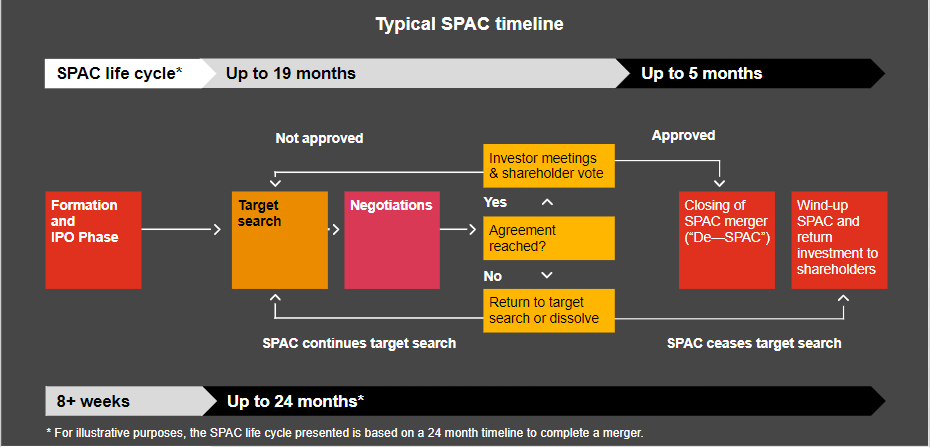

A special purpose acquisition company. A SPAC is a company with no operations that offers securities for cash and places substantially all the offering proceeds into a trust or escrow account for future use in the acquisition of one or more private operating companies.

Nasdaq Bets On Blank Check Co Ipo To Boost Listings Spacs Are Sizzling

Nasdaq Bets On Blank Check Co Ipo To Boost Listings Spacs Are Sizzling

SPACs are acquisition companies listed under IM-5101-2 and as such would be exempt from the rules in this proposal until they complete a business combination.

Special purpose acquisition company list. Special purpose acquisition companies SPACs also known as blank-check firms continue to expand their focus across the technology market. Flying Eagle Acquisition NYSE. A special purpose acquisition company SPAC is formed for the purpose of raising capital through an IPO and using those funds to acquire an operating business.

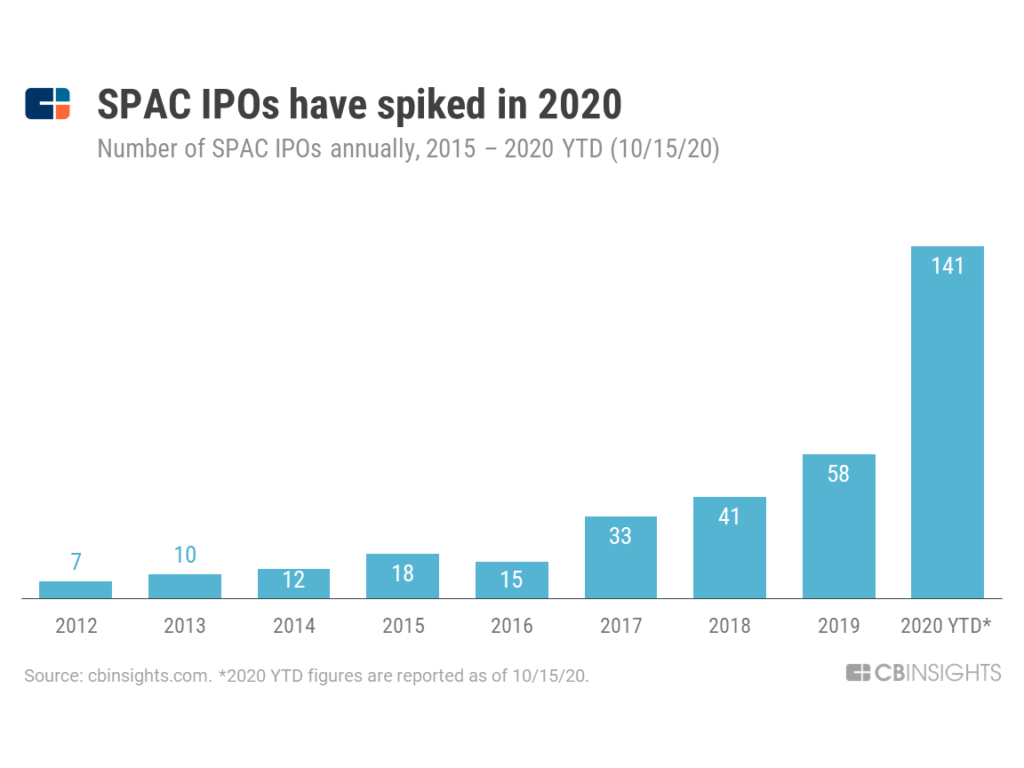

Despite being around for almost two decades special purpose acquisition companies commonly referred to as SPACs or metonymically blank check companies have recently risen to prominence within the financial sector. SECP to Introduce Concept of Special Purpose Acquisition Company. Some people refer to these as SPAC stocks.

There are many causes and attributions for this recent surge in interest it could be the slew of industry veterans such as Bill Ackman and Billy Beane who have. A special purpose acquisition company SPAC is essentially a shell corporation whose sole purpose is to raise money to acquire one or more businesses or assets. Target companies are usually privately held.

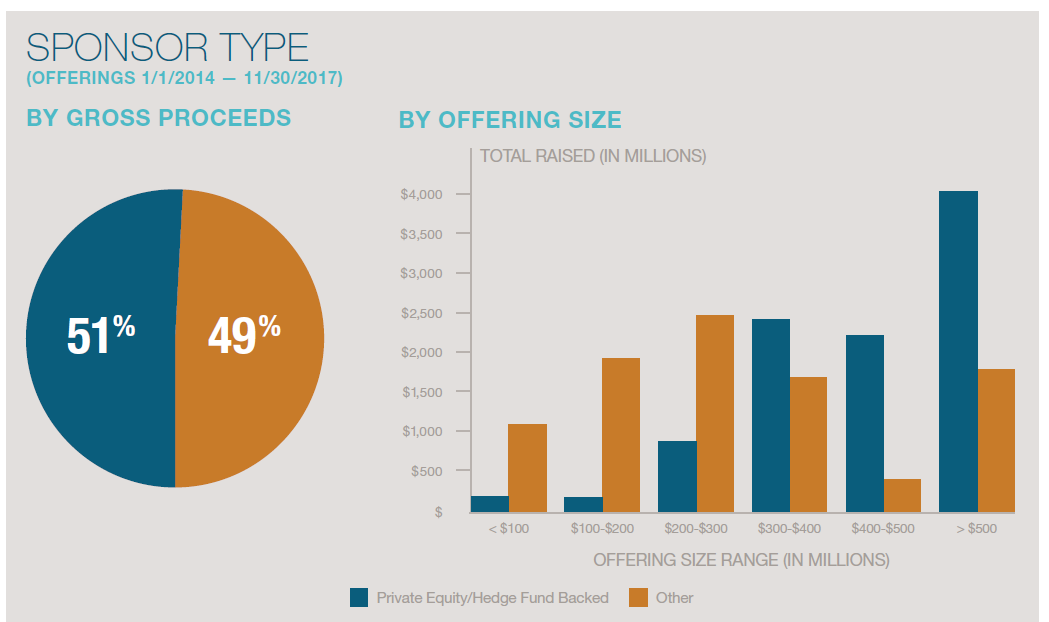

SPACs bring together experienced management teams often comprising industry veterans private equity sponsors or other financing experts who can leverage their expertise to raise capital. SECP to introduce concept of special purpose acquisition company SPACs is prevailing in many jurisdictions including USA Canada and Malaysia said a. Analysis includes total gross proceeds announcement deadline date and number of months left until deadline held in trust and list of symbols for all trading securities included in the unit.

Upon completing a business. FEAC Conyers Park II Acquisition NASDAQ. And that focus could soon involve IT distributors MSP software providers and cloud computing companies that work closely with VARs ChannelE2E believes.

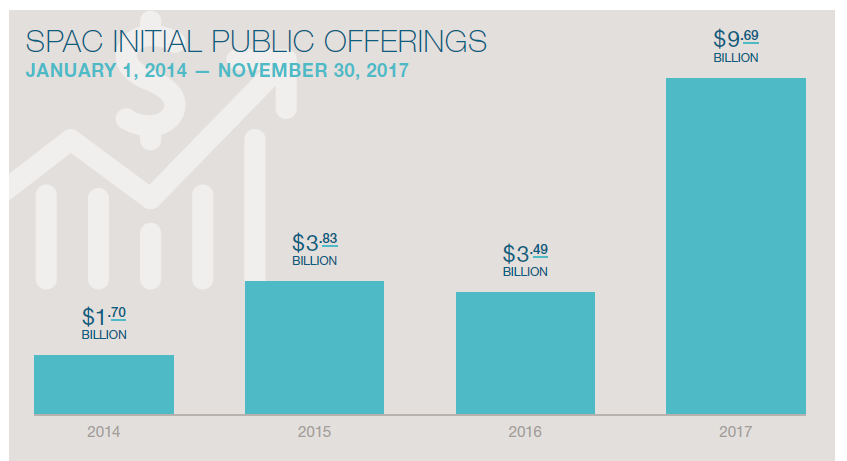

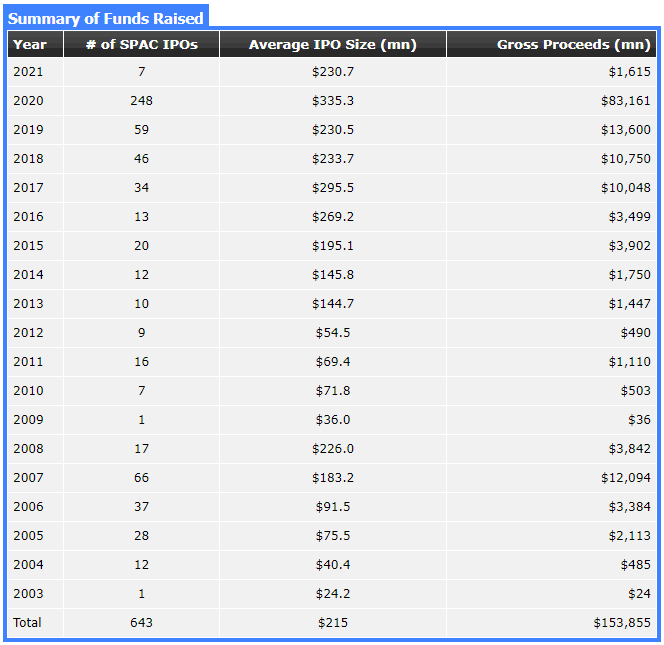

Whats Behind the Boom and Where Does It Go from Here. SPAC launches quadrupled since 2019 with an astonishing 200 going public in 2020. The Rise of the SPAC.

A download-able weekly list of all SPAC Special Purpose Acquisition Company IPO transactions. NKLA Churchill Capital Corp. 130 rows List of Special Purpose Acquisition Companies With Pending Mergers.

Subsequently an operating company can merge with or be acquired by the publicly traded SPAC and become a listed company in lieu of executing its own IPO. CPAA Social Capital Hedosophia Holdings Corp. A SPAC raises capital through an initial public offering IPO for the purpose of acquiring an existing operating company.

A Special Purpose Acquisition Company SPAC also known as blank check company is a company with no commercial operations. First out of the gate was Altimar Acquisition a 275 million SPAC that closed a deal in December with asset managers Owl Rock and Dyal to combine. On 462021 the company announced a pending merger with Topps the trading card company.

This acquisition is accomplished through a reverse merger or a purchase agreement. On 3292021 the company announced a pending merger with Cazoo the UKs leading online car retailer. Upon merger the merged entity shall be automatically listed and in case of acquisition the SPAC shall list.

It is formed strictly to raise capital through an initial public offering IPO for the purpose of buying an existing company. 114 rows 27 February 2021. 471 rows List of Shell Companies or Special Purpose Acquisition Companies SPACs There are.

Join this informative webinar to find out whats behind the boom and what 2021 will hold for the. Following its initial public offering or IPO the SPAC will identify acquisition candidates and attempt.

Spac Listings On Nasdaq Spac Structure Investment

Spac Listings On Nasdaq Spac Structure Investment

What Are Spacs The Trend In 2020 Cb Insights Research

What Are Spacs The Trend In 2020 Cb Insights Research

What Is A Special Purpose Acquisition Company And Why Are Companies Going Public Via Spacs Investeek

What Is A Special Purpose Acquisition Company And Why Are Companies Going Public Via Spacs Investeek

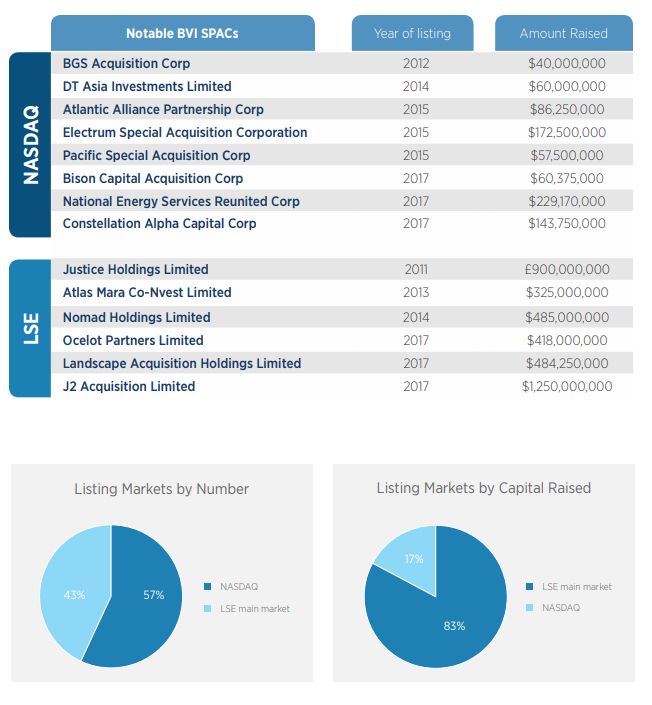

The Rise Of Bvi Special Purpose Acquisition Companies Corporate Commercial Law Bermuda

The Rise Of Bvi Special Purpose Acquisition Companies Corporate Commercial Law Bermuda

Special Purpose Acquisition Companies An Introduction

Special Purpose Acquisition Companies An Introduction

Special Purpose Acquisition Company Spac Overview How It Works

Special Purpose Acquisition Company Spac Overview How It Works

A Record Pace For Spacs Nasdaq

A Record Pace For Spacs Nasdaq

Special Purpose Acquisition Companies An Introduction

Special Purpose Acquisition Companies An Introduction

Us Special Purpose Acquisition Companies Build Their Buying Power S P Global Market Intelligence

Us Special Purpose Acquisition Companies Build Their Buying Power S P Global Market Intelligence

Top Spac Listings And How To Invest

Top Spac Listings And How To Invest

What Are Spacs The Trend In 2020 Cb Insights Research

What Are Spacs The Trend In 2020 Cb Insights Research

![]() 8 Best Spacs To Buy For May 2021 What Is A Spac

8 Best Spacs To Buy For May 2021 What Is A Spac

My Shortlist For Betting On Spacs Seeking Alpha

My Shortlist For Betting On Spacs Seeking Alpha

Comments

Post a Comment